- The Pound Sterling reached its highest level in a year versus the US Dollar, 1.3050 tested.

- GBP/USD appears to be a ‘buy-the-dips’ trade in the action-packed week ahead.

- Pound Sterling reverses from the overbought zone, implying more upside going forward.

The Pound Sterling (GBP) recorded a fresh 12-month high above 1.3000 against the US Dollar (USD) but the GBP/USD pair snapped its two consecutive weekly gains to settle in the red.

Pound Sterling briefly recaptured the key 1.3000 mark

Even though monetary policy divergence between the US Federal Reserve (Fed) and the Bank of England (BoE) remained the dominant factor driving the GBP/USD price action, the late comeback by the USD on broad risk aversion spoilt the party for the Pound Sterling.

GBP/USD extended the previous week’s upsurge and hit the highest level since July 2023 at 1.3045 after the UK Consumer Price Index (CPI) inflation bolstered expectations that the BoE would refrain from cutting interest rates in August. The UK CPI rose 2.0% in the year to June, having increased by 2.0% in May, according to the data released by the Office for National Statistics (ONS) on Wednesday, aligning with the market consensus while staying at the BoE’s 2.0% target. The sticky Services CPI inflation held steady at 5.7% YoY in the same period.

Meanwhile, markets fully priced in a September Fed rate cut, in light of softer inflation readings from the US and dovish Fed commentaries, especially the one from Chairman Jerome Powell. Powell said on Monday that the central bank will not wait until inflation hits 2% to lower interest rates. His appearance was the last one before the Fed entered its ‘blackout period’, fuelling a big market reaction.

The tide, however, turned in favor of the US Dollar buyers, helping the Greenback stage an impressive comeback in the latter part of the week. Wall Street witnessed a significant sell-off, as traders rotated away from high-priced megacap growth stocks amid the second-quarter earnings season. Further, escalating US-China trade tensions also aggravated risk-off sentiment, as markets remained wary of a further worsening of trade relations under a potential Donald Trump’s US presidency. A report that the US was considering tighter curbs on exports of advanced semiconductor technology to China sent chip stocks and the Nasdaq tumbling, per Reuters.

Resurgent US Dollar demand fuelled a sharp correction in the GBP/USD pair, sending it back under the 1.3000 threshold. Meanwhile, the UK labor market report showed Thursday that wage growth slowed to its lowest pace in nearly two years for the three months through May. The Unemployment Rate held steady at 4.4% in May, as anticipated. The wage inflation data prompted investors to ponder about the August rate cut, exerting additional downside pressure on the Pound Sterling.

The weak UK Retail Sales report also added to the gloom surrounding the GBP/USD pair. Retail Sales dropped 1.2% over the month in June after rebounding 2.9% in May, the latest data published by the ONS showed Friday. Markets projected a 0.4% decline in the reported month. The core Retail Sales, stripping the auto motor fuel sales, declined by 1.5% MoM, against the previous jump of 2.9% and the estimated -0.5% print.

Week ahead: A busy UK and US calendar

With the critical UK economic releases out of the way, US statistics will likely hog the limelight in the week ahead, impacting the GBP/USD price action.

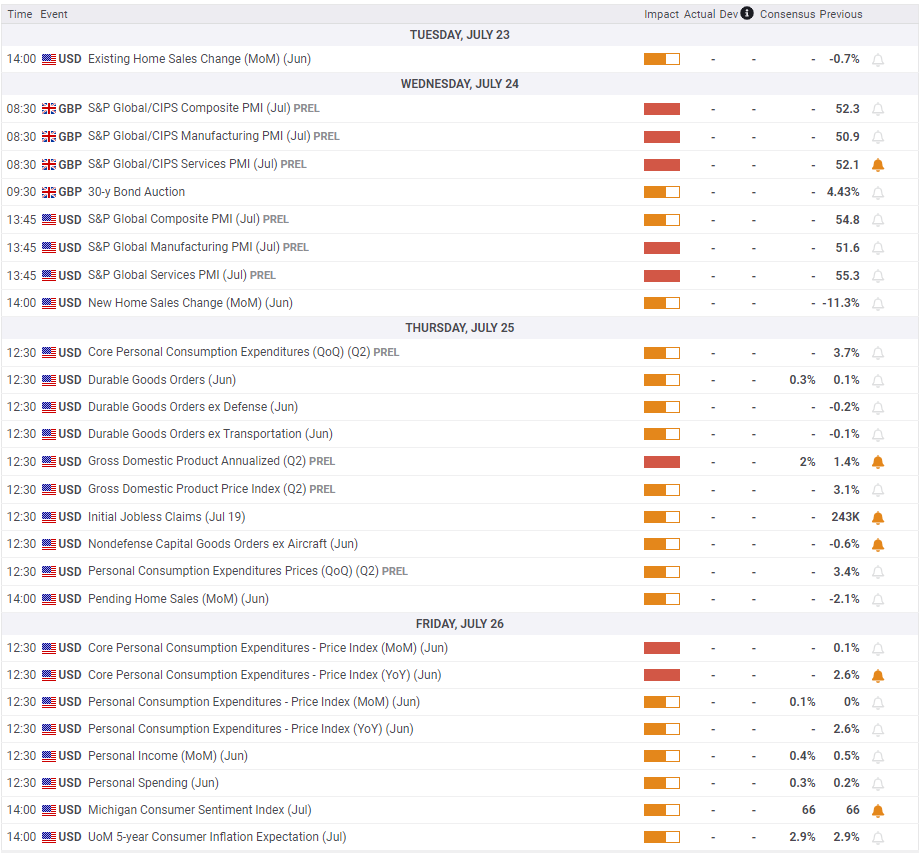

It’s a typical quiet start to a big week, filled with high-impact in the second half. Monday is devoid of any important macro releases from both sides of the Atlantic. Therefore, speculations surrounding the Fed and BoE interest rate expectations and potential trade concerns will continue to have a pivotal role.

The mid-tier US Existing Home Sales is the only relevant data due on Tuesday. However, Wednesday will feature the preliminary S&P Global Manufacturing and Services PMI data from the UK and the US.

Meanwhile, the advance second-quarter Gross Domestic Product (GDP) data from the US will grab the eyeballs on Thursday. Markets will also look to the weekly Jobless Claims and Durable Goods Orders data that will be released parallelly that day.

The focus will then shift to Friday’s US core Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation gauge, which will provide fresh cues on the interest rate outlook amid the Fed ‘blackout period’.

GBP/USD: Technical Outlook

Following a brief attempt to penetrate the 1.3000 level, the Pound Sterling continues to remain as a ‘buy-dips’ trade, as observed on the GBP/USD daily chart.

The 14-day Relative Strength Index (RSI) has reversed from the overbought territory to trade near 64, at the press time, suggesting that the upside risks remain intact.

However, if the GBP/USD correction from the 2024 highs gathers steam, the immediate cushion is seen at the throwback support from the March 8 high of 1.2894.

A sustained move below the latter will challenge the bullish commitments at the previous key resistance near 1.2800. At that level, the 21-day Simple Moving Average (SMA) converges.

Further south, the 50-day SMA at 1.2751 will be tested. Additional declines will call for a test of the June low of 1.2613.

On the upside, recapturing the 1.3000 key level on a weekly closing basis is critical to reviving the uptrend toward the yearly high of 1.3045.

If buyers gain a strong foothold above that level, a fresh run to the 1.3100 round figure and beyond cannot be ruled out.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.