- US initial jobless claims falls to 227k vs exp 245k

- UK PMI composite hits 11-month low as business confidence wavers

- Eurozone PMIs: Persistent price pressures lean ECB toward 25bps Dec cut, not 50bps

- ECB’s Holzmann: 50bps cut in Dec unlikely, but can’t be ruled out

- Japan’s private sector falls into contraction as PMI services plunges to 20-month low

- Australian’s PMI manufacturing hits 53-month low, inflation pressures easing

- EUR/USD Mid-Day Outlook

- Economic Indicators Update

The forex markets are relatively calm today, as major currency pairs and crosses gyrate within familiar ranges, digesting recent moves, and awaiting fresh data. Euro is having a slight recovery, supported by mixed PMI data that reflected an improving outlook in Germany, offset by a more concerning deterioration in France. Inflationary pressures continue to linger, which suggests ECB might lean towards a 25bps rate cut in December rather than a 50bps reduction. However, it’s important to note that Euro’s recovery remains weak, with plenty of data still expected ahead of the next meeting weeks away.

Japanese Yen is also recovering modestly following verbal intervention by Japanese officials after the currency briefly dipped through the 153 mark against Dollar. While the intervention has paused further selling pressure, Yen lacks strong momentum needed for a more sustained rebound. The currency’s next move will continue to depend heavily on yield differentials between Japan and the US/Europe, as well as the outcome of Japan’s snap election on October 27. With these two significant factors still unresolved, traders may still push Yen lower ahead of the election, keeping the currency vulnerable.

Overall in the currency markets, Dollar is staying as the strongest performer for the week so far, followed by Canadian, and then Swiss Franc. Yen is still the weakest, followed by Aussie and then Kiwi. Euro and Sterling are positioning in the middle with the Pound having a slight upper hand.

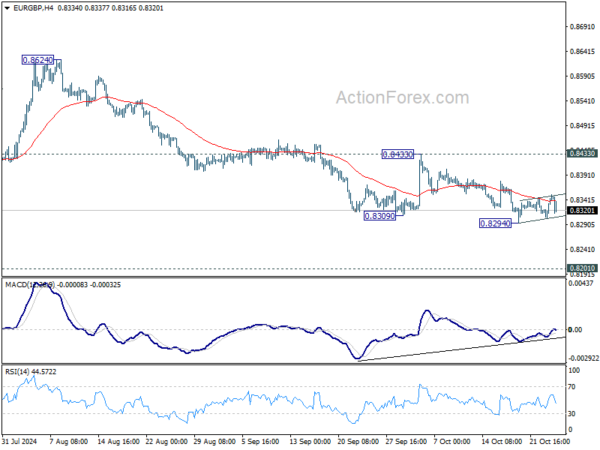

Technically, EUR/GBP’s consolidation pattern from 0.8924 temporary low might have completed after rejected by 55 4H EMA twice. Focus is back on 0.8294. Firm break there will resume larger down trend down trend. But strong support should emerge around 0.8201 key long term support to bring sustainable rebound. So the next time could be an opportunity to buy the cross.

In Europe, at the time of writing, FTSE is up 0.46%. DAX is up 0.64%. CAC is up 0.50%. UK 10-year yield is up 0.0420 at 4.249. Germany 10-year yield is down -0.047 at 2.264. Earlier in Asia, Nikkei rose 0.10%. Hong Kong HSI fell -1.30%. China Shanghai SSE fell -0.68%. Singapore Strait Times rose 0.12%. Japan 10-year JGB yield fell -0.0209 to 0.958.

US initial jobless claims falls to 227k vs exp 245k

US initial jobless claims fell -15k to 227k in the week ending October 19, well below expectation of 245k. Four-week moving average of initial claims rose 2k to 238.5k.

Continuing claims rose 28k to 1897k in the week ending October 12. Four-week moving average of continuing claims rose 18k to 1861k.

UK PMI composite hits 11-month low as business confidence wavers

UK business activity weakened in October, with both the manufacturing and services sectors showing signs of slowing momentum. PMI Manufacturing index dropped from 51.5 to 50.3, marking a 6-month low, while PMI Services index fell from 52.4 to 51.8, an 11-month low. Consequently, Composite PMI also declined to an 11-month low, slipping from 52.6 to 51.7.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, attributed this slump to “gloomy government rhetoric” and rising uncertainty ahead of the Budget. He added that external risks, such as conflicts in the Middle East, the ongoing war in Ukraine, and the upcoming US elections, have further dampened economic confidence.

The early PMI data suggests that the UK economy grew at a meagre 0.1% quarterly rate in October. However, Williamson noted that further cooling of input cost inflation, now at its lowest level in four years, could allow BoE to take a “more aggressive stance” toward rate cuts if the economic slowdown persists.

