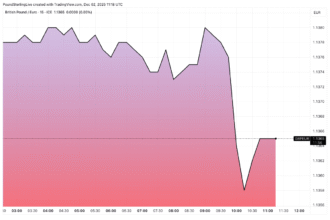

The Pound to Euro (GBP/EUR) exchange rate swung back and forth last week as investors reacted to changing expectations over future Bank of England (BoE) policy moves and political uncertainty in France.

Pound to Euro (GBP/EUR): 1.1502 (-0.12%)

Pound to Dollar (GBP/USD): 1.34148 (-0.08%)

Euro to Dollar (EUR/USD): 1.1663 (+0.04%)

WEEKLY RECAP:

The Pound (GBP) opened the week on a softer footing, initially weighed by warnings from the Institute for Fiscal Studies (IFS) that Chancellor Rachel Reeves’ upcoming budget could risk “unnecessary economic damage” if focused more on politics than long-term growth.

Sterling then extended losses on Tuesday after the latest UK labour market data showed unemployment rising to a four-year high and wage growth cooling, reigniting speculation that the Bank of England (BoE) could deliver another rate cut this year.

Midweek, GBP clawed back some ground as the UK GDP release showed the economy returned to growth in August (+0.1%), easing immediate fears of stagnation.

The Pound’s late-week performance was choppy. Sterling dipped during Friday’s risk-off mood before bouncing as BoE Chief Economist Huw Pill said he supports a “more cautious pace” of monetary easing — comments that helped temper expectations of aggressive rate cuts.

Meanwhile, the Euro (EUR) had its own hurdles to clear.

The single currency faced early-week pressure amid ongoing political tensions in France, where Prime Minister Sébastien Lecornu faced two no-confidence votes. EUR sentiment improved once Lecornu survived both, providing a measure of political stability.

Mixed Eurozone data also left the Euro rangebound: Germany’s ZEW sentiment index improved again in October, but industrial production fell 1.2% in August, marking continued weakness in the bloc’s manufacturing base.

Near-Term GBP/EUR Forecast: UK CPI and Eurozone PMIs to Drive Mid-Week Moves

Looking ahead, the GBP/EUR exchange rate could start the week quietly due to a lack of tier-one data, but volatility may rise sharply midweek.

Wednesday’s UK CPI release will be the key risk event. Inflation is expected to climb slightly from 3.8% to 4.0% in September, which could boost Sterling by dampening BoE rate cut speculation.

On Friday, attention turns to a trio of releases: UK retail sales, and the Eurozone and UK flash PMIs.

If British activity improves while Eurozone data weakens — as forecasters expect — the Pound could strengthen further, potentially pushing GBP/EUR back toward the upper end of its recent range.