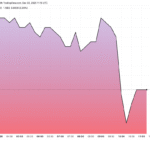

What’s going on here?

The euro surged past $1.10, marking its best month since November 2023 and gaining over 2.5% in August.

What does this mean?

It’s been a spectacular month for the euro, which climbed more than 2.5% against the dollar, hitting the significant $1.10 mark. This makes it the second-best performing currency against the USD in 2024, right after the British pound. Market focus shifted to the euro after traders initially watched the yen’s rally post a surprise rate hike by Japan’s central bank. Historically, crossing $1.10 has been tough, with some analysts earlier predicting a potential drop to parity. The euro’s strength is largely due to the rate differential between the US Federal Reserve (Fed) and the European Central Bank (ECB). With the ECB likely maintaining rates, and the Fed expected to cut 94 basis points over three meetings, the path for the euro remains bullish.

Why should I care?

For markets: Euro eyes new heights.

As the euro gains strength, it’s emerging as a safer bet for traders amid global currency volatility. ING predicts a short-term rise to $1.12, while BofA expects $1.12 by year-end. Even with potential rate adjustments, the euro’s appeal may remain due to easing political risks in Europe.

The bigger picture: Navigating the central bank landscape.

The euro’s rise comes as a ‘cleaner central bank story,’ particularly as risks like the French elections fade. Fidelity International notes that as central banks’ actions diverge – with the ECB holding rates steady and the Fed expected to cut – the euro’s relative stability might continue to draw investor interest.