This stability was notable in an environment of still-elevated global inflationary pressures and tight monetary policies among major central banks, which led to higher relative interest rates on some of the main international currencies. Geopolitical tensions, such as Russia’s unjustified war against Ukraine and the tragic conflict in the Middle East, also continued to raise risks of a more fragmented international monetary system.

Although the data so far show no evidence of substantial changes in the use of international currencies, we need to remain vigilant to any cracks that start appearing. Some countries are increasingly seeking to use units other than the major invoicing currencies for international trade as well as alternatives to traditional cross-border payment systems. The accumulation of gold as a reserve asset has continued, most notably in countries closely linked to Russia, as well as official investments in non-standard reserve currencies. Overall, this suggests that the international currency status of the euro should not be taken for granted.

This changing landscape increases the onus on European policymakers to create the conditions for the euro to thrive. Its international role is primarily supported by a deeper and more complete Economic and Monetary Union (EMU), including advancing the capital markets union (CMU), in the context of the pursuit of sound economic policies in the euro area. The Eurosystem supports these policies and emphasises the need for further efforts to complete EMU. Deeper European economic and financial integration, together with enhancements in cross-border payment systems between the euro and other currencies, will be pivotal in increasing the resilience of the international role of the euro in a potentially more fragmented world.

The ECB will continue to monitor developments and publish information on the international role of the euro on a regular basis.

Christine Lagarde

President

This 23rd annual review of the international role of the euro presents an overview of developments in the use of the euro by non-euro area residents in 2023. This was a year that saw continuing geopolitical tensions, increases in policy interest rates and inflation declining from high levels in major advanced economies.

On balance, the international role of the euro remained broadly stable in 2023. A composite index of the international role of the euro – computed as a simple arithmetic average of the share of the euro across a broad range of indicators – decreased by 0.7 percentage points (p.p.) in the year to the fourth quarter of 2023 at constant exchange rates, while it remained broadly stable at current exchange rates, at above 19%. The resilience of the international role of the euro in the past decade stands in contrast with the decline in the share of the euro area in global output (Chart 1). The euro remained well established as the second most important currency in the international monetary system (Chart 2).

Chart 1

The international role of the euro remained broadly stable in 2023

Composite index of the international role of the euro and share of the euro area in global GDP

(percentages; at current and constant Q4 2023 exchange rates; four-quarter moving averages)

Chart 2

The euro remained the second most important currency in the international monetary system

Snapshot of the international monetary system

(percentages)

Sources: BIS, IMF, CLS Bank International, Ilzetzki, Reinhart and Rogoff (2019) and ECB calculations.

Notes: The latest data on foreign exchange reserves, international debt, international loans and international deposits are for the fourth quarter of 2023. Foreign exchange turnover data as of April 2022. *Since transactions in foreign exchange markets always involve two currencies, foreign exchange turnover shares add up to 200%.

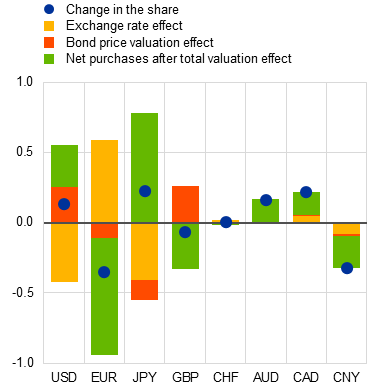

The share of the euro in global official holdings of foreign exchange reserves decreased in 2023. In the review period, the share of the euro in global foreign exchange reserves decreased by one percentage point at constant exchange rates (and by almost half a percentage point at current exchange rates) to 20%, levels last seen in 2020 (blue line in Chart 3, panel a, Table 1 and Table A1 in the statistical annex). By contrast, the shares of the US dollar, Japanese yen and other non-traditional reserve currencies increased. The share of the US dollar increased marginally at constant exchange rates by 0.3 p.p. to 58.4%, remaining close to recent lows. The share of the yen increased slightly by 0.6 p.p. to 5.7%, whereas that of the Chinese renminbi declined by 0.2 p.p. to 2.3%, close to 2020 levels.[1] Box 1 provides further evidence on global investments by sovereign wealth funds and their purchases of equity stakes over the past two decades. It shows that the share of euro-denominated equities accounted for only around 9% of such investments, about half the share of the euro in global foreign exchange reserves.

The diversification of global reserve portfolios into non-traditional reserve units continued. The share of reserve currencies other than the US dollar and the euro increased by 0.4 p.p. at constant exchange rates in 2023. At above 20%, it now surpasses the share of the euro, pointing to the growing importance of non-standard units in global official portfolios, which, beside the Chinese renminbi, include the Australian dollar, the Canadian dollar and various other currencies, such as the Korean won, the Singapore dollar, the Swedish krona and the Norwegian krone (see the red line in Chart 3, panel a).[2]

Chart 3

Declining share of the euro in global foreign exchange reserves accompanied by net sales of euro-denominated reserve assets

|

a) Shares of selected currencies in global foreign exchange reserves |

b) Decomposition of changes in the shares of the main reserve currencies in 2023 |

|---|---|

|

(percentages; at constant Q4 2023 exchange rates) |

(percentage points and percentage point contributions) |

|

|

Sources: IMF and ECB calculations.

