- USD/JPY softens to around 147.75 in Tuesday’s early Asian session.

- Fed’s Miran called for cutting the main interest rate to avert job loss.

- Political uncertainty in Japan could undermine the Japanese Yen.

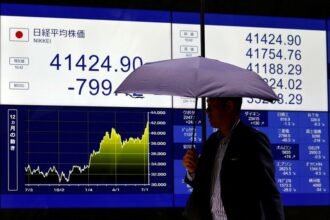

The USD/JPY pair loses ground to near 147.75 during the early Asian session on Tuesday. The US Dollar (USD) weakens against the Japanese Yen (JPY) as investors digested comments from Federal Reserve (Fed) officials about its latest monetary policy stance. Traders await the advanced US S&P Global Manufacturing and Services Purchasing Managers Index (PMI) reports later on Tuesday.

The US central bank delivered an expected rate cut last week but indicated no rush to lower borrowing costs quickly in the coming months. Fed Chair Jerome Powell stated during the press conference that the decision was a “risk management cut” intended to address a weakening labor market while inflation remains somewhat elevated.

On Monday, St. Louis Fed President Alberto Musalem said that he supported the rate cut at last week’s Fed meeting as a precautionary move to protect the job market, but said there may be “limited room” for additional cuts given inflation above the Fed’s 2% target.

Fed Governor Stephen Miran last week voted against the quarter-percentage-point reduction in favor of a steeper 50 bps rate cut, saying that Fed interest rates are far too high and far too restrictive. Traders will take more cues from the Fed Chair Jerome Powell’s speech in Rhode Island later on Tuesday.

On the other hand, political uncertainty in Japan ahead of the Liberal Democratic Party leadership election scheduled for October 4 was a factor in the Bank of Japan’s (BoJ) caution over further rate hikes. This, in turn, could weigh on the JPY in the near term.

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.