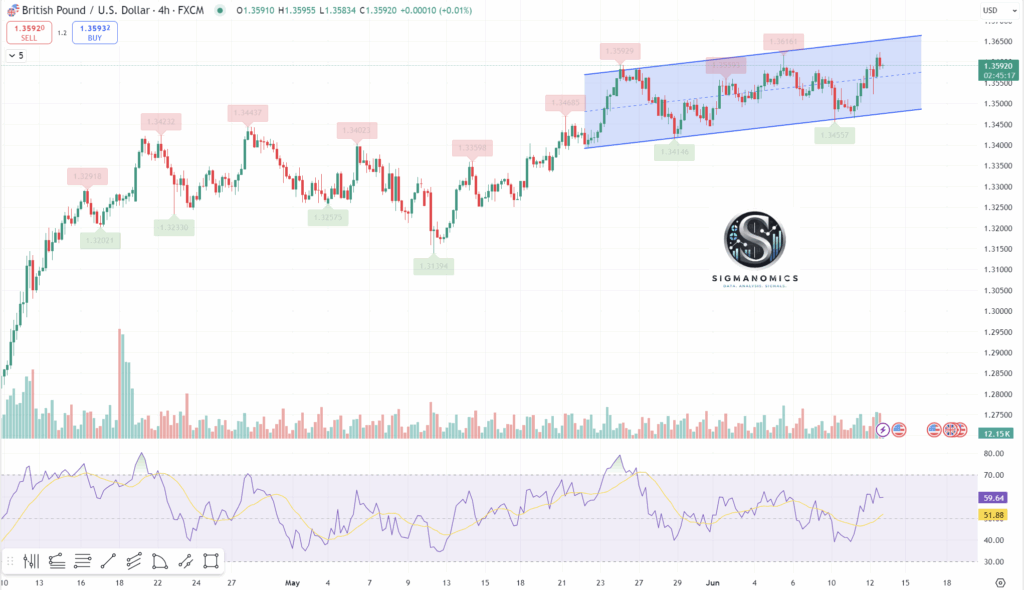

GBP/USD Forecast: Pound Sterling could extend correction if 1.3530 support fails

GBP/USD stays on the back foot and trades near 1.3550 in the European session on Tuesday after posting small gains on Monday. The pair could extend its decline if the support level at 1.3530 fails.

The improving risk mood made it difficult for the US Dollar (USD) to stay resilient against its peers on Monday and helped GBP/USD push higher. The Wall Street Journal reported that Iran was looking to end hostilities with Israel and resume talks about its nuclear program. Major equity indexes ended the day decisively higher, reflecting a risk-positive market atmosphere. Read more…

GBP/USD reaches highest level since February, 2022

The greenback, commonly referred to as the cable, has reached its highest level against the U.S. dollar since early 2022, trading at the psychologically significant level of 1.36 as of June 2025. This currency pair has been influenced by diverging central bank policies, different economic narratives, and varying inflation rates on both sides of the Atlantic. In detail, the dollar has plunged nearly 10 percent on the back of underwhelming job data in the U.S. paired with speculation of Fed rate cuts on the back of inflation. Conversely, the U.K. has shown solid data with retail sales rising 1.2 percent in April, while inflation rose 3.5 percent year-over-over in April from 2.6 percent. This recent consumer prices report has led the Bank of England to reconsider moves toward rate cuts.

In this report, we will examine the economic situations in the United Kingdom and the United States, analyze their impact on the GBP/USD exchange rate, and provide a detailed technical analysis across multiple time frames. Read more…