Monitor to address cash flow uncertainty

It’s bad for a domestic business when receivables start slowing down. But that can be even more problematic for companies trading globally that must monitor unpredictable cash flow in multiple currencies. With the explosion of internet-based commerce, a growing number of companies fit this description. To do a better job of keeping tabs on international cash flow, companies should consider adopting a treasury management system that provides a global cash platform, recommends Adam Towers, vice president and group product manager, International Solutions, at U.S. Bank.

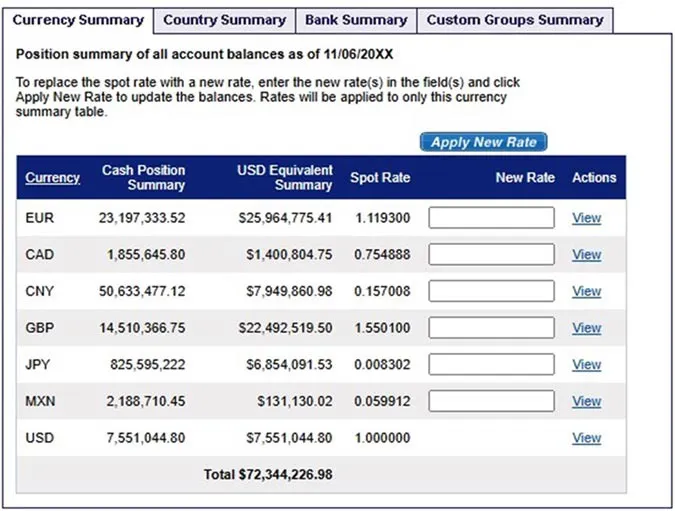

As cash flows become less predictable, it’s easy for a company that has multiple bank accounts in multiple countries in multiple currencies to become overdrawn in an account or a particular currency. Monitoring for such problems gets easier, however, if the company adopts a global platform that provides a summary view of its cash balances by country, bank and currency (see screenshot below).

Permission granted by U.S. Bank

With this sort of platform, if you see you are overdrawn in British pounds (GBP), for instance, you can drill down to learn which accounts at which banks are overdrawn and then effect funds transfers between accounts to alleviate any GBP shortfalls.

Addressing cash flow uncertainty is critical. Having a single screen where you can go to review all your cash in various currencies gives you more visibility to your company’s cash positions, which enables more effective cash forecasting.

“Today, many middle-market businesses have accounts in multiple regions for buying and selling goods,” Towers says. “A company with five banks using three currencies can really benefit from the visibility and efficiency of managing all of its cash in one central place.”

Consolidate global funds to enhance cash visibility

To get a broad and comprehensive view of your global cash balances, consider consolidating your funds or using an overlay structure with a bank in the United States.

A safe and secure banking partner located in the U.S. can help you avoid the risks associated with holding funds in other countries, such as currency controls or changes in repatriation taxes. What’s more, you can manage and move funds from an overseas account to consolidate balances with your U.S. bank in foreign currency or U.S. dollars. You can also use the accounts you have with your U.S. bank as an overlay structure for day-to-day transactions or as a contingency option to supplement your overseas bank accounts.

A U.S. company doing international business can leverage U.S.-based foreign currency accounts (FCAs) to consolidate excess foreign cash into the U.S. in an FDIC-insured account. Accounts are available in a host of currencies and may be opened as resident or non-resident accounts. Additionally, because FCAs are based in the U.S., Foreign Bank Account Reporting (FBAR) may not be required.

Working with their U.S. bank, treasury managers with international businesses can choose from a variety of solutions for investing excess cash, including U.S. dollar and non-dollar investment options.

Manage currency exchange rate volatility

During periods of financial uncertainty, currency exchange rates move unpredictably and often quite sharply.

For international businesses, extreme foreign exchange rate volatility can have an enormous impact on costs and revenue. For example, if you enter into an agreement to buy raw materials from a German company at a certain price in euros, before the transaction is completed, the euro could dramatically appreciate in value against the dollar, making the purchase much more expensive. Similarly, for exporters, big rate swings can eat into profits on sales to foreign customers.

Fortunately, companies can take steps to mitigate the risks of foreign exchange rate volatility, protect assets and even stabilize costs in uncertain times. Here are some strategies U.S. Bank experts recommend:

Consider hedging. Currency hedging products enable companies to secure a guaranteed foreign exchange rate in advance of transaction, whether buying or selling.

The simplest hedging solution for addressing exchange rate volatility is the forward contract, a basic arrangement in which you set a specific date when you will get the currency you need for a price you agree to today.

By selling at a euro-denominated price and entering into a forward contract, a U.S. exporter would forfeit the potential opportunity to earn an extra profit if the euro appreciated against the dollar between the time the exporter set the price and when it shipped the goods. Yet the exporter also eliminates the possibility of losing out if currency markets move in the opposite direction.

Similarly, using a forward contract, a U.S. importer that agrees to pay a supplier in euros knows today what the dollar cost of those euros will be when the time comes to pay the supplier.

“Hedging is not about making a bet that the market will go up or down,” explains Chris Braun, managing director and head of FX Sales at U.S. Bank. “It’s about taking the volatility out of the market and creating certainty.”

Companies can use a wide variety of other foreign exchange tools — including foreign currency option contracts — to address exchange rate volatility. With all the available choices, some treasurers shy away from FX hedging because it seems too complex. However, hedging need not be feared. The FX sales representative at your bank can help you evaluate whether hedging makes sense for your company, and if it does, suggest the right tools and strategies to meet your objectives.

Ask your foreign suppliers to invoice you in U.S. dollars (USD) and their local currency. By asking for prices in both USD and its supplier’s local currency, an importer can assess the most cost-effective choice.

Typically, the USD price will be more, because a USD payment would require a foreign supplier to do the currency conversion and manage the foreign exchange. However, an importer might decide it’s worthwhile to pay a little more to avoid having to manage the FX risk. “Giving yourself that flexibility can be really powerful,” Towers says.

The absolute best practice: seek expert assistance

Here’s a final and critically important recommendation:

Consult with the international specialists at your bank. In times of financial uncertainty, it’s especially important for companies engaged in international business to consult with knowledgeable treasury management and foreign exchange banking professionals.

With regulations that vary from country to country, multiple currencies to manage, and processes that are vastly different from domestic trade, international trade is a complex, fast-moving arena. “As a result,” Towers says, “whether you need to explore hedging your exposure to foreign currencies, negotiate terms with a trading partner or choose the right treasury management system, it always makes sense to talk to the international experts at your bank.”

It may seem intimidating to pay or invoice in foreign currency, but our goal is to make it easy for you. Contact your banking partner to learn more about foreign exchange services and FX risk mitigation. Your partners can help find the right services to fit your needs.