Pound Sterling trades with caution as US inflation takes centre stage

The Pound Sterling (GBP) trades cautiously against the US Dollar (USD) near a three-week low around 1.3430 on Tuesday. Investors brace for significant volatility in the GBP/USD pair as the United States (US) Consumer Price Index (CPI) data for June is scheduled to be published at 12:30 GMT.

Ahead of the US inflation data, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades marginally lower from the three-week high around 98.00. Investors will pay attention to the US CPI data, as it will provide clarity about the impact of tariffs imposed by President Donald Trump on inflation . Federal Reserve (Fed) officials have been arguing in favor of keeping interest rates at their current levels until they get clarity about how much Trump’s tariff policies will impact prices, and the CPI release could offer some insights on the matter. Read more…

GBP/USD at breaking point: Will the bulls roar back?

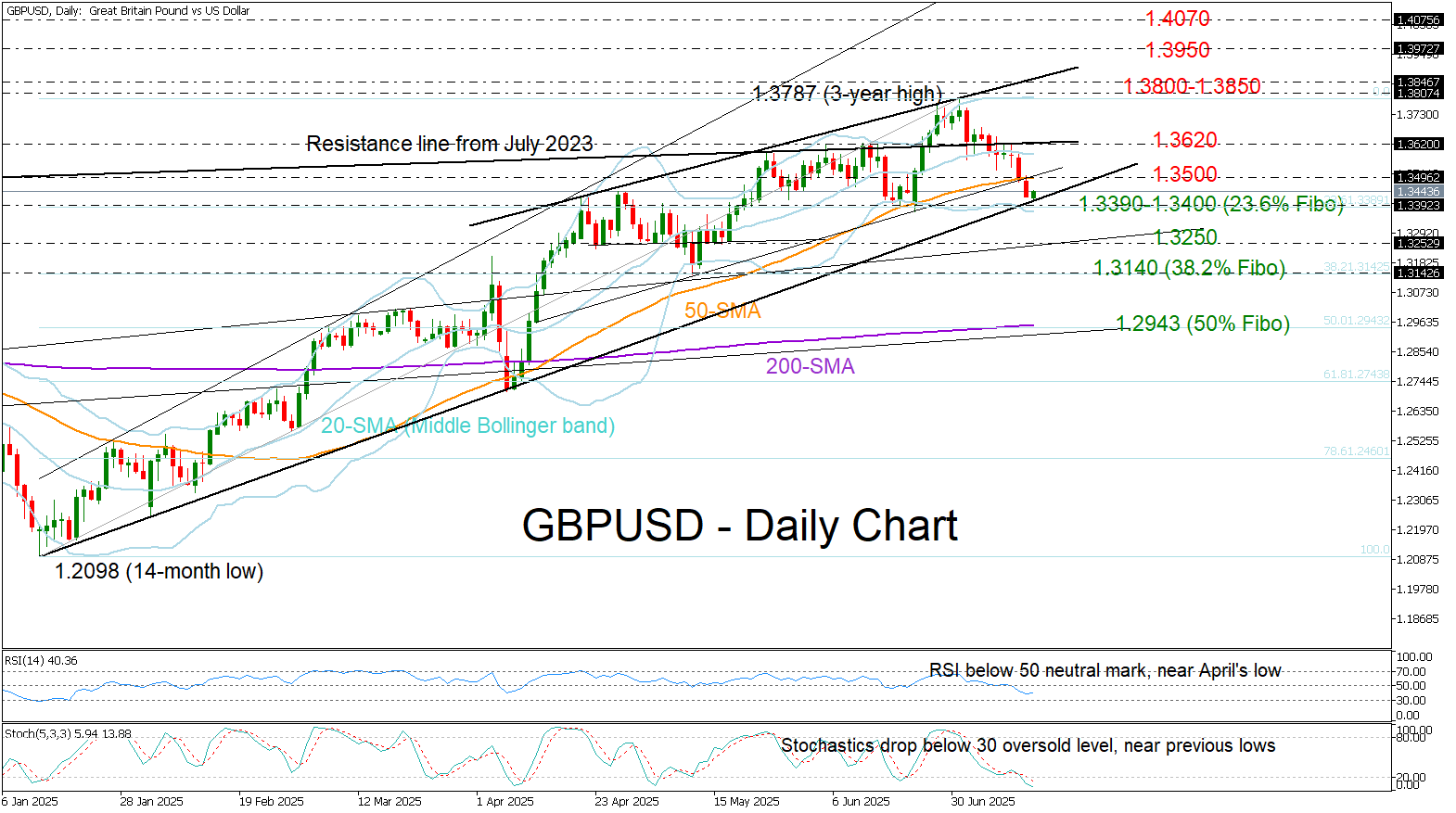

GBP/USD extended its decline below the 50-day simple moving average (SMA) after Bank of England Governor Andrew Bailey expressed a willingness to implement larger rate cuts if the labor market shows signs of weakness, according to an interview with The Times.

U.S. and UK CPI figures, due today and tomorrow respectively, are expected to show some persistence in inflation, and the pair is already hovering near a potential pivot zone, trading around the 2025 support trendline at 1.3400. Notably, the 23.6% Fibonacci retracement of the 2025 uptrend is also nearby, at 1.3390. Read more…