What’s going on here?

The Philippine peso shone on Thursday, climbing 0.4% against the dollar – the only gainer among Asian currencies.

What does this mean?

While Southeast Asian financial markets had mixed results, the Philippines stood out. Manila’s stock market rose 0.9%, driven by a 3.7% jump in BDO Unibank shares. This boost came after the Bangko Sentral ng Pilipinas (BSP) cut interest rates for the first time in nearly four years, with another cut likely by year-end. Foreign investors noticed, infusing $71 million into Philippine stocks this week – more than the $63.6 million total inflows since the start of the month. Meanwhile, the Indonesian rupiah fell 0.8% amidst political unrest, as delayed election law changes led to protests, pulling Jakarta’s stock index down 0.6%. Investors are also eyeing the US Federal Reserve, whose dovish hints could spark a rate-cut spree in emerging Asian markets.

Why should I care?

For markets: Riding the wave of optimism.

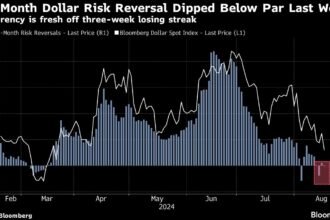

The peso’s recent strength could pave the way for other emerging Asian currencies, especially if regional central banks mirror the Fed’s dovish stance. South Korea and Thailand have already held rates steady while hinting at easing, which bodes well for market sentiment. Continued declines in US Treasury yields and the dollar might trigger a domino effect of rate cuts across Asia, stimulating stock markets and attracting more foreign investments.

The bigger picture: Global economic shifts on the horizon.

US monetary policy has far-reaching effects, and lower US interest rates generally increase the appetite for riskier assets, including those in emerging markets. If the Fed eases up, central banks in Asia might follow suit to stay competitive in the global capital market. This could spur economic growth but also requires careful management of potential inflationary pressures.