Notes: The latest observation is for the fourth quarter of 2023. The valuation effect for currency between period and can be expressed as: where is reserve assets held, is the bilateral exchange rate against the US dollar, is the share of reserves held as securities and is the average total return on the security portfolio between periods and . Subtracting this value from the actual change in the level of reserve assets gives the approximate net purchases in period t.

In absolute terms, after accounting for valuation effects, euro-denominated reserve assets are estimated to have declined in 2023. Considering all currencies, official reserve managers held about €11.2 trillion (USD 12.3 trillion) in total foreign exchange reserves at the end of 2023, slightly more than in 2022. However, estimates by ECB staff suggest that, after accounting for valuation effects, official reserve managers were net sellers of euro reserve assets, to the tune of around €100 billion. Instead, they purchased reserve assets denominated in US dollars, Japanese yen, Australian dollars and Canadian dollars (see the green bars in Chart 3, panel b).[3] In particular, there were purchases of yen-denominated reserve assets by official investors, presumably aimed at offsetting the yen’s depreciation over the review period.

The net sale of euro-denominated reserve assets can be ascribed to some extent to transactions by large holders of euro reserves. Investment decisions by large official holders of euro-denominated reserves, such as the Swiss National Bank (SNB), have a significant influence on the share of the euro in global foreign exchange reserves. In 2023 the share of the euro in the foreign exchange reserves of the SNB remained stable at 37%. However, the SNB intervened in support of the Swiss franc during the review period, resulting in a decline in overall foreign exchange reserve holdings.[4] ECB staff estimates suggest that SNB holdings of euro-denominated reserves declined by €35 billion – accounting for around a third of global net sales of euro by official managers in 2023.[5] The importance of large official holders of euro-denominated reserves can also be seen from a decomposition of changes in the share of the euro in foreign exchange reserves at country level into three components: (i) shifts in preferences that changed the share of the euro in the foreign exchange reserves of countries disclosing the currency composition of their foreign exchange reserves; (ii) wealth effects, which account for changes in total reserves held by official investors; and (iii) a residual term which captures a mix of shifts in preferences and wealth effects in countries that do not disclose the currency composition of their foreign exchange reserves.[6] Chart 4, panel b, shows the results of this decomposition from 2015 to 2021, a period for which data on the currency composition of foreign exchange reserves is available for a relatively large sample of countries.[7] The 1.5 p.p. increase in the share of the euro over this period was driven by large wealth effects (9 p.p.) reflecting the accumulation of reserves by Switzerland and Russia, by far the two largest holders of euro-denominated reserves, each holding around 40% of their total foreign exchange reserves in euro, which is about twice the average share globally. In contrast, shifts in preferences point to a reduction in the appeal of the euro in the remaining countries between 2015 and 2021 – this factor contributed negatively (-1.5 p.p.) to the share of the euro. The residual term also contributed negatively (-6 p.p.). Holdings of reserves in euro of the Central Bank of Russia accounted for around 8% of global reserves in euro before they were immobilised in 2022. This suggests that sanction-related measures might be relevant to the share of the euro in global foreign exchange reserves going forward.

Table 1

The international role of the euro from different perspectives

Summary of data in this report

|

Indicator |

Share of the euro |

Total outstanding amounts |

|||||

|---|---|---|---|---|---|---|---|

|

Latest |

Comparison period |

Difference (p.p.) |

Latest |

Comparison period |

Unit |

Difference (%) |

|

|

Stock of global foreign exchange reserves with known currency composition |

20.0 (Q4 2023) |

21.0 (Q4 2022) |

-1.0 |

12,332 (Q4 2023) |

11,918 (Q4 2022) |

USD billions |

3.5 |

|

Outstanding international debt securities: narrow measure, i.e. excluding home currency issuance |

23.2 |

22.5 |

0.7 |

18,454 |

17,671 |

USD billions |

4.4 |

|

Outstanding international loans: by banks outside the euro area to borrowers outside the euro area |

18.4 |

19.8 |

-1.4 |

2,759 |

2,734 |

USD billions |

0.9 |

|

Outstanding international deposits: with banks outside the euro area from creditors outside the euro area |

14.7 |

18.0 |

-3.3 |

3,172 |

3,147 |

USD billions |

0.8 |

|

Foreign currency-denominated bond issuance, at current exchange rates |

22.6 |

24.7 |

-2.1 |

1,784 |

1,608 |

USD billions |

11.0 |

|

Euro nominal effective exchange rate (broad measure against 41 trading partners) |

123.9 |

119.1 |

4.8 |

||||

|

Daily foreign exchange trading (settled by CLS), as a percentage of foreign exchange settlement |

33.7 |

37.7 |

-4.0 |

||||

|

Invoicing of goods exported from the euro area to non-euro area countries, at current exchange rates |

60.2 |

59.7 |

0.5 |

||||

|

Invoicing of goods imported into the euro area from non-euro area countries, at current exchange rates |

51.9 |

51.7 |

0.2 |

||||

|

106.4 |

141.3 |

EUR billions |

-24.7 |

||||

Sources: BIS, CLS Bank International, Dealogic, IMF, national sources and ECB calculations.

Notes: An increase in the euro nominal effective exchange rate indicates an appreciation of the euro. For foreign exchange trading, currency shares add up to 200% because transactions always involve two currencies.

