- The Pound Sterling held its corrective decline against the US Dollar amid lingering tariff concerns.

- GBP/USD traders gear up for an action-packed week ahead as trade talks and inflation data loom.

- Technically, GBP/USD appears at a critical juncture, exposed to two-way risks.

The Pound Sterling (GBP) entered a consolidative phase against the US Dollar (USD), following the recent GBP/USD correction from near four-year highs of 1.3789.

Pound Sterling continued its correction amid trade tariff jitters

Despite the corrective consolidation, GBP/USD sellers held the upper hand amid a steady recovery staged by the US Dollar from multi-year troughs.

The Greenback attracted safe-haven flows as trade war fears resurfaced, following US President Donald Trump’s announcements of new tariffs throughout the week.

Markets set off the week unnerved as Trump’s July 9 trade deal deadline approached.

Trump announced on social media on Monday that 25% tariffs will be imposed on imports from Japan and the Republic of Korea, respectively, beginning August 1.

Later, he announced that similar letters were sent to the leaders of 12 other countries, informing them that tariffs ranging 25% to 40% will be charged starting next month.

Fresh tariff headlines continued to dominate risk sentiment, boosting the go-to haven US Dollar while smashing GBP/USD to 10-day lows of 1.3526.

Heading into the Minutes of the US Federal Reserve (Fed) July meeting, Trump threatened 10% additional levies on all BRICS nations, including India, effective August 1, while also announcing 50% tariffs on Copper imports.

President Trump on Wednesday issued August 1 tariff notices to seven minor trading partners, with a 20% tariff on goods from the Philippines, 30% on goods from Sri Lanka, Algeria, Iraq, and Libya, and 25% on Brunei and Moldova.

He further announced a 50% tariff on US copper imports and a 50% duty on goods from Brazil, both effective on August 1.

Lingering trade tensions and the hawkish Fed Minutes provided further strength to the ongoing USD recovery, keeping the pair in multi-day lows.

The Minutes “showed that only “a couple” of Fed officials believed interest rate cuts could happen as early as this month, with most favouring reductions later this year,” per Reuters.

In the second half of the week, markets digested Trump’s fresh threat of a 35% tariff rate for goods imported from Canada, starting August 1.

He went on to announce more tariffs and noted he planned to impose blanket levies of 15% or 20% on most trade partners.

Late Thursday, the President said the European Union (EU) could receive a letter on tariff rates by Friday, raising doubts about the progress of trade talks between Washington and the old continent.

Risk sentiment remained sour on Friday, with GBP/USD licking its wounds and bracing for a big week ahead.

The pair was also weighed down by the unexpected UK economic contraction in May. Data from the Office for National Statistics (ONS) showed UK Gross Domestic Product (GDP) contracted 0.1% month-on-month (MoM) in May, compared to an expected 0.1% growth.

Other data from the UK showed that monthly Industrial and Manufacturing Production came in at -0.9% and -1%, respectively, in May. Both readings fell short of market expectations.

Focus on trade headlines in the US/UK inflation week

An action-packed week is unfolding, following a relatively quiet one data-wise.

However, fresh updates surrounding US President Donald Trump’s tariff plans will continue to flow, dictating market sentiment and the higher-yielding Pound Sterling.

Traders brace for a quiet start, with no major data releases due on Monday.

Tuesday will feature the Chinese second-quarter Gross Domestic Product (GDP) alongside the Retail Sales and Industrial Production data.

The main event risk that day will be the US Consumer Price Index (CPI) report, which will be key to altering the markets’ pricing of the Fed rate cuts this year.

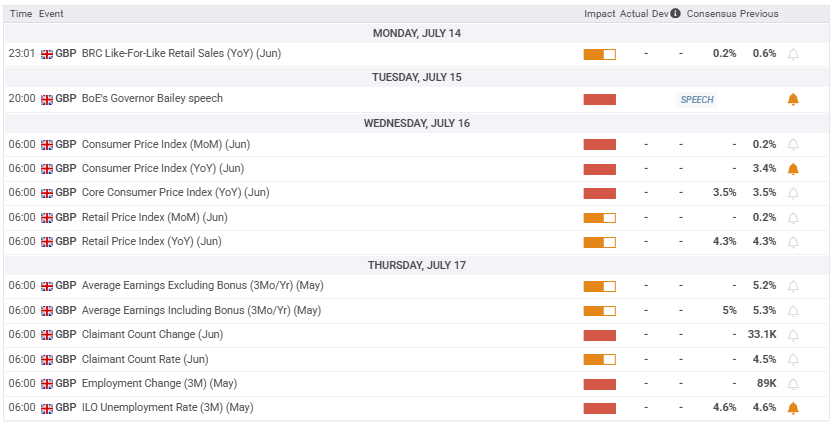

Bank of England (BoE) Governor Andrew Bailey’s speech at the Annual Mansion House Financial and Professional Services Dinner, in London, will also be closely followed late Tuesday.

On Wednesday, the UK CPI inflation data will likely steal the show ahead of the US Producer Price Index (PPI) release.

The UK labor data will be reported on Thursday, followed by the US Retail Sales and the weekly Jobless Claims statistics.

The preliminary University of Michigan (UoM) Consumer Sentiment and Inflation Expectations data will be eagerly awaited on Friday for fresh hints on the inflation and interest rates outlook.

Besides data publications, all eyes will remain on the speeches from Fed policymakers as the US central bank enters the ‘blackout period’ on Saturday before its July 29-30 monetary policy meeting.

GBP/USD: Technical Outlook

GBP/USD breached the critical previous resistance-turned-support of the February 2022 high at 1.3643 on a sustained basis on Monday, paving the way for more bearishness.

The 14-day Relative Strength Index (RSI) has pierced the midline to the downside, currently near 49, opening the door for additional declines.

However, Pound Sterling buyers find immediate strong support at the 50-day Simple Moving Average (SMA) at 1.3498.

Only a sustained move below that level could initiate a fresh downtrend toward the June 23 low of 1.3371.

Ahead of that, the static demand area at 1.3445 could offer some comfort to buyers.

The line in the sand for the pair is seen at the 100-day SMA at 1.3252.

On the other hand, scaling the immediate resistance at the 21-day SMA of 1.3595 is critical to reviving the GBP/USD rally.

The next topside hurdle is seen at the 1.3750 psychological level, above which a test of the 1.3800 round level will be inevitable.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data.

Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money.

When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.