GBP/USD holds steady above mid-1.3500s ahead of UK CPI, Fed/BoE policy meetings

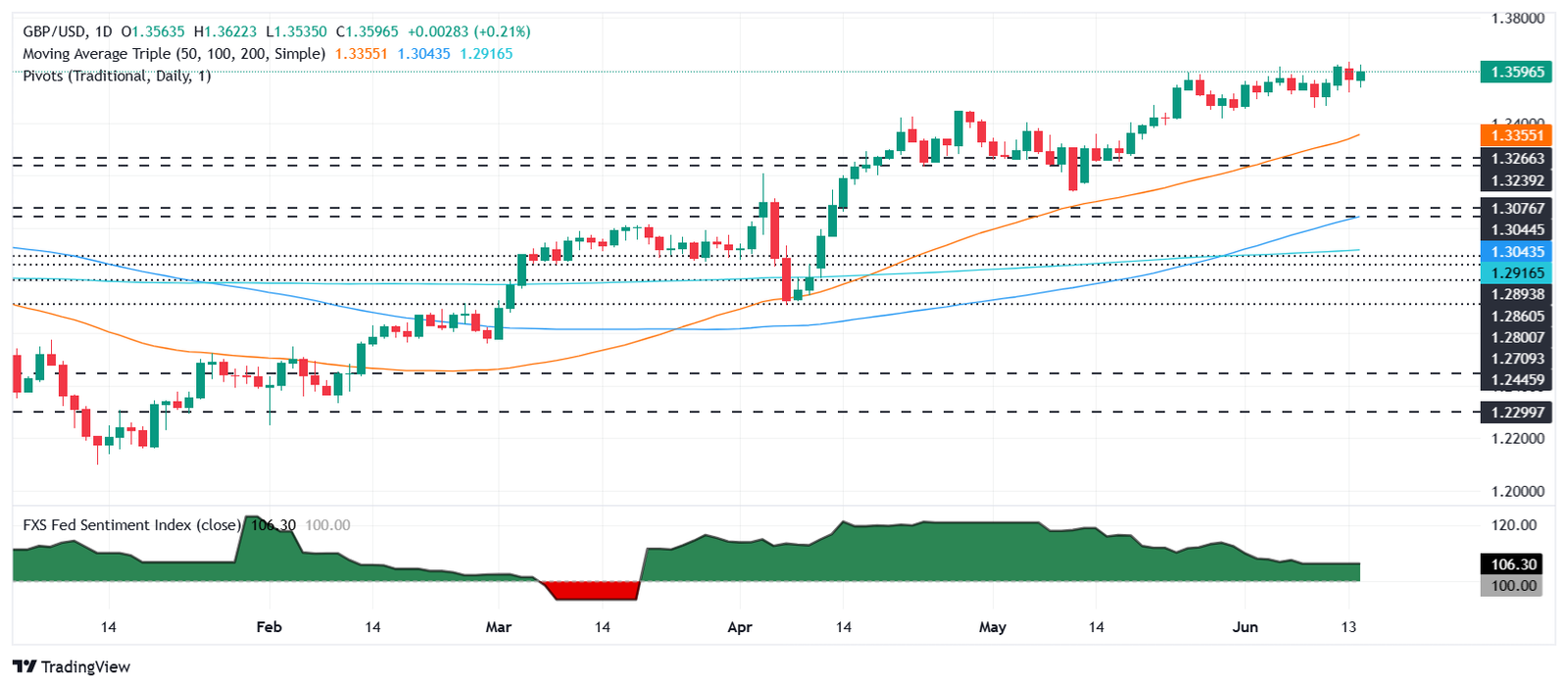

The GBP/USD pair lacks any firm intraday directional bias and oscillates in a narrow trading band, above mid-1.3500s during the Asian session on Tuesday. Spot prices, however, remain close to a three-year top touched last Friday as traders opt to wait for this week’s key data/central bank event risks before positioning for the next leg of a directional move.

The UK consumer inflation figures are due for release on Wednesday ahead of the crucial Bank of England (BoE) policy meeting on Thursday, which should influence the British Pound (GBP). Moreover, the US Federal Reserve (Fed) interest rate decision on Wednesday will drive the US Dollar (USD) in the near term and provide some meaningful impetus to the GBP/USD pair. Read more…

GBP/USD hangs out near highs ahead of double-header central bank rate calls

GBP/USD continues to churn chart paper on the high end of 40-month peaks, cycling the 1.3600 region as Cable traders enjoy a continued boost. Greenback flows continue to wither across the board on geopolitical headlines, keeping the Pound Sterling buoyed as dual central bank rate calls loom ahead.

The Israel-Iran conflict continues to spill over, with both sides launching missile strikes at various targets and the Trump administration weighing the concept of getting involved directly in the altercation. Broad-market investor sentiment is banking on the two sides reaching some sort of peace arrangement before the altercation boils over into the surrounding region. Read more…

GBP/USD rebounds above 1.36 as Israel-Iran conflict deepens, Dollar weakens on risk shift

The GBP/USD surged during the North American session, rising back above the 1.36 figure as hostilities within the Israel-Iran conflict escalated over the weekend and continued into the new week. At the time of writing, the pair trades at 1.3600, gaining 0.27%.

Last Friday, the GBP/USD retreated on risk aversion and plunged to 1.3515 as Israel delivered strikes on Iran’s military and nuclear facilities, alongside targeted attacks on senior officials. Since then, Iran has retaliated, and with both parties exchanging blows, a truce seems far from reach. Read more…