- Donald Trump’s growing support among prominent technology figures is a “bitcoin play,” posited billionaire Trump critic Mark Cuban, offering an arguable—and in Cuban’s words, “contrary”—theory that the potential deterioration of the American economy under Trump will make major Silicon Valley bitcoin investors even richer.

- Key Takeaways

- Contra

- Crucial Quote

- Key Background

- Tangent

Donald Trump’s growing support among prominent technology figures is a “bitcoin play,” posited billionaire Trump critic Mark Cuban, offering an arguable—and in Cuban’s words, “contrary”—theory that the potential deterioration of the American economy under Trump will make major Silicon Valley bitcoin investors even richer.

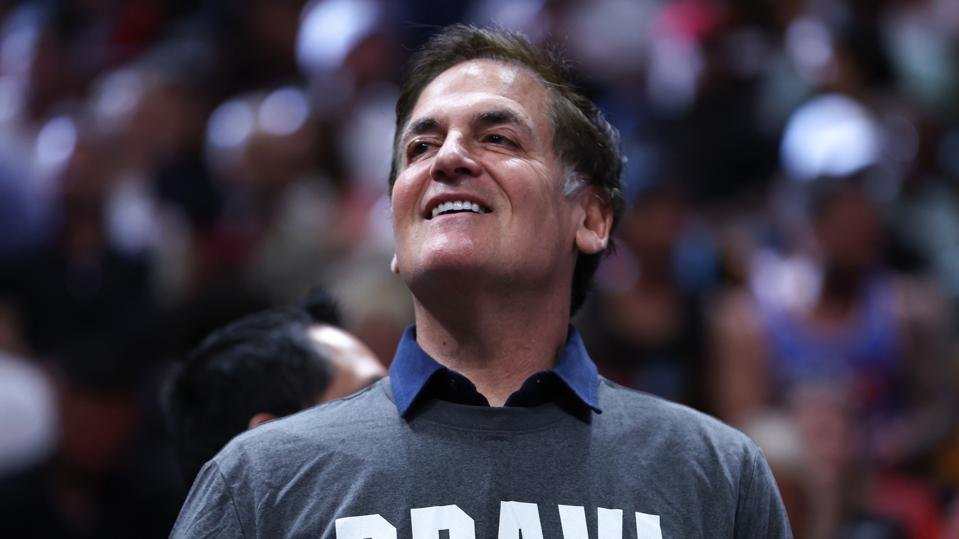

Billionaire Mark Cuban thinks there’s a reason beyond the surface behind Silicon Valley’s Trump tilt.

Getty Images

Key Takeaways

- “You can’t align the stars any better for a BTC price acceleration” than a Trump presidency, Cuban wrote in a Wednesday post on X, arguing it’s not due to Trump’s plan to regulate the cryptocurrency industry less, but rather the fallout of Trump’s broader economic vision.

- Lower taxes and higher tariffs, especially on Chinese imports, will make inflation worse, Cuban predicted, and higher inflation typically causes investors to move their money into assets considered more likely to store value, such as commodities like gold or safe haven currencies, the most famous of which is the U.S. dollar.

- But “global uncertainty as to the geopolitical role of the USA” under Trump may cause “the decline of the dollar as the reserve currency” of choice, theorized Cuban, who alluded to the prospect of “hyperinflation” in which prices quickly skyrocket in a country’s central bank-issued currency.

- The decline of the dollar would cause the market to flood into the new de facto “global currency” bitcoin, which is not backed by a central bank and whose proponents have long argued is the ultimate safe haven due to its relative independence from the global financial and political systems, causing bitcoin prices to skyrocket due to the digital asset’s scarcity.

- Thus, the many bitcoin holders, like Trump backer Elon Musk (whose companies SpaceX and Tesla own a great deal of the token) or early bitcoin investors and pro-Trump donors Cameron and Tyler Winklevoss, would become extremely rich, noted Cuban.

Contra

Unsurprisingly considering Cuban admitted his theory is a “contrary opinion” and possibly “crazy,” there are plenty of holes to poke in Cuban’s argument. For one, periods of intense inflation are bad across most industries, as consumers’ diminished spending power typically brings lower profits, similarly causing companies’ valuations to decline as earnings potential shrinks.

Basically, for someone to truly profit off of the scenario Cuban outlined in which bitcoin emerges while the broader economy crumbles, they would already need to have an outsized exposure in their portfolio to bitcoin and little exposure to cash or U.S. Treasuries.

That isn’t true of many of the big tech Trump supporters with major investments in public and private companies, like Musk, who owns more than $100 billion worth of Tesla’s publicly traded stock, or venture capitalists like Marc Andreessen and Ben Horowitz. In simple math, Tesla held 9,720 bitcoin as of the end of 2023, worth about $6.3 billion at bitcoin’s roughly $65,000 price Wednesday. If bitcoin prices tripled, Tesla would have a stake worth almost $20 billion, a total equivalent to less than 3% of the company’s $800 billion market capitalization, hardly moving the needle.

Crucial Quote

Asked by Forbes about the reasoning behind the apparent dissonance between the rising value of bitcoin in a high inflation scenario and the declining value of all other investments, Cuban explained via email that stakeholders in companies deal with “the uncertainty of execution and market forces” and the “incredibly hard” process of passing legislation beneficial to a company’s valuation. Yet “with BTC, you just hit the refresh button :),” wrote Cuban.

Key Background

Cuban, worth $5.4 billion according to Forbes’ estimates, first grew wealthy with his sale of early streaming service Broadcast.com during the 1990s dot-com boom, and was the majority owner of the NBA’s Dallas Mavericks from 2000 to 2023. Both Cuban of “Shark Tank” and Trump (worth $6.1 billion) of “The Apprentice” grew famous for their reality television business shows, but Cuban, an ardent Biden supporter, has no plans to go into politics despite rumors of a presidential run, he told Forbes in 2020.

Tangent

Historically left-leaning, several notable Silicon Valley products have expressed their support for Trump over the last week, including Musk on Saturday and Andreessen and Horowitz on Monday. Horowitz and Andreessen told employees of their influential Silicon Valley investment firm they intend to donate to political action committees supporting Trump’s election. Horowitz explained Trump is the “right choice” for tech due to the Biden administration’s regulation of industries like artificial intelligence and crypto.

Are you – or is someone you know -creating the next Afterpay or Canva? Nominations are open for Forbes Australia’s first 30 under 30 list. Entries close midnight, July 31, 2024.

Look back on the week that was with hand-picked articles from Australia and around the world. Sign up to the Forbes Australia newsletter here or become a member here.