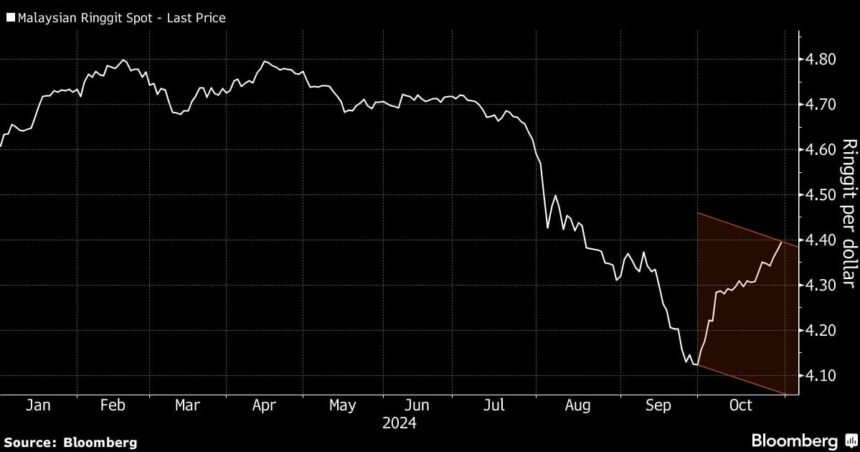

(Bloomberg) — Malaysia’s currency is on course for its worst month in more than nine years, as investors scale back on risk assets amid concerns over the US election.

The ringgit is down more than 6% against the dollar in October, putting it on pace for its biggest monthly loss since August 2015. The ringgit traded at 4.39 per dollar on Wednesday.

The renewed strength in the dollar is battering Asian currencies, almost all of which have come under heavy pressure in October as traders reassess the pace of Federal Reserve interest-rate cuts and avoid risky assets in the run-up to the US election.

But the ringgit is partly a victim of its own success: a 14% appreciation against the dollar in the last quarter, which made it Asia’s best performer, ensured there was room for a correction this month, according to Oversea-Chinese Banking Corp.

“The previous gain was significant; therefore there’s more room for corrective play,” said Christopher Wong, a currency strategist at OCBC in Singapore. “The ringgit’s sensitivity to the yuan and the yen is also one of the highest in the region, which helps explain why it is suffering more than the rest.”

The Japanese yen is the only currency across Asia that has performed worse than the ringgit this month, losing around 6.3% of its value against the dollar. China’s offshore yuan has depreciated around 2% against the dollar.

The fate of the ringgit in the near-term rests partly on the results of the US elections. Analysts at OCBC and MUFG Bank predict the currency will strengthen if Democratic presidential candidate Kamala Harris takes the White House, since it will reduce the risks of tariffs that could hurt economies across Asia.

MUFG forecasts that the currency will climb to 4.12 per dollar by the year-end, while OCBC sees it gaining to 4.22.

–With assistance from Malavika Kaur Makol.

©2024 Bloomberg L.P.