Higher euro area interest rates did not translate into a stronger role for the euro as a reserve currency. In the review period, short-term interest rates in the euro area increased by 330 basis points (b.p.), while long-term interest rates increased by 150 b.p.. Evidence from a survey of official reserve managers conducted in mid-2023 suggested that the return of euro area interest rates to positive territory might strengthen the global appeal of the euro as a reserve currency.[8] However, as pointed out above, official reserve managers sold euro-denominated reserves. It needs to be stressed that, while euro area short-term interest rates turned positive, they remained almost 200 b.p. lower than in the United States and about 100 b.p. lower than those on other major reserve currencies, with the exception of the yen (Chart 4, panel a). Indeed, most recent survey data show a relative decline in the attractiveness of the euro as a reserve currency, even though a majority of official managers continued to consider a potential increase in the share of the euro.[9] Respondents to this survey cited weak growth prospects in the euro area, lack of supply of highly-rated assets and centralised debt issuance as potential factors hindering investment in euro-denominated assets. In line with this, the share of highly-rated euro area government debt securities in global supply of such highly-rated government debt securities has declined (Chart 5).

Chart 4

Higher euro area interest rates, though still lower than on several major reserve currencies; significant influence of large holders of euro reserves

|

a) Five-year and one-month interest rates in major economies in 2023 |

b) Decomposition of the change in the share of the euro in global foreign exchange reserves between 2015 and 2021 |

|---|---|

|

(percentages) |

(percentage points) |

|

|

Sources: LSEG Datastream, BIS, S&P Global and ECB calculations (panel a); IMF, Ito and McCauley (2020), Arslanalp, Eichengreen and Simpson-Bell (2022) and ECB calculations (panel b).

Notes: The five-year government yield for the euro area in panel a) is calculated as a debt-weighted average of five-year euro area yields of sovereigns with a Standard & Poor’s (S&P) credit rating of at least AA. Panel b) applies the methodology of Goldberg and Hannaoui (2024) for the euro. The decomposition is obtained with data on holdings of foreign exchange reserves and their currency composition in 2015 and 2021 for a sample of 54 countries, which accounts for about half of global official holdings of euro reserve assets. In panel b), “Preference” denotes the variation attributed to shifts in preferences from changes in the share of the euro in countries disclosing the currency composition of their foreign exchange reserves; “Wealth” accounts for changes in total reserves held by official investors; “Undisclosed” is a residual term, which captures a mix of shifts in preferences and wealth effects in countries not disclosing the currency composition of their foreign exchange reserves; “Change in IMF COFER share” shows the percentage change of the euro share in global foreign exchange reserves between 2015 and 2021, as reported by the IMF.

Geopolitical risk is expected to be an increasingly important consideration for official reserve management decisions in the next decade. According to the latest HSBC survey of 91 central banks in April 2024, accounting for 65% of global foreign exchange reserves, “geopolitical escalation” is the most important risk affecting the management of reserve portfolios, in particular decisions on investment location, counterparties and currency of denomination.[10] An earlier survey published by the Official Monetary and Financial Institutions Forum (OMFIF) in June 2023 suggested that more than 80% of respondents considered geopolitics as one of the top three factors affecting reserve management over the next five to ten years. This compares with less than 20% in 2021 (Chart 6, panel a). The same survey suggested that close to 40% of central banks planned to increase their holdings of renminbi in the next ten years – more than for any other currency. Respondents pointed to “diversification” and “China’s growing role in the global economy” as the main reasons to increase their exposure to the renminbi.

Chart 5

The share of highly-rated euro area government debt securities in global supply has declined

Share of highly-rated euro area government debt in outstanding highly-rated global government debt

(percentage)

Sources: BIS, Bloomberg, S&P Global Ratings (S&P) and ECB calculations.

Notes: The data refer to total debt securities issued by the general government with at least an AA rating from S&P. The latest observation is for the third quarter of 2023. Euro area sovereign issuers include Austria, Belgium, Estonia (since 2012), Finland, France, Germany, Italy (until 2006), Ireland (until 2009 and since 2020), Luxembourg, Portugal (until 2009), Slovenia (until 2012 and since 2020), Spain (until 2011). Non euro area sovereign issuers rated above AA include Australia, Canada, China (since 2011 rated A+ since 2018), Denmark, Hong Kong (since 2006), Japan (rated A+ since 2016), Norway, Singapore, South Korea (since 2018), Sweden, Switzerland, the United Kingdom and the United States.

Chart 6

|

a) Central banks considering geopolitics as a major factor for reserve management in the next five to ten years |

b) Holdings of official BRICS Plus investors (excluding Russia) of euro-denominated government debt securities |

|---|---|

|

(percentages) |

(EUR billions) |

|

|

Sources: OMFIF (panel a); ECB Securities Holdings Statistics on euro area custodians (panel b).

Notes: The OMFIF survey shown in panel a) covered 75 central banks accounting for about 40% of global foreign exchange reserves in June 2023. The latest observation in panel b) is for the end of 2023. The BRICS Plus countries, excluding Russia, shown in panel b) include Brazil, India, China and South Africa plus other countries that joined the group in January 2024 (Iran, the United Arab Emirates, Egypt and Ethiopia).

