Synopsis

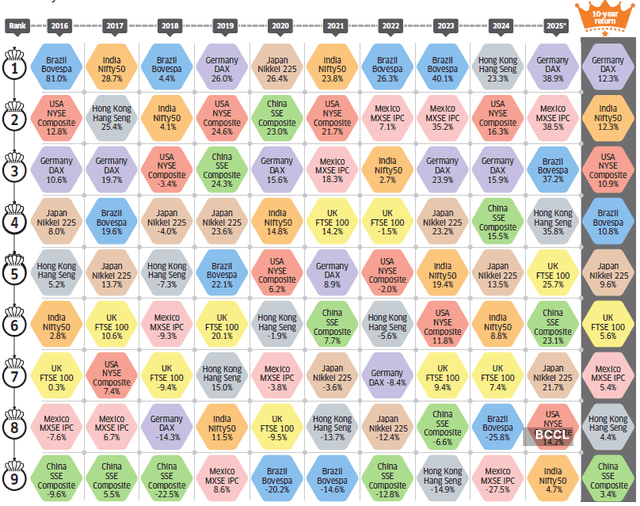

Welcome to TrendMap, your visual guide to investment performance. This edition tracks 10 years of global equity returns. Currency fluctuations impact the returns on foreign investments. To capture the real value from an Indian investor’s standpoint, these returns are adjusted to reflect their equivalent in Indian rupees. The key takeaway: no market dominates—diversification matters.

iStock

iStock

Source:

Reuters-Refinitiv. *2025 returns are YTD based on 9 September 2025 closing values. Other years’ returns are calculated between the first and the last trading day’s closing values. Returns are normalised to the Indian rupee. 10-year return is compounded average return, calculated between 9 September 2015 and 9 September 2025.Germany’s engineering excellence and its dominant sectors—technology, infrastructure, and industrials— have propelled the DAX index to outperform major global equity benchmarks over the past decade. In 2025, despite widespread tariff uncertainties, the DAX emerged as the top-performing index, buoyed by broad-based investor confidence and the country’s resilient economic fundamentals. India’s equity benchmark lagged in 2025, weighed down by muted earnings. However, over the broader 10-year horizon, it is the second-best performing market, underscoring its long-term resilience and investor appeal.

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source