Euro Pratik Sales IPO Day 1 Highlights: Euro Pratik Sales IPO subscription status was 43% on day 1. The retail portion was subscribed 33%, and NII portion has been booked 89%, Qualified Institutional Buyers (QIBs) portion has received 26% bids. The employee portion has been subscribed 1.23 times.

The initial public offering of Euro Pratik Sales Ltd, a key player in the decorative wall panel sector, is open for subscription from September 16 to September 18. Euro Pratik Sales IPO price band has been set between ₹235 and ₹247 per equity share, with a face value of Re 1.

This public offering consists entirely of a sale of shares worth ₹451.32 crore by the promoters, without any fresh issue component.

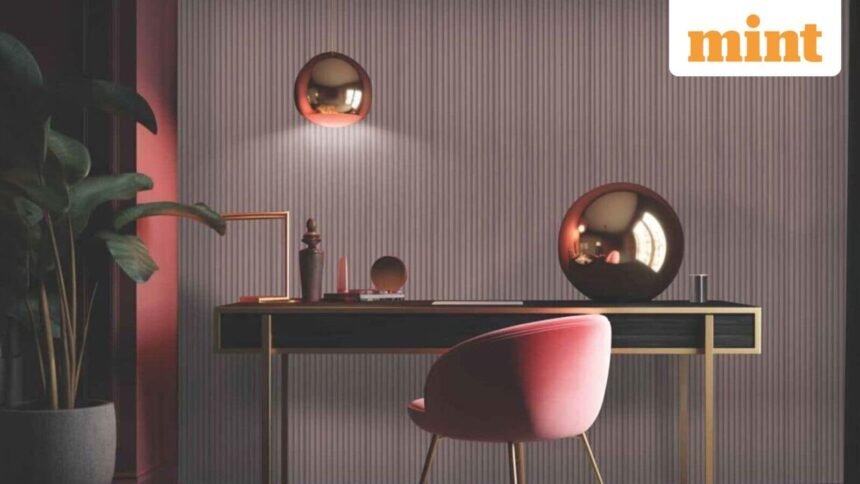

Euro Pratik boasts a diverse product portfolio designed for both residential and commercial uses, primarily marketed under its leading brands ‘Euro Pratik’ and Gloirio.

The company follows an asset-light model, outsourcing its manufacturing to contract partners located in South Korea, China, and the United States. As of March 31, 2025, it has a distribution network covering 116 cities across India, supported by 180 distributors in 25 states and five union territories.

Euro Pratik Sales IPO GMP today or grey market premium was ₹0, which meant shares were trading at their issue price of ₹247 with no premium or discount in the grey market according to investorgain.com.

(Stay tuned for more updates)