To date, interest in the euro among official investors in BRICS Plus countries, excluding Russia, has remained stable. Chart 6, panel b, shows the evolution of the holdings of the official sector (including central banks, sovereign wealth funds and other government bodies) in BRICS Plus countries, excluding Russia, of euro-denominated debt securities issued by the euro area government sector, as reported in ECB Securities Holdings Statistics for custodians resident in the euro area.[11] It is notable that the holdings in question increased by more than €50 billion to about €610 billion over the review period. The increase was larger than the increase in total holdings of foreign currency-denominated securities in these countries, resulting in a higher euro share in spite of the rise in geopolitical tensions in the review period.[12]

Accumulation of gold by central banks continued in 2023, driven by diversification considerations and as protection from geopolitical risks. Central banks purchased more than 1,000 tonnes of gold in 2023, close to the historical record of the previous year.[13] China – at over 225 tonnes – was the largest purchaser, followed by Poland, Singapore and Libya (Chart 7). Kazakhstan, a member of the Russia-led Eurasian Economic Union, was the largest seller of gold reserves in 2023. Survey data suggest that two-thirds of central banks invested in gold for purposes of diversification and one-third to protect against geopolitical risk.[14]

Chart 7

|

a) Central bank gold purchases |

b) Top gold purchasers and sellers in 2023 |

|---|---|

|

(tonnes) |

(tonnes) |

|

|

Sources: IMF, World Gold Council and ECB calculations.

Note: The latest observations for Bolivia, Cambodia and Libya are for the second quarter of 2023.

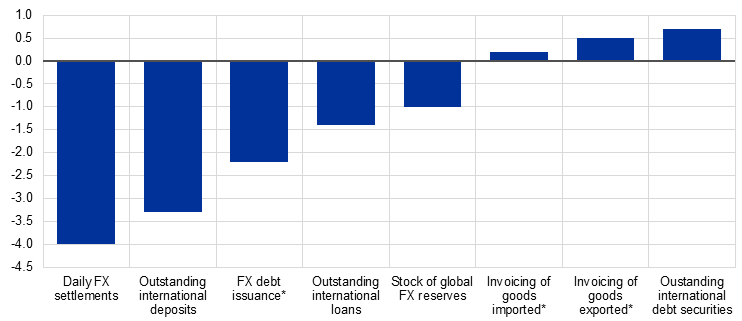

Other indicators of the international role of the euro point to declines, albeit limited, in the position of the euro. These indicators include the outstanding stock of international deposits, the outstanding stock of international loans, and global foreign exchange settlements. The share of the euro in these market segments fell by between 1.4 and 4 p.p. in 2023 when measured at constant exchange rates (see Chart 8).[15] With the exception of international deposits, these changes were not particularly large, at less than one standard deviation of changes in the corresponding variables since 1999. The share of the euro in foreign currency bond issuance declined by more than 2 p.p., though issuance volumes in euro remained broadly stable (Chart 9). The decline in the share of the euro reflected buoyant issuance of bonds denominated in US dollars, which was up 13% in volume terms compared to the previous year and whose share increased by more than 1 p.p. This trend was driven by issuers of US dollar-denominated bonds resident in the euro area and other advanced economies, notably regional development banks (Chart 10). In emerging markets, lower issuance by China of US dollar bonds was compensated by other countries, such as Saudi Arabia (USD 22 billion), possibly reflecting funding requirements for the country’s Vision 2030 investment plan.

Chart 8

Changes in the share of the euro in other market segments in 2023

(percentage point changes at constant Q4 2023 exchange rates over the review period, unless otherwise indicated)

Sources: BIS, CLS Bank International, Dealogic, IMF, national sources and ECB staff calculations.

Notes: * Indicates percentage point change at current exchange rates.

Chart 9

The share of the euro in international issuance of foreign currency-denominated bonds declined in 2023

|

a) Currency composition of foreign currency-denominated bond issuance (volumes) |

b) Currency composition of foreign currency-denominated bond issuance (shares) |

|---|---|

|

(USD billions) |

(percentages) |

|

|

Sources: Dealogic and ECB calculations.

Note: The latest observation is for the end of 2023.

Chart 10

Resumption of issuance of foreign currency bonds in advanced economies against subdued issuance in emerging markets

|

a) Regional breakdown of US dollar-denominated international bond issuance |

b) Regional breakdown of euro-denominated international bond issuance |

|---|---|

|

(USD billions) |

(USD billions) |

|

|

Sources: Dealogic and ECB calculations.

Note: The latest observation is for the end of 2023.

Turning to global payments, the role of the euro remained stable in the review period. Developments in the value of euro payments settled between banks in T2 did not show structural breaks in the review period.[16] In particular, the monthly value of global customer and interbank euro payments in T2 involving at least one bank located outside the euro area remained in line with previous years (Chart 11).[17] This indicates that the global reach of euro payments remained stable in contrast to the share of the euro in global payments processed in Swift – a global messaging network used by financial institutions – which suggests a notable decline in the course of 2023.[18] The share of payments processed in euro by Swift (excluding intra-euro area payments) fell indeed to around 13% at the end of 2023, from 32% at the end of 2022. However, the apparent decline in the review period was due to technical factors and did not reflect real changes in the preferences of market participants for the euro in the area of global payments.[19] The decline coincided with the launch of the Eurosystem’s new T2-T2S platform[20] and with the move to a new Swift messaging standard – two technical factors which drove the changes in the data reported.[21]

Chart 11

Global customer and interbank payments in T2

(left-hand scale: EUR trillions; right-hand scale: percentages; monthly totals)

Sources: TARGET2, T2 and ECB calculations.

