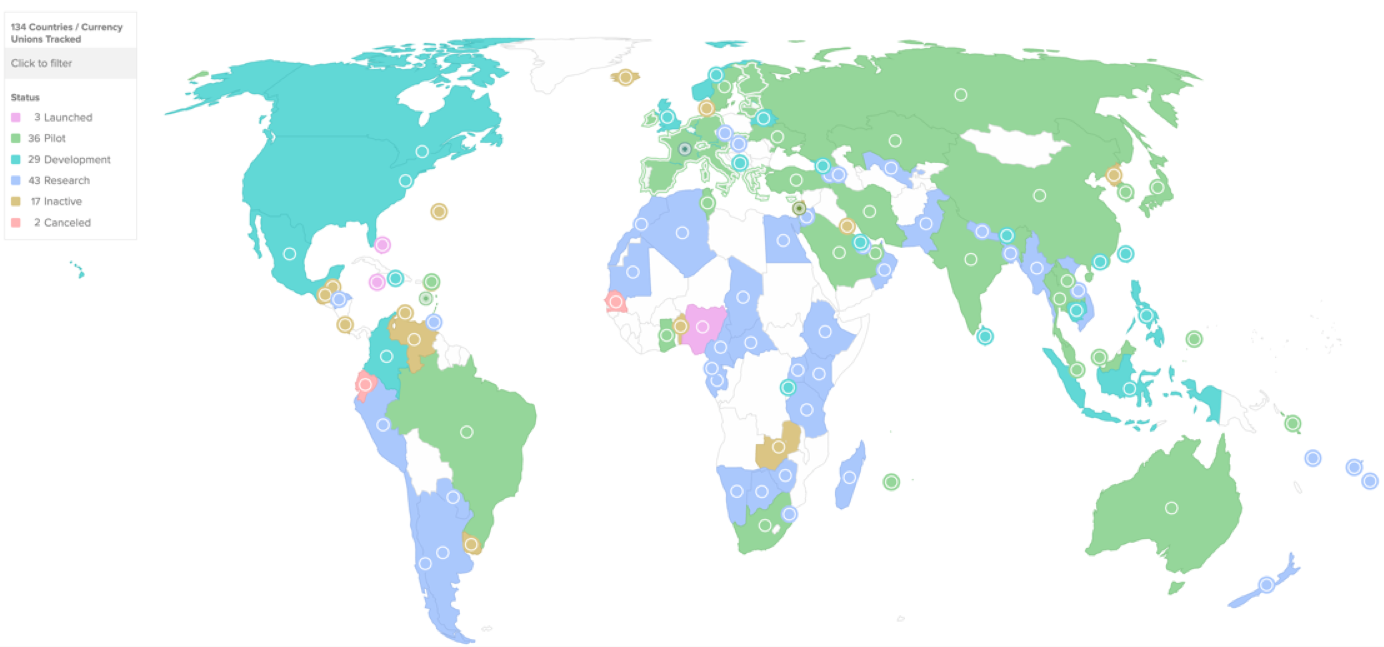

LONDON, March 14 (Reuters) – A total of 134 countries representing 98% of the global economy are now exploring digital versions of their currencies, with over half in advanced development, pilot or launch stages, a closely-followed study on Thursday showed.

While still inching forward on a banks only “wholesale” digital dollar, one for the wider U.S. population now looked “stalled” the report said, with Federal Reserve chief Jerome Powell saying this month, “nothing like that is remotely close to happening”.

U.S. President Joe Biden ordered officials to look into a digital dollar in 2022 but it has become a divisive political issue with Biden’s Republican rival in this year’s U.S. election race, Donald Trump, vowing not to allow it.

“The biggest headline here is that the divergence between the world’s largest central banks over CBDCs (Central Bank Digital Currency) is growing,” the Atlantic Council’s Josh Lipsky said pointing to how much further ahead China, Europe and Japan were.

The risk of the U.S. lagging behind was “a more fractured international payments system” Lipsky added, saying Washington could also lose some of its global finance clout if other countries press on and set the new standards around CBDCs.

DIVIDED WORLD

The report also showed how work on wholesale CBDCs had doubled since Russia’s 2022 invasion of Ukraine and subsequent G7 sanctions response.

Thirteen cross-border wholesale projects are currently underway, including one named “mBridge” which connects China, Thailand, the UAE, and Hong Kong, and will expand to 11 more currently undisclosed countries this year.

All BRICS member states – Brazil, Russia, India, China and South Africa – are at advanced stages and Lipsky predicted there would be a further push by the bloc this year at a summit in Russia for alternative payment systems to the dollar.

They could all be part of an avalanche of major launches by 2027 as could the ECB, whose current pilot scheme is viewed as a potential blueprint for other leading major economies.

China’s digital yuan is still the largest and most advanced pilot though having been trialled in various scenarios from public transport tickets and COVID checks to buying oil and precious metals.

When will China fully launch the e-CNY? “That is the question,” Lipsky said. “Not this year, but 2025 or 2026? It’s hard to say.”

Sign up here.

Reporting by Marc Jones; Editing by Michael Perry

Our Standards: The Thomson Reuters Trust Principles.