US Dollar

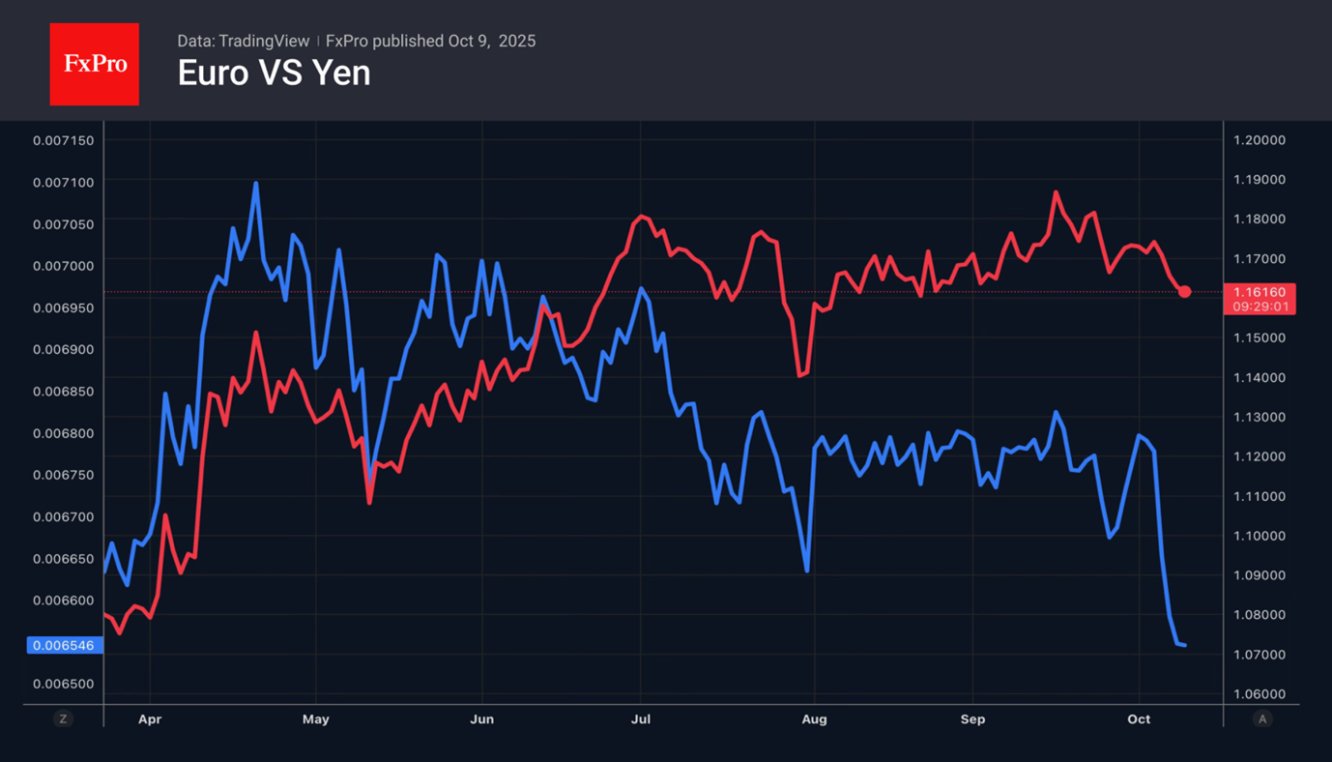

The continued its advance thanks to the weakness of its competitors. The political crisis in France has heightened the risks of early parliamentary elections and the potential resignation of Emmanuel Macron as president, thereby putting pressure on the . The new leader of the Liberal Democratic Party and soon-to-be Prime Minister of Japan, Sanae Takaichi, supports fiscal stimulus and opposes interest rate hikes. Doubts about the central bank’s independence have weakened the .

US Dollar fans are not put off by the almost 80% chance of a in the federal funds rate from 4.25% now to 3.75% by the end of this year. The worsening political crisis in France could slow down the eurozone and force the ECB to resume its monetary easing. Keeping the Bank of Japan’s rate low will give the green light to carry trade, pushing USD/JPY higher.

The shutdown adds uncertainty. On the one hand, the Fed is not receiving important data for lowering rates. On the other hand, alternative statistics signal a weakening jobs market and push the central bank towards further policy easing.

