(Bloomberg) — The chances of a sharp retreat in the British pound are growing if the Bank of England opts to lower interest rates later this week.

Most Read from Bloomberg

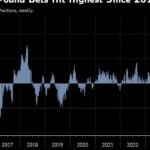

A chorus of strategists say the market’s increasingly bullish positioning leaves sterling primed for a correction. Hedge funds last week ramped up bets for a stronger currency to the highest in a decade, data from the Commodity Futures Trading Commission shows, while a broader measure of wagers that includes asset managers rose to its highest on record.

Whether the BOE cuts rates on Thursday is essentially a coin-toss, market pricing shows. That means that if it does, it could deal “a substantial hit on the pound,” according to FX strategist Francesco Pesole at ING.

He joins the likes of Lee Hardman, a senior currency strategist at MUFG, who says the the currency is “vulnerable to a position squeeze in the near term.” Last week, JPMorgan Chase & Co. warned the pound’s peer-beating rally could be vulnerable to a correction.

Sterling hit a one-year high earlier this month as investors bet relatively high interest rates, an improving economy and a stable UK government will keep it at the top of the pile among Group-of-Ten currencies this year. Since the start of the year, it has gained nearly 1% versus the US dollar.

Leveraged funds, which include hedge funds, have increased their net-long wagers in the UK currency to levels last seen in July 2014, the latest weekly CFTC data show. Such bets have more than doubled in the past month and have increased for four straight weeks.

But ING’s Pesole says investors are underpricing the risk of cuts. Market pricing points to a total of 50 basis points of cuts by year-end, but there could very well be a third, he argues.

There are “reasons for a contraction” in the pound against the dollar as well as the potential for euro gains versus the UK currency due to “inconsistencies with rate differentials,” Pesole wrote in a note.

(Recasts throughout)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.