Notes: The last data point relates to December 2023. “Global” payments are those where the instructing bank and/or the beneficiary bank is located outside the euro area. The T2 statistics may be subject to revision owing to methodological changes resulting from the launch of the consolidated T2-T2S platform.

At the same time, risks of potential fragmentation of global payment systems continued to emerge. Anecdotal evidence suggests that some of the BRICS Plus members continued to explore ways of using their own currencies to invoice international trade transactions and settle cross-border payments in search of alternatives to the currencies of countries sanctioning Russia (Table 2). This is important for the global use of currencies: recent theoretical models suggest that international invoicing currency choices can spill over to currency choices in other dimensions through economies of scope and feedback loops between financial and trade-related decisions.[22]

Since its invasion of Ukraine, Russia has pursued multiple initiatives to de-dollarise and de-euroise its foreign trade. Russia has promoted the use of national currencies in bilateral trade with other BRICS Plus economies and with countries in Asia and the Middle East to by-pass the currencies of sanctioning countries – notably in international trade in oil and other commodities of which Russia is a major exporter.[23] For instance, as of March 2023, 80% of bilateral trade between Iran and Russia was settled in national currencies, according to Russia’s Deputy Prime Minister.[24] According to Russian sources, 20 countries have joined the System for Transfer of Financial Messages (SPFS), the local alternative to Swift developed by the Bank of Russia.[25] Despite Russia’s efforts to promote the rouble, the Chinese renminbi appears to be emerging as the potential leading vehicle currency in this evolving regional payment landscape. For instance, in June 2023, Pakistan started to pay for imports of discounted Russian crude oil in the Chinese currency (see Table 2). Bilateral trade between Russia and India is a further case in point. Initially, India tried to promote use of the Indian rupee to settle trade transactions with Russia. However, by mid-2023, major Indian refineries started to use the Chinese renminbi to pay for imports of Russian crude oil (see Table 2).[26] There is also evidence of a redirection of Russia’s trade towards China – now accounting for around 40% of total Russian trade – which is supporting invoicing of transactions in non-sanctioned currencies (Chart 12, panel b).[27] Use of the renminbi as a vehicle currency in Russian trade, i.e. with countries other than China, remains more limited.[28]

Chart 12

Rising role of the renminbi in trade invoicing in China and Russia

a) Use of the renminbi for settlement of China’s external trade

(left-hand scale: USD billions at constant Q4 2023 exchange rates; right-hand scale: percentages)

b) Trade between Russia and China and invoicing in non-sanctioned currencies

(percentages)

Sources: CEIC, IMF Direction of Trade Statistics, People’s Bank of China, Bank of Russia and ECB calculations. Panel a) based on Amighini and García-Herrero (2023).

Notes: The latest observation for Russian imports and exports to China is for December 2023. The share of trade with China in Russia’s total trade is derived from data reported by Russia’s trading partners. The list of currencies of countries sanctioning Russia includes major currencies like the euro, US dollar, pound sterling, Swiss franc, Japanese yen, Canadian dollar and Australian dollar. Trade in non-sanctioned currencies mostly captures transactions invoiced in Chinese renminbi and, to a lesser extent, the Indian rupee.

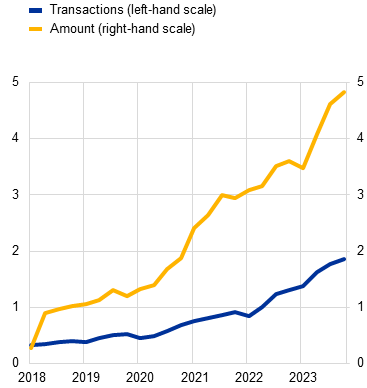

The gradual rise in the role of the renminbi in international trade invoicing might ultimately lead to more diversified currency patterns, at least in some regions. Renminbi internationalisation could take place through China’s trade and financing links.[29] The share of the renminbi in the invoicing of China’s trade increased to around one quarter for goods (one-third for services) in 2023 (Chart 12, panel a). The renminbi is now the third most important currency in global trade finance, with a 5% share, after the US dollar (83%) and the euro (7%) (Chart 13, panel a).[30] A caveat is that this is not an accurate proxy for international payments, since it includes domestic payments. Moreover, Hong Kong accounts for a majority of offshore renminbi transactions (80%), which points to a strong regional role for the renminbi.[31] Activity in the Chinese renminbi-based Cross-border Interbank Payment System (CIPS) continued to grow in the review period, reaching around USD 4.8 trillion by the end of 2023 (Chart 13, panel b). The number of direct participants in the system increased from 77 to 139 over the review period, whereas the total number of participants (direct and indirect) increased from more than 1,300 to almost 1,500.

Chart 13

Role of the renminbi in global trade finance and evolution of activity in CIPS

|

a) Top four currencies in Swift trade finance messages |

b) CIPS activity |

|---|---|

|

(percentages) |

(left-hand scale: millions of transactions; right-hand scale: USD trillions at constant Q4 2023 exchange rates) |

|

|

Sources: Swift RMB Tracker, People’s Bank of China and ECB calculations.

Note: The latest observations are for the end of 2023.

