- Best Global Foreign Exchange Bank

- Best FX Services For Banks (New For 2026)

- Best FX Bank For Currency Heding (New For 2026)

- Best FX Derivatives Provider (New For 2026)

- Best FX Bank For Corporates

- Best FX Bank For Frontier & Emerging Markets Currencies

- Best Liquidity Provider

- Best FX Market Maker

- Best ESG-Linked Derivatives

- Best FX Commodity Trading Bank

This year’s Best FX Banks Global Winners list recognizes the institutions that distinguished themselves by converting market complexity into opportunity.

Foreign exchange markets navigated another year of profound adjustment, shaped by shifting interest rates, uneven global growