- The Pound Sterling surrenders gains against the US Dollar as the British currency underperforms.

- US President Trump increased reciprocal tariffs on China to 104% against Beijing’s retaliation.

- Deutsche Bank expects the BoE to cut interest rates by 50 bps in May.

The Pound Sterling (GBP) tumbles against its major peers on Wednesday. The British currency faces a sharp selling pressure as the Bank of England’s (BoE) Financial Policy Committee (FPC) has warned that a major shift in global trading arrangements could harm “financial stability by depressing growth”.

The imposition of protectionist policies by United States (US) President Trump has stemmed the risks of a global recession. Analysts at JPMorgan believe the rapid escalation with US tariffs on China is disruptive enough to push the global economy into a recession.

China is known as the world’s manufacturing hub, given its competitive advantage in labor cost and supportive government policies. Financial market participants worry that Chinese firms will look for other markets to sell their products if its trade war with the US brews further. Such a scenario will be unfavorable for the United Kingdom (UK) economy as it seems incapable of battling a price war against China.

Meanwhile, traders have raised BoE dovish bets amid fears that Trump’s tariff policy could send shockwaves through the UK economy. Analysts at Deutsche Bank expect that the BoE may consider a more “forceful” response to current economic conditions and deliver a larger-than-usual interest rate cut of 50 basis points (bps) in the May policy meeting. The central bank identified a substantial decline in survey activity indicators, unwarranted tightening of financial conditions, and fears of labor market slowdown as key reasons behind the BoE’s ultra-dovish decision.

This week, investors will focus on the monthly Gross Domestic Product (GDP) and the factory data for February, which will be released on Friday. The UK economy is expected to have grown by 0.1% after contracting at a similar pace in January.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.82% | 0.02% | -0.99% | -0.72% | -1.27% | -0.67% | -1.09% | |

| EUR | 0.82% | 0.84% | -0.16% | 0.07% | -0.41% | 0.14% | -0.29% | |

| GBP | -0.02% | -0.84% | -1.02% | -0.74% | -1.25% | -0.69% | -1.12% | |

| JPY | 0.99% | 0.16% | 1.02% | 0.23% | -0.24% | 0.30% | -0.14% | |

| CAD | 0.72% | -0.07% | 0.74% | -0.23% | -0.39% | 0.06% | -0.37% | |

| AUD | 1.27% | 0.41% | 1.25% | 0.24% | 0.39% | 0.56% | 0.11% | |

| NZD | 0.67% | -0.14% | 0.69% | -0.30% | -0.06% | -0.56% | -0.44% | |

| CHF | 1.09% | 0.29% | 1.12% | 0.14% | 0.37% | -0.11% | 0.44% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling surrenders gains against US Dollar

- The Pound Sterling gives up its entire intraday gains and turns flat to near 1.2765 against the US Dollar (USD) in Wednesday’s North American session. The GBP/USD pair falls back even though the US Dollar faces selling pressure amid firming expectations that the US could enter a recession this year. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, plummets to near 102.00.

- A fresh escalation in the trade war between the US and China has prompted risks of a recession in the US. During the European trading session, China announced additional 50% tariffs on the US over the 34% imposed last week, and all will become effective from April 10. Hefty import duties have been slapped by China on the US to match reciprocal tariffs increased by President Donald Trump on Tuesday. Trump raised reciprocal levies on Beijing for retaliation and currency manipulation to offset the impact of higher duties.

- Additionally, accelerating Federal Reserve (Fed) dovish bets due to increasing risks of a US recession have also weighed on the US Dollar. According to a CME FedWatch tool, traders are certain that the central bank will cut interest rates in the June meeting.

- For more cues on the monetary policy outlook, investors will focus on the Federal Open Market Committee (FOMC) minutes of the March policy meeting, which will be published at 18:00 GMT. In the policy meeting, the Fed left interest rates steady in the range of 4.25%-4.50%, and officials collectively maintained their guidance for two interest rate cuts this year.

- This week, investors will also focus on the US Consumer Price Index (CPI) data for March, which will be released on Thursday.