Finally, the development of digital currencies could influence the role of various currencies in cross-border payment patterns. For instance, China has made efforts to allow for greater international acceptance of the digital yuan (e-CNY), China’s central bank digital currency (see Box 2). In parallel, BRICS countries announced their intention to explore the development of a platform (BRICS Bridge) to link central bank digital currency initiatives within the group. Turning to crypto-assets, in March 2024 the Russian news agency Tass reported that the BRICS are working on a crypto-asset and blockchain-based common platform to settle international trade transactions, albeit with no reference to the BRICS Bridge project (Table 2). Whether these developments will influence currency patterns in global payments remains uncertain, as much will depend on the actual take-up and scalability of the various initiatives.

Table 2

Anecdotal evidence on intentions to use alternative units to the major international currencies

Overview of selected news and statements

|

Date |

News and statements |

Source |

|---|---|---|

|

27/3/2024 |

Russian oil firms face delays in payments as banks in China, the United Arab Emirates and Turkey are concerned about possible secondary sanctions from the United States. |

Reuters |

|

5/3/2024 |

BRICS countries are working on the creation of a payment system based on blockchain technology and digital currencies. |

TASS |

|

27/2/2024 |

BRICS members meet in Brazil to discuss the BRICS Bridge payment platform. |

Ledger Insights |

|

31/1/2024 |

The Bank of Russia holds consultations with like-minded countries about use of CBDCs in cross-border payments. |

Central Banking |

|

31/1/2024 |

India’s exports to Russia of engineering goods paid for in rupees surge to the equivalent of over USD 1 billion. |

Reuters |

|

16/1/2024 |

Four new countries join the Russian SPFS, increasing the number of members to 20. |

Interfax |

|

16/1/2024 |

Trading volumes in Chinese yuan surpass those in US dollars on the Moscow Exchange in 2023. |

Reuters |

|

27/12/2023 |

Russia and Iran sign an agreement to trade using their national currencies, also promoting use of non-Swift interbank systems. |

Reuters |

|

3/11/2023 |

The China National Petroleum Association (CNPC) completes the first settlement of crude oil trade using digital yuan. |

Central Banking |

|

24/8/2023 |

South Africa’s finance minister stresses that BRICS countries do not aim at replacing Swift with another payment system, but rather at strengthening trade in local currencies. |

Reuters |

|

23/8/2023 |

Brazil’s Prime Minister Lula proposes a BRICS common currency for trade and investment transactions to reduce BRICS countries’ vulnerabilities. |

Reuters |

|

15/7/2023 |

India and the United Arab Emirates sign several memoranda of understanding to settle cross-border transactions in national currencies. |

Reuters |

|

10/8/2023 |

South Africa’s finance minister encourages BRICS New Development Bank members to issue loans in local currencies to de-dollarise their economies and reduce foreign exchange risks. |

Reuters |

|

3/7/2023 |

Indian refiners start paying in yuan for Russian oil imports. |

Reuters |

|

14/6/2023 |

Pakistan starts paying in yuan for discounted oil from Russia. |

Reuters |

|

26/4/2023 |

The yuan overtakes the US dollar as the most widely used currency in China for cross-border transactions. |

Bloomberg L.P. |

|

30/3/2023 |

Brazil and China set up an infrastructure for renminbi clearing. |

Bloomberg L.P. |

|

29/3/2023 |

ASEAN’s members discuss a plan to reduce their dependence on major currencies and develop a local currency transaction scheme. |

ASEAN Briefing |

|

18/3/2023 |

Bangladesh agrees to pay Russia for a power plant in yuan after refusing to make payments in roubles. |

Bloomberg L.P. |

Sources: Reuters, Bloomberg L.P., Ledger Insights, Central Banking, ASEAN Briefing, TASS and Interfax.

Box 1

Sovereign wealth funds and the euro area: preliminary evidence

Sovereign wealth funds (SWFs) are state-owned investment funds or entities that are commonly established to manage the foreign assets of national states. They are typically categorised as stabilisation funds to finance budget deficits or balance-of-payments needs, savings funds for future generations, pension reserve funds, or reserve investment corporations established to reduce the carrying costs of foreign exchange reserves.[32] Total assets of SWFs reached USD 12 trillion at the end of 2023 (Chart A), matching the equivalent held in global foreign exchange reserves.[33] China hosts the largest SWFs, but other large SWFs are located in resource-rich economies or emerging markets with large current account surpluses. SWF assets are also highly concentrated: the SWFs of China, the United Arab Emirates, Norway, Singapore and Kuwait combined hold about two-thirds of total SWF assets.

Chart A

Total assets and annual gross purchases by SWFs

(USD billions)

Sources: ECB staff calculations based on data from the Sovereign Wealth Fund Institute.

The academic literature on SWFs is limited, largely due to a paucity of data and the limited transparency of their portfolios. The growing size of the assets managed by SWFs has attracted interest in their strategies and their impact on capital flows and financial markets, notably asset prices.[34] However, SWF strategies in terms of investment destinations and currency preferences remain unexplored. This box presents preliminary evidence aimed at filling this gap. It uses data on a subset of transactions by 96 SWFs in 59 countries over the past 24 years, sourced from the Sovereign Wealth Fund Institute. The dataset is restricted to purchases of assets (i.e. it excludes sales). It provides information on the sizes and types of investment, including equities, hybrid financial instruments (such as convertible bonds), real estate private equity funds and venture capital funds. Purchases of debt securities are not covered in the dataset.[35] The dataset provides information on the currency in which purchases have been executed. Currency considerations are generally more relevant for bonds than equities,[36] but they are especially relevant for investments involving companies with dual listings, hybrid securities or depositary receipts, as well as for deals involving unlisted companies, which may be executed through financial conduits that may not use the currency of the country in which the target company is resident.[37] Nonetheless, the available data cover a significant share of investments by SWFs. For instance, the ten largest reporting funds have seen cumulated transactions of around USD 2 trillion since 2000, or about one-quarter of their reported assets and about one-third of their equity holdings in 2023.[38] Annual reported transactions peaked at around USD 250 billion in 2017 and have averaged about USD 150 billion subsequently (Chart A). The whole dataset covers cumulated transactions totalling USD 2.5 trillion since 2000.

