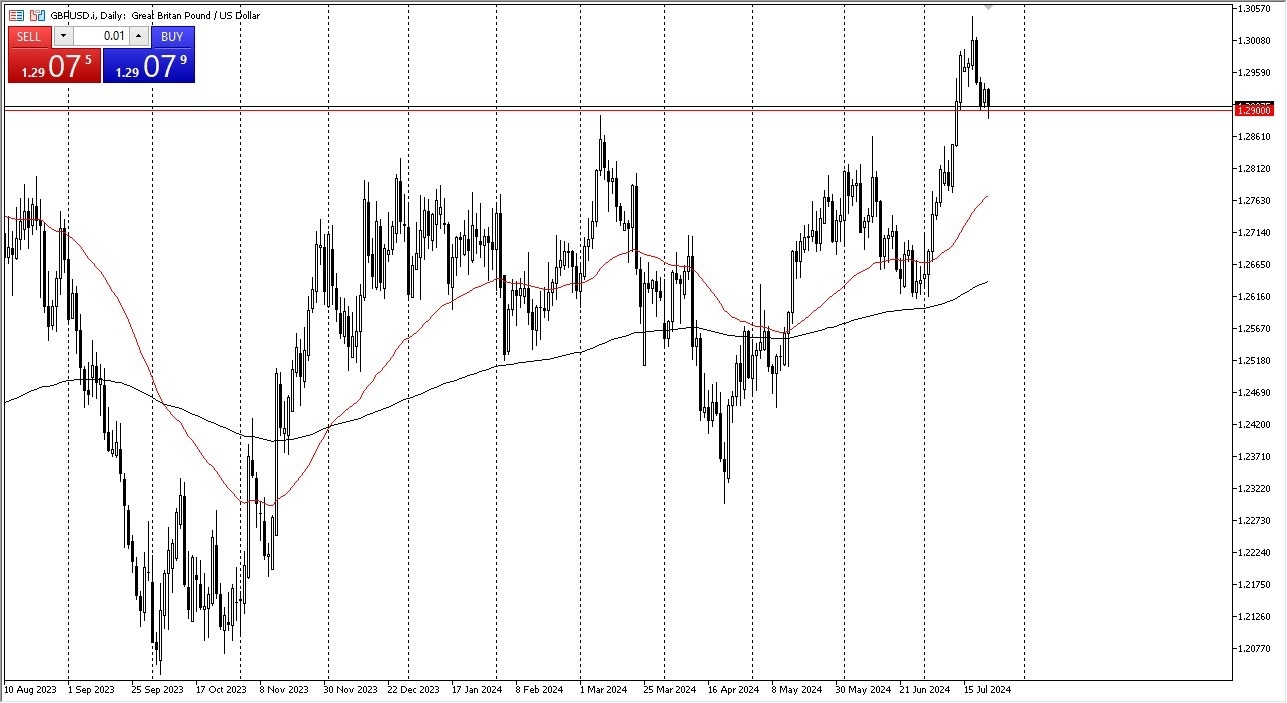

- The British pound has drifted a little bit lower during the trading session, but it looks like buyers are trying to protect the 1.29 level.

- It’s probably worth noting that we are getting somewhat close to the breakout point from the previous rally, and therefore I think you’ve got a situation where it’s a breakout, a pullback, and then a continuation type of trade.

If the US dollar does in fact shrink against currencies in general, this is a pair that it will. You will almost certainly see it happen here as well. The 1.30 level above should be a short term target. If we can break above and then it could really unravel the US dollar and we could see sterling rally quite nicely. This of course is something that I have seen recently, and I think this continues to be a potential direction of the GBP/USD market.

Interest Rates Matter, But Not Here

Keep in mind that the interest rate differential between the two currencies is essentially nothing. So, it’s not even a question of getting paid at the end of every day, like we see in so many other parents at the moment. At this point, it’s more or less going to be about momentum. Momentum is something that can drive a market much further than you expect, for much longer than you anticipate.

When you zoom out, you can see that the 1.31 level is an area that could be a target, as it was a swing high, and if we can break that region, we could really start to take off, perhaps going as high as 1.36. That being said, in the short term, this is a market that I think remains volatile, but it looks like every time we dip, there are buyers out there willing to jump in and take advantage of cheap British pound, as the market seemingly likes the Pound over the Dollar in general. This is a situation that I think will continue to be the case going forward.

Ready to trade our daily Forex forecast? Here’s some of the best forex broker UK reviews to check out.