Stocks

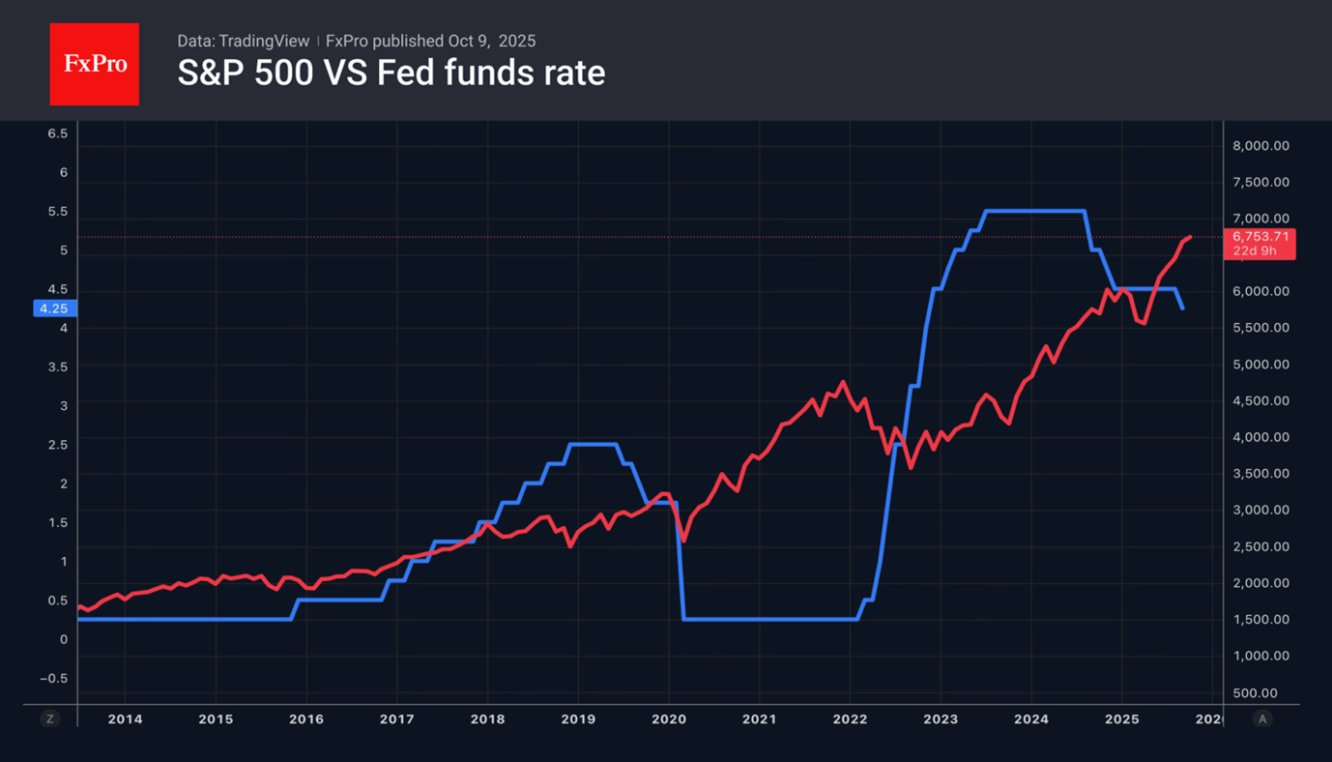

The hit its 33rd record high this year. News of ’s meagre profits from its collaboration with OpenAI led to a pullback. However, investors immediately bought up the dip, willing to wait until AI technologies deliver impressive financial results. Coupled with expectations of further and the imminent start of the corporate reporting season, this is giving the stock market a boost.

When the S&P 500 set records in September, it maintained low volatility, changing by no more than 1% over the latest 31 trading sessions. This is the longest streak since the pandemic. Due to the shutdown, investors are hungry for information and are eagerly awaiting the start of the third-quarter corporate reporting season.

According to Wall Street forecasts, earnings will grow by 7.2%. This is the slowest pace in two years and could easily be exceeded by actual data. This will be a new driver for the S&P 500 rally.

The FxPro Analyst Team