Chart B

Destination and origin of purchases by SWFs since 2000

|

a) Breakdown of SWF purchases by region of destination of investments |

b) Breakdown of SWF purchases by region of origin |

|---|---|

|

(percentages) |

(percentages) |

|

|

Sources: ECB staff calculations based on data from the Sovereign Wealth Fund Institute.

Note: Averages for the period 2000-2023.

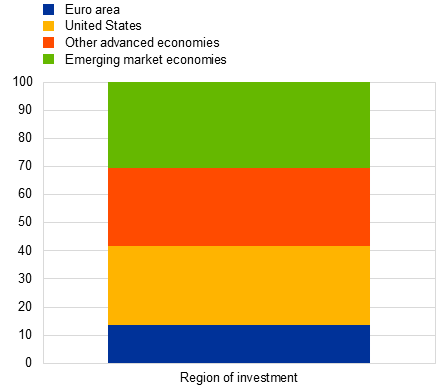

Chart B shows how SWFs have allocated their purchases of assets since 2000. Panel a) breaks down investments by region of destination, while panel b) breaks them down by region of origin. Reported purchases of assets by SWFs are largely located in major advanced economies, such as the United States and the euro area, and in other advanced economies (Chart B, panel a).[39] These account for around 70% of total reported purchases of SWFs since the beginning of the sample, while investment in emerging economies accounts for the remainder. Investment in the euro area, in particular, accounts for 14% of total reported purchases. Chart B, panel b shows that a significant share, almost 50%, originates from SWFs located in emerging economies, about 20 p.p. more than the share of these economies as a destination of investment. As a result, capital channelled through SWFs flows from poorer to richer countries in line with a well-known paradox in academic literature on international economics.[40]

In terms of currencies, the US dollar is dominant in reported SWF investments, while the euro is the second most important currency. The US dollar accounts for more than two-thirds of SWF investment flows (Table A).[41] The euro accounts for about 9% of total transactions in the dataset.[42] Interestingly, more than 40% of purchases of euro area assets were in US dollars. For instance, this concerns purchases of equity of euro area firms listed in the United States.[43] [44] Similarly, the US dollar shares of investments targeting assets in other advanced economies and emerging market economies are significantly large, at about 40% and 60% respectively. Admittedly, there may be reporting bias as regards acquisitions of unlisted equity.

Interestingly, there is also evidence that the euro is used in deals involving SWF acquisitions outside the euro area. A small share of purchases of assets outside the euro area, around 5-6%, was in euro, but only where the target company was located outside the United States. Deals involving US companies were almost exclusively denominated in US dollars. Euro-denominated deals often involved financial intermediaries or special purpose companies providing bridge financing in major currencies, such as the euro, to finance local projects.[45]

All in all, preliminary analysis of SWFs suggests that the US dollar is often used as a vehicle currency for purchases of assets not involving US-based firms. The euro remains a distant second and is occasionally used to finance acquisitions by SWFs of firms located outside the euro area.

Table A

Currency composition of SWF investments by region of destination of investments

(percentages)

|

Currency shares |

All |

Euro area |

United States |

Other advanced economies |

Emerging market economies |

|---|---|---|---|---|---|

|

Euro |

9.2 |

54.0 |

0.2 |

5.3 |

6.4 |

|

US dollar |

68.0 |

43.5 |

98.7 |

42.1 |

61.2 |

|

Others |

22.8 |

2.5 |

1.1 |

52.6 |

32.4 |

Sources: ECB staff calculations based on data from the Sovereign Wealth Fund Institute.

Notes: Transactions with unreported currencies are excluded. Averages for the period 2000-2023.

Box 2

Views regarding the internationalisation of central bank digital currencies and their implications for the euro area

Most of the central bank digital currency (CBDC) projects currently at an advanced stage of development have a domestic focus. However, a recent BIS survey suggests that about 30% of central banks in advanced economies and 20% of central banks in emerging markets are working on CBDCs that could be used across borders, in particular to reduce frictions in cross-border payments and maintain payment security.[47] In this context, discussions on the design and development of retail CBDCs in selected major economies issuing international currencies are of particular relevance for CBDC projects globally and the future of the international monetary system. This box looks at retail CBDC internationalisation and discusses its relevance for the euro area and the digital euro project.

