(Bloomberg) — The dollar’s bounceback in July is convincing some emerging-market investors to bet it will keep rising in coming months.

T. Rowe Price Group Inc. says it now favors dollar-denominated emerging market bonds rather than local-currency ones as a tactical trade. Barclays Plc is telling its clients to avoid shorting the greenback versus its Asian peers, while Fidelity International says the higher-for-longer US interest rates make it less attractive to borrow the dollar to fund carry trades.

Fund managers and analysts alike are reappraising the “Sell the Dollar” trade as the greenback’s revival sapped some of the optimism toward developing-nation assets. Bets the dollar would continue to fall pushed the MSCI emerging-market equity index to a more than three-year high last month, and a similar gauge of currencies to a sixth monthly gain in June.

“I’m weighted towards” dollar-denominated emerging-market bonds for now, given their attractive coupons, said Leonard Kwan, a fund manager at T. Rowe Price in Hong Kong. There’s likely to be a “consolidative period for the dollar over the next three-to-six months,” which will challenge the returns from local-currency debt, he said.

Emerging-market dollar bonds handily outperformed their local-currency counterparts last month, with a Bloomberg gauge of the securities returning 0.9%, while one measuring local-currency debt fell by the same amount.

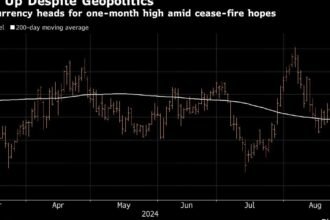

A similar trend was seen in currencies. Bloomberg’s dollar spot index climbed 2.7% in July, snapping a six-month losing streak, while MSCI’s emerging-markets currency index fell 1.2%.

On Friday, the greenback tumbled after soft US jobs data prompted traders to boost bets that the Federal Reserve will cut rates as soon as next month. The dollar gauge still gained 1% for the week, its best since November.

“We remain reluctant to jump into outright” trades betting the dollar will weaken against Asian currencies into the summer, Barclays strategists including Lemon Zhang wrote in July 24 note. “Instead, we have recommended going long the US dollar against some low yielders in the region with stretched valuations and idiosyncratic risks,” such as the Thai baht and Hong Kong dollar, they said.

Barclays also favors what it calls relative-value trades that avoid the dollar altogether — such as betting the Singapore dollar will weaken against its Chinese counterpart, and going short the baht versus the South Korean won.

Investors who have been using the dollar as a funding currency for carry trades may also want to seek other options, according to Fidelity. Carry trades involve borrowing in a currency with relatively low interest rates and investing in another offering higher returns.

“Given that US dollar interest rates may remain relatively higher for some time, it may be worth considering alternative funding currencies that offer lower costs while maintaining similar risk profiles,” said Lei Zhu, head of Asian fixed income at Fidelity in Hong Kong.

Possibilities include borrowing in the Hong Kong dollar, which has lower short-term fund rates than the greenback, or even the Chinese yuan, she said.

Meanwhile, the dollar’s revival in July is making it cheaper for Asian funds to hedge their holdings of greenback-denominated assets.

The aggregate hedging cost for local-currency funds, as measured by dollar-Asia forward implied yields from eight economies and the equivalent US secured overnight refinancing rate, fell five percentage points last month, the first drop this year, data compiled by Bloomberg show.

“With the dollar strengthening again, unhedged or underhedged entities may view this as an opportunity to reduce their US dollar foreign-exchange exposure and to rebalance their positions,” Fidelity’s Zhu said.

–With assistance from Matthew Burgess and Malavika Kaur Makol.

More stories like this are available on bloomberg.com