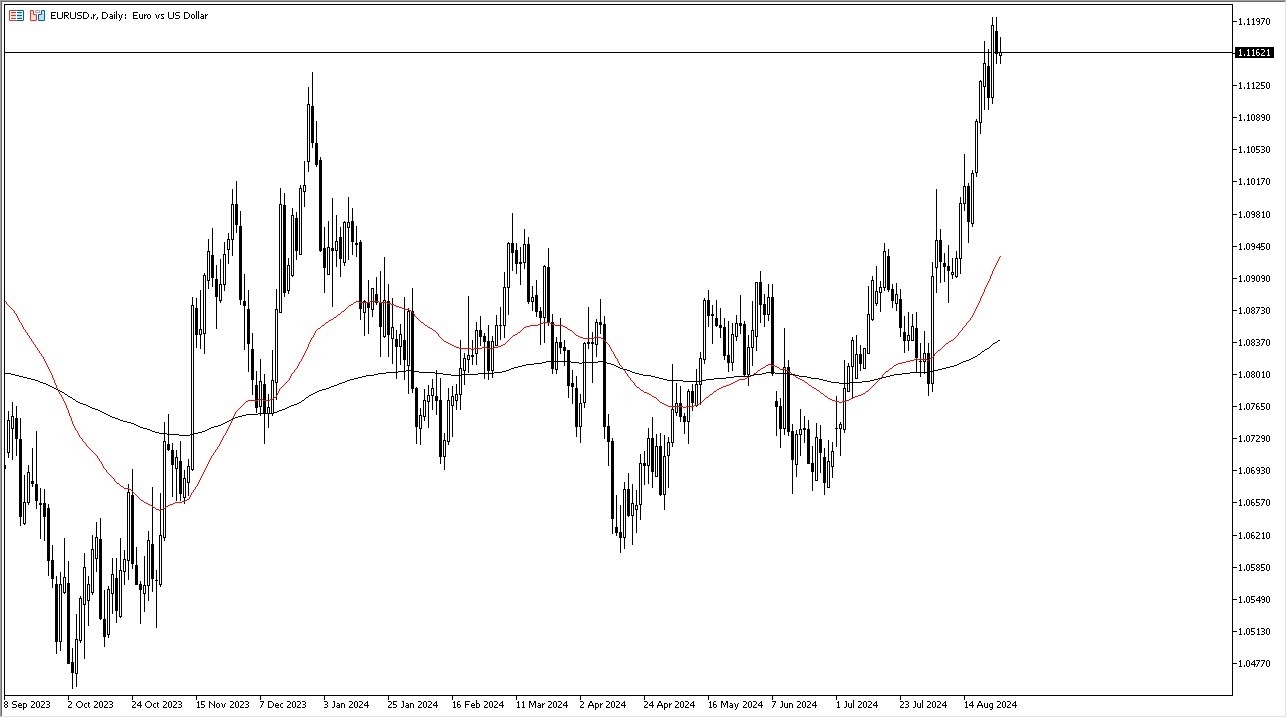

- It’s obvious that the euro is a little overextended at the moment, and I think it makes quite a bit of sense that we would continue to see a little bit of hesitation.

- After all, the 1.12 level above is an area that’s been an important resistance more than once, and I think it makes a certain amount of sense that we will continue to pay close attention to it.

Furthermore, you need to keep in mind that the European Central Bank is also loose with its monetary policy, so even if the Federal Reserve does start cutting rates, which most people think that they will in September, the reality is that we still have a couple of central banks that are both soft and weak. If that is going to be the case, then you’ve got a scenario where this is a market that will more likely than not be looking for some type of range to trade in.

Technical Analysis

Do not get me wrong, the technical analysis for the EUR/USD pair at the moment is rather bullish. We have had the “golden cross” when the 50-Day EMA crosses above the 200-Day EMA indicator, and that of course has longer-term traders excited. However, the reality is that there is a ton of resistance between the 1.12 level in the 1.1250 level above. Furthermore, we are about 6 country miles from the 50-Day EMA, so we are most certainly overstretched by applying the “eye test.”

If we do pull back from here, I would anticipate that there will probably be a certain amount of value hunters out there looking to pick up “cheap euros.” However, I still have to question how much more upside we have in this type of environment, due to the fact that we have gotten so far in such a short amount of time. Ultimately, I think this is a scenario where the markets are going to try to find their “equilibrium”, and I don’t think we have found it quite yet.

Ready to trade our Forex daily analysis and predictions? Here are the best European brokers to choose from.