Pound Sterling climbs to near 1.3000 ahead of Jackshon Hole event

The Pound Sterling (GBP) exhibits a strong performance against its major peers in the European trading hours on Tuesday. The British currency trades firm on expectations that the policy-easing cycle from the Bank of England (BoE) will be slower than that of other central banks.

Despite a sharp slowdown in price pressures in the UK’s service sector, a closely watched inflation gauge by BoE policymakers, the drop is still insufficient to compel officials to cut interest rates aggressively. Services inflation decelerated to 5.2% in July from 5.7% in June. However, easing services inflation has opened doors for BoE sequential interest rate cuts. Currently, markets have attached a 37% probability of such action, Reuters reported. Read more…

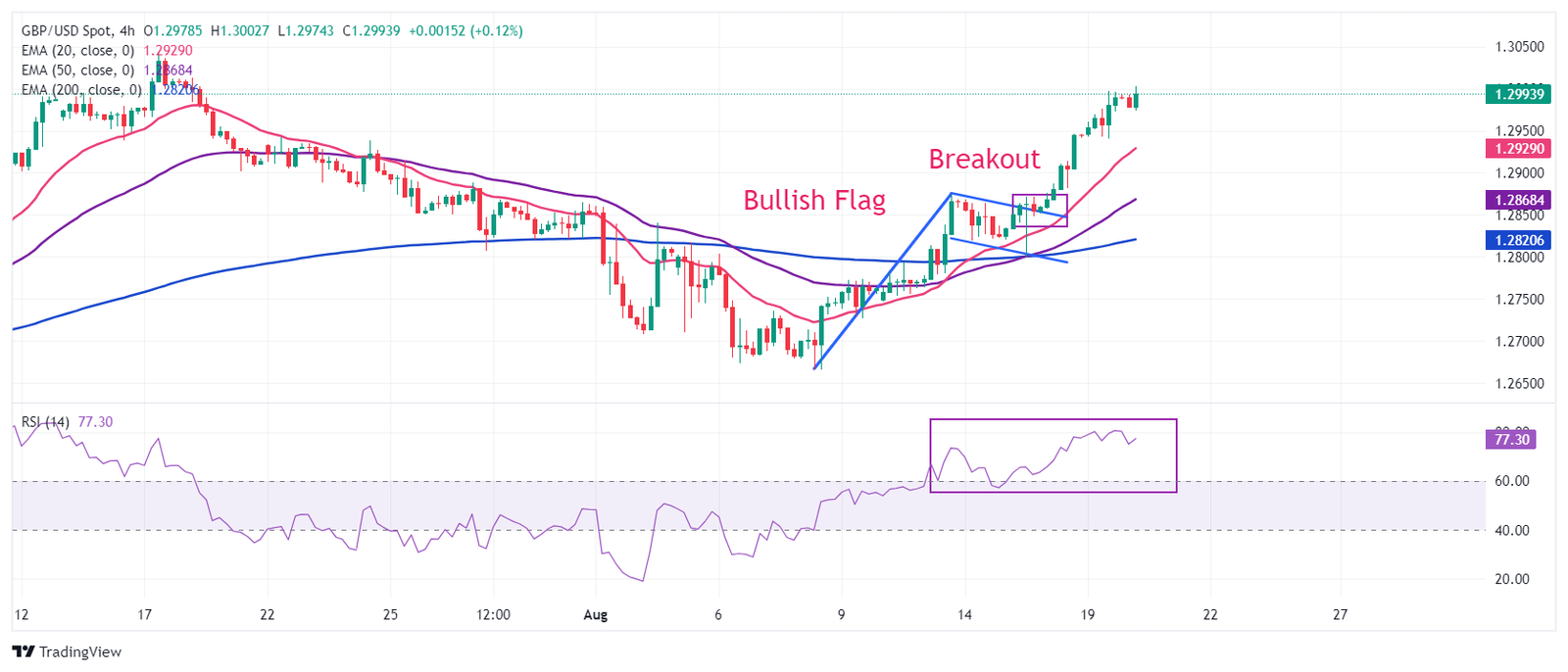

GBP/USD Forecast: Pound Sterling could correct lower if sellers defend 1.3000

GBP/USD closed the third consecutive trading day in positive territory on Monday and continued to stretch higher early Tuesday, reaching its highest level since mid-July above 1.3000. The near-term technical outlook shows that the pair remains overbought in the near term.

The improving risk mood made it difficult for the US Dollar (USD) to find demand on Monday and allowed GBP/USD to build on the previous week’s gains. Early Tuesday, US stock index futures trade marginally higher on the day. In the absence of high-tier macroeconomic data releases that could impact the USD’s valuation, the risk perception could continue to drive GBP/USD’s action. A bullish opening in Wall Street, followed by another leg higher in major equity indexes, could help the pair hold its ground in the second half of the day. Read more…