GBP/USD Forecast: Pound Sterling could extend slide if 1.3650 support fails

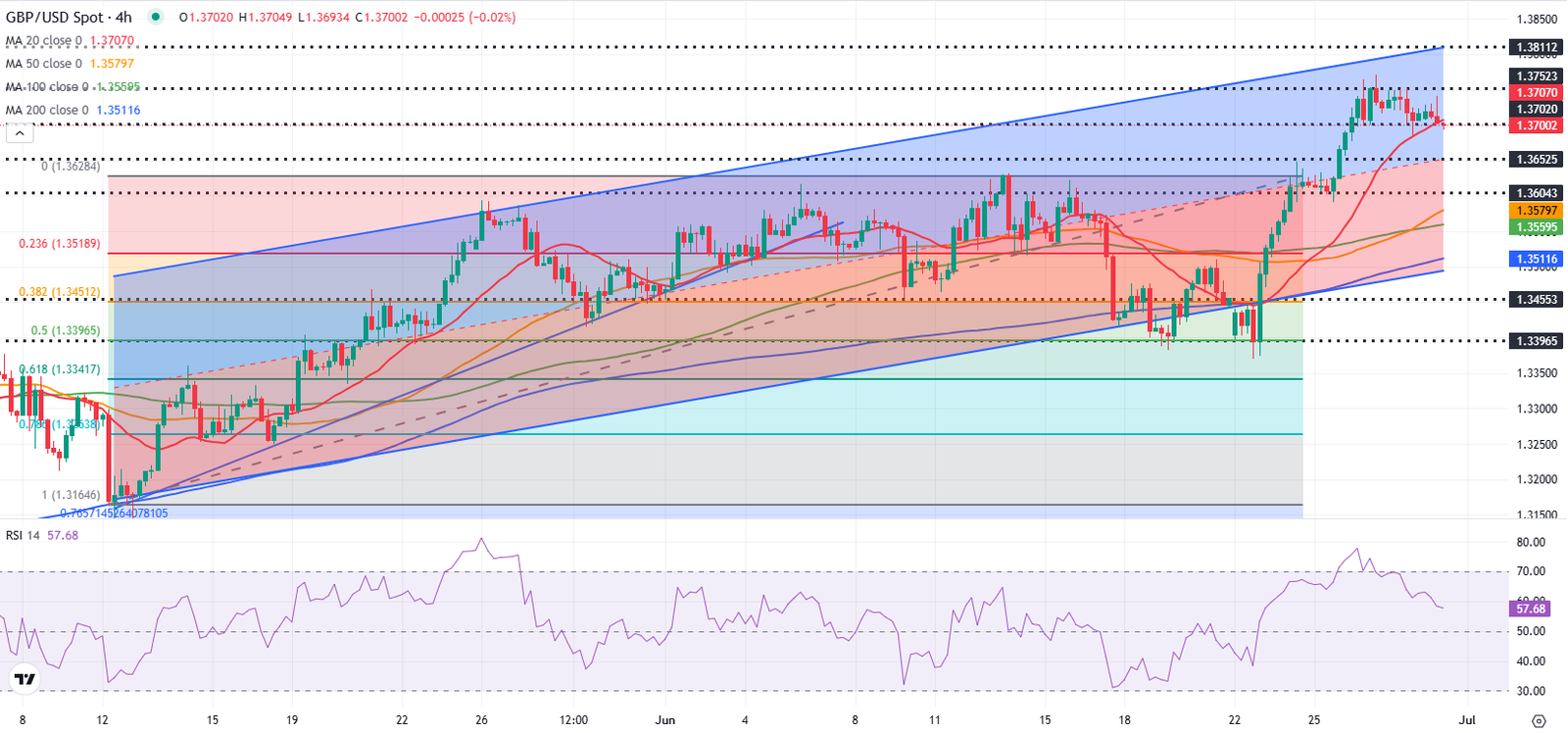

GBP/USD corrects lower and trades at around 1.3700 on Monday after gaining about 2% last week. The pair’s technical outlook points to a loss of bullish momentum in the short term.

GBP/USD rose sharply last week as the risk-positive market atmosphere, on easing geopolitical tensions, and growing concerns over the Federal Reserve (Fed) losing its independence weighed heavily on the US Dollar (USD). Read more…

GBP/USD Price Forecast: Rebounds toward 1.3750 near multi-year highs

The GBP/USD pair retraces its recent losses from the previous session, trading around 1.3730 during the Asian hours on Monday. The bullish bias persists as the daily chart’s technical analysis indicates that the pair moves upwards within the ascending channel pattern.

The 14-day Relative Strength Index (RSI) remains slightly below the 70 level, strengthening the bullish bias. However, a breach above the 70 mark would indicate an oversold situation and a downward correction soon. Additionally, the GBP/USD pair rises above the nine-day Exponential Moving Average (EMA), suggesting the short-term price momentum is stronger. Read more…

GBP/USD Weekly Outlook: Pound Sterling awaits central bank talks in the NFP week

The Pound Sterling (GBP) recovery gathered steam against the US Dollar (USD), driving the GBP/USD pair to the highest level since October 2021, above 1.3750.

It was a clear win-win case for the higher-yielding Pound Sterling as the US Dollar gradually lost its safe-haven appeal amid yo-yo-ing sentiment surrounding the US Federal Reserve’s policy outlook. Read more…