Eurozone PMIs: Persistent price pressures lean ECB toward 25bps Dec cut, not 50bps

Eurozone’s economic activity showed mixed signals in October, with PMI Manufacturing rising slightly from 45.0 to 45.9, while PMI Services fell marginally from 51.4 to 51.2. As a result, Composite PMI ticked up slightly to 49.7 from 49.6, but remained below the 50-point mark, indicating ongoing economic contraction.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, described the Eurozone as “stuck in a bit of a rut,” noting that the economy contracted for the second consecutive month. While the manufacturing sector continues to slump, its negative impact is being balanced out by minor gains in services. De la Rubia added, “For now, it is not clear whether we will see a further deterioration or an improvement in the near future.”

According to de la Rubia, for ECB, the data present an “unwelcome surprise,” particularly in the services sector. Inflationary pressures appear to be lingering, driven by wage growth, which has been pushing up costs and selling prices for service providers.

This persistent inflation suggests that the ECB may lean towards a 25bps rate cut in December, as opposed to the larger 50bps cut some had speculated.

Germany PMI Manufacturing index rose to 42.6 from 40.6, while PMI Services climbed to 51.4 from 50.6. This led to a rise in Composite PMI to 48.4 from 47.5.

France PMI Manufacturing edged down slightly from 44.6 to 44.5. More notably, Services PMI dropped to 48.3 from 49.6, hitting a 7-month low, while Composite PMI fell from 48.6 to 47.3, its lowest point in nine months.

ECB’s Holzmann: 50bps cut in Dec unlikely, but can’t be ruled out

Austrian ECB Governing Council member Robert Holzmann, one of the more hawkish voices, signaled that a 25bps cut is “probable” at the December meeting. While a larger, half-point cut isn’t “impossible”, it’s unlikely.

Holzmann emphasized caution, saying, “I’m still concerned that inflation might prove stronger than expected,” reflecting his hesitation in moving too quickly toward easing.

Despite acknowledging some downside risks, he remarked, “I don’t see enough of them to conclude that they dominate,” adding that the view of risks being tilted to the downside is still a minority on the ECB Governing Council.

Separately, Slovenia’s ECB Governing Council member Bostjan Vasle echoed the sentiment, expressing support for “going to neutral in measured steps.”

Vasle noted that while data has shown improvement, inflation “has not yet been defeated,” and discussions about undershooting the inflation target are premature. He further commented, “Once we get closer to neutral, it may be appropriate to align our language accordingly.”

Japan’s private sector falls into contraction as PMI services plunges to 20-month low

Japan’s private sector slipped into contraction territory at the beginning of Q4, with PMI Manufacturing index declining from 49.7 to 49.0 in October. The services sector saw a much sharper fall, with PMI Services tumbling from 53.1 to 49.3, its worst reading since February 2022. As a result, PMI Composite also dropped from 52.0 to 49.4, the weakest figure since November 2022.

According to Usama Bhatti, economist at S&P Global Market Intelligence, Japan’s economic slowdown has become more pronounced, with firms attributing the downturn to a “muted economy and subdued new order inflows.”

Business confidence for the coming year also took a hit, softening to the lowest level since August 2020. Bhatti noted that the “stubbornness of high prices” and ongoing economic weakness are weighing on overall sentiment.

Australian’s PMI manufacturing hits 53-month low, inflation pressures easing

Australia’s manufacturing sector continues to struggle, with PMI Manufacturing index slipping slightly from 46.7 to 46.6 in October, marking its lowest point in 53 months. According to Judo Bank’s Matthew De Pasquale, key indicators such as output and new orders have dropped to levels that signal the sector is “on the verge of recession.”

However, services sector, which accounts for over 80% of the country’s economic output, showed modest improvement. PMI Services ticked up from 50.5 to 50.6, and new business activity rose to its highest level since May, suggesting some resilience. De Pasquale noted that while business growth remains “soft,” the outlook for the services sector is improving with new business activity at the highest level since May

Inflation also appears to be moderating. Input cost pressures fell to their lowest levels since the onset of pandemic-induced inflation in 2021. Final prices, particularly in services, are also trending downward. De Pasquale added that inflation “remains on track” to return to RBA’s target range of 2% to 3%.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0760; (P) 1.0783; (R1) 1.0806; More…

Further decline is expected in EUR/USD despite loss of downside momentum as seen in 4H MACD. Firm break of 61.8% retracement of 1.0447 to 1.1213 at 1.0740 will extend the fall from 1.1213 to 1.0601 support next. Nevertheless, break of 1.0871 will indicate short term bottoming, and turn bias back to the upside for stronger rebound.

In the bigger picture, price actions from 1.1274 (2023 high) are seen as a consolidation pattern to up trend from 0.9534 (2022 low), with fall from 1.1213 as the third leg. Downside should be contained by 50% retracement of 0.9534 (2022 low) to 1.1274 at 1.0404, to bring up trend resumption at a later stage.