October 29, 2024 – Written by David Woodsmith

STORY LINK Pound Sterling Edges Higher into UK Budget, GBP/USD Re-Tests 1.30

The Pound to Dollar (GBP/USD) exchange rate found support above 1.2950 on Tuesday and rallied to test the 1.3000 level after the New York open as the dollar retreated after the batch of US data, but failed to make a decisive break higher.

According to Scotiabank; “gains through 1.2995/00 could still see the pound extend to the 1.3070/75 area.”

ING remained broadly bearish on Cable; “GBP/USD continues to look vulnerable ahead of tomorrow’s Budget event and next week’s US election, and risks remain skewed to a move to 1.2800-1.2850.”

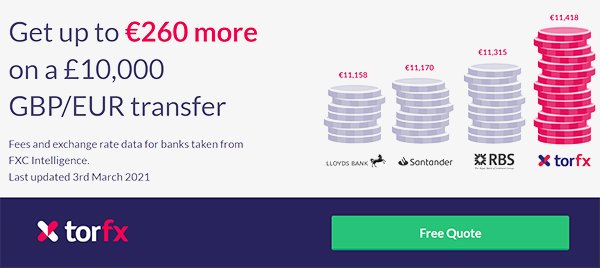

The Pound to Euro (GBP/EUR) exchange rate also advanced to 1.2030 as the Pound secured a tentative net gain ahead of Wednesday’s budget.

Spending, tax and gilt issuance details will all be key elements on Wednesday.

Scotiabank commented; “Gilts are a little softer in line with the broader tone in fixed income as UK markets are brace for tomorrow’s budget announcement. More spending (investment in health services, for example) and more debt issuance is expected after Chancellor Reeves announced changes in the way the government measures indebtedness to give it more room to manoeuver and achieve its policy goals.”

US data was notably mixed on Tuesday.

Consumer confidence jumped to 108.7 for October from 98.7 the previous month and well above consensus forecasts of 99.5.

There was a strong increase in the current conditions component and a smaller rise in expectations.

Dana M. Peterson, Chief Economist at The Conference Board commented; “Consumer confidence recorded the strongest monthly gain since March 2021, but still did not break free of the narrow range that has prevailed over the past two years. Views on the current availability of jobs rebounded after several months of weakness, potentially reflecting better labor market data.

Consumers were more confident in the labour market, but the JOLTS release on job openings recorded a sharp decline to 7.44mn for September from a downwardly-revised 7.86mn previously. This was below expectations of 8.00mn and the weakest reading since January 2021.

Markets overall put greater weight on the job-openings data with markets slightly more confident that the Fed would cut interest rates in November and December.

International Money Transfer? Ask our resident FX expert a money transfer question or try John’s new, free, no-obligation personal service! ,where he helps every step of the way,

ensuring you get the best exchange rates on your currency requirements.

TAGS: Pound Sterling Forecasts