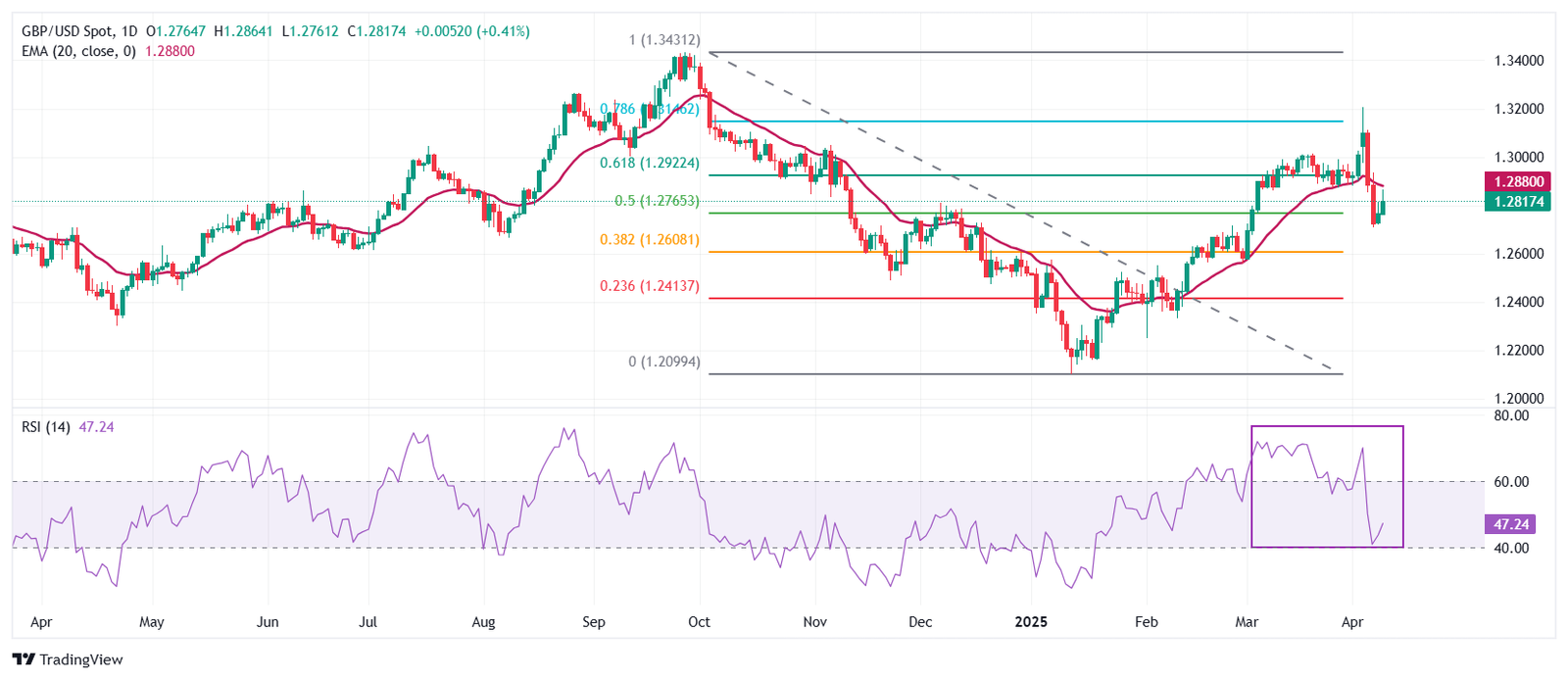

Technical Analysis: Pound Sterling remains below 20-day EMA

The Pound Sterling retreats to near 1.2765 against the US Dollar on Wednesday. The near-term outlook of the pair is bearish as it trades below the 20-day Exponential Moving Average (EMA), which trades around 1.2877.

The 14-day Relative Strength Index (RSI) rebounds after falling to near 40.00. A fresh bearish momentum could be triggered if the RSI fails to hold the 40.00 level.

Looking down, the 38.2% Fibonacci retracement plotted from late September high to mid-January low near 1.2610 will act as a key support zone for the pair. On the upside, the psychological figure of 1.3000 will act as a key resistance zone.

(This story was corrected at 10:07 GMT to say that the Federal Open Market Committee (FOMC) minutes of the March policy meeting will be published at 18:00 GMT, not 19:00 GMT.)

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.