GBP/USD Forecast: Pound Sterling could target new multi-month highs

GBP/USD gained traction in the American session on Wednesday and registered its highest daily close since March. The pair trades in positive territory above 1.2850 in the European session on Thursday.

The improving risk mood caused the US Dollar (USD) to lose interest in the American trading hours on Wednesday and allowed GBP/USD to extend its uptrend. Additionally, Bank of England (BoE) Chief Economist Huw Pill said that they still have some work to do before the domestic persistent component of inflation is gone, further supporting Pound Sterling. Read more…

GBP/USD outlook: Stronger than expected UK GDP numbers lift cable to four-month high

Cable hit new four-month high in European trading on Thursday, lifted by better than expected UK May GDP numbers, which poured cold water on expectations for BoE rate cut next month.

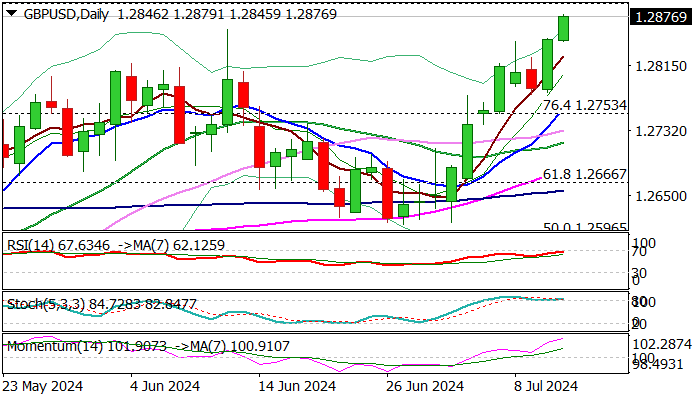

Fresh strength broke through pivotal barriers at 1.2846/60 (200WMA/former top June 12) and pressuring key barrier at 1.2893 (2024 high, posted on March 8). Firmly bullish technical picture on daily chart (Tenkan/Kijun-sen forming a bull-cross and bullish momentum is strengthening) support the action, though headwinds on approach to 1.2893 could be expected, due to overbought conditions and significance of barrier. Read more…

GBP/USD Forecast: Pound Sterling stabilizes near 1.2800 as markets await next catalyst

GBP/USD edged lower during the American trading hours on Tuesday and closed the day in negative territory. The pair holds steady near 1.2800 in the European session on Wednesday as investors refrain from taking large positions while awaiting the next fundamental driver.

Federal Reserve (Fed) Chairman Jerome Powell presented the Semi-Annual Monetary Policy Report and responded to questions before the Senate Banking Committee on the first day of his Congressional testimony on Tuesday. Read more…