“>

“>The Indian rupee is expected to open little changed on Friday, holding near an all-time low, despite the strength in most Asian peers and the positive risk mood.

Non-deliverable forwards indicate the rupee will open unchanged to the U.S. dollar from 83.9625 in the previous session and near the lifetime low of 83.9725 hit on Wednesday.

Asian currencies inched up between 0.1 and 0.2%, while equity gauges rose as U.S. jobless claims came in lower than expected in the latest week, allaying concerns about a U.S. economic downturn.

Still, it’s not too surprising that the rupee will “ignore” Asian cues, a currency trader at a bank said.

“That’s how it has been in recent sessions, reflecting the extent of (dollar) demand).”

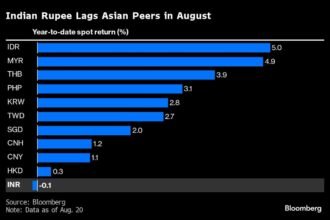

The rupee has been among the worst-performing currencies in Asia in August, which “is to be expected” in a soft dollar environment, he said.

U.S. Treasury yields rose on Thursday, while the S&P 500 index had its best day since November 2022 after the jobs data.

The odds of a 50 basis points Federal Reserve rate cut in September have retreated to 55% from a near certainty earlier this week, at the peak of worries over the Japanese markets.

ANZ Bank, however, thinks a 50 bps rate cut is unlikely.

“Our view is the economy is rebalancing and conditions are aligning for the Fed to begin to cut rates in September. We expect the rate cuts will be in 25 bps increments unless the data shows a sharper correction in the U.S. economy.”