Starting with China, officials have so far avoided explicitly linking the development of a CBDC (e-CNY) to internationalisation of the renminbi. However, there are visible efforts by China to explore the international use of the e-CNY. The e-CNY is being designed primarily for domestic retail use, but its architecture is adaptable to wholesale and cross-border applications.[48] Meanwhile, China is actively exploring international applications of the e-CNY through various initiatives and collaborations with foreign jurisdictions – even if its main collaborative project, mBridge, remains a wholesale cross-border multi-CBDC project.[49] Steps have also been taken to broaden access to the e-CNY for foreign users through selected initiatives and pilot programmes, which could pave the way for using e-CNY for payments and settlement in economic and trade exchanges between China and South-East Asian countries.[50] Finally, Chinese authorities have recently lifted some restrictions on foreign access, in particular with the aim of making the e-CNY more accessible to tourists.[51]

Turning to the United Kingdom, in February 2023 the Bank of England and HM Treasury launched a public consultation on a digital pound – envisaged as a retail CBDC for use by households and businesses. Their consultation paper proposed that non-UK residents would be able to hold and use digital pounds on the same basis as UK residents.[52] The UK authorities further stated that any non-resident access would be set up in accordance with the G7’s 2021 pledge to design any future CBDCs in a way that would avoid the risk of currency substitution in other countries.[53] Most respondents to the consultation supported the proposal on access for non-UK residents, but several felt that the rollout of a digital pound should initially focus on UK residents.[54]

Finally, the United States has not yet taken an official position on pursuing or implementing a US-issued CBDC.[55] Domestically, US institutions are scrutinising the potential benefits and challenges tied to the introduction of a CBDC.[56] In addition, China’s strides in the development of the e-CNY and its potential internationalisation have led to security concerns and the introduction of two bills in the US Congress to study and counter e-CNY developments.[57] However, the proposal of a US-issued CBDC has been met with growing political pushback, largely related to user privacy and consumer protection as well as to the respective roles of the Federal Reserve System and private market participants in the payments system.[58] Federal Reserve officials have questioned the need to develop a retail CBDC to spur innovation in the field of payments and dismissed the idea that digital assets may represent a threat to the international role of the dollar, in particular because trading in decentralised finance relies on stablecoins that are predominantly pegged to the US dollar.[59] Recently, the Chairman of the Federal Reserve Board reiterated that it is “nowhere near recommending – or let alone adopting – a central bank digital currency in any form”.[60]

From a European and euro area perspective, a digital euro would be a digital retail means of payment issued by the ECB available for all people and businesses and all retail payment scenarios in the entire euro area, wherever digital payments are accepted. It would combine some of the most valued characteristics of cash with the main advantages of digital payments and cover the most common payment scenarios, including payments in online and physical stores and between people both online and offline.[61] In parallel, a digital euro could bring about strategic advantages;[62] it is expected to strengthen Europe’s strategic autonomy and resilience, decreasing its dependence on private external providers, particularly in the context of a potential crisis or geopolitical tensions.[63] The legislative proposal on a digital euro currently being discussed by European co-legislators acknowledges the strategic importance of countering the risk that third-country CBDCs and stablecoins may reduce the role of the euro and envisages the use of digital euro outside the euro area and in cross-currency payments to foster the international use of the euro.[64] The draft legislation contains specific provisions on the distribution of digital euro outside the euro area, distinguishing between distribution (i) outside the euro area, but within the European Union; (ii) in third countries, i.e. outside the European Union; and (iii) in third countries or territories under a monetary agreement with the European Union. The proposal also includes provisions on cross-currency payments for the purpose of trade or remittances, in line with the G20 agenda. In its opinion on the legislative proposal, the ECB welcomed that the proposed regulation would make digital euro initially accessible to persons established or residing in the euro area, while access for visitors together with access for consumers and merchants in the European Economic Area and selected third countries could be part of subsequent releases. The ECB clarified that a digital euro would allow for cross-currency payments by establishing interoperability between digital euro and other CBDCs, subject to prior agreements between the ECB and third countries. Such interoperability could be achieved either via an interlinking model based on common standards or by enabling multi-currency features in the digital euro back-end.[65],[66]

To conclude, a number of CBDC projects both in advanced economies and in emerging markets cover the potential use of CBDCs outside the jurisdiction in which they are issued and for cross-border purposes. In addition, BRICS countries are exploring alternative payment options, including the potential development of a platform to link CBDC initiatives of these economies.[67] In particular, recent efforts by China, if successful, could lead to a greater international acceptance of the e-CNY. Whether these developments will influence the international monetary system remains uncertain at this stage, as much will depend on actual take-up of the initiatives. In parallel, efforts by multilateral institutions like the IMF and the BIS could support the development of frameworks to facilitate the creation of CBDCs which would reduce frictions in cross-border payments, avoiding a fragmentation of the international monetary system.[68] From a euro area perspective, the ECB will therefore take CBDC internationalisation into account in view of the digital euro’s objective of supporting the euro area’s open strategic autonomy. Moreover, sustaining proactive involvement with central banks in other jurisdictions is imperative to guarantee that the possible international use of CBDCs, especially for cross-border transactions, truly brings benefits. This requires careful calibration of design features to mitigate unintended consequences for the stability of the international monetary system.

See more.

© European Central Bank, 2024

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.ecb.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

For specific terminology please refer to the ECB glossary (available in English only).

The cut-off date for the statistics included in this report was 30 April 2024.

PDF ISBN 978-92-899-6459-3, ISSN 1725-6593, doi:10.2866/7715, QB-XN-24-001-EN-N

HTML ISBN 978-92-899-6460-9, ISSN 1725-6593, doi:10.2866/501734, QB-XN-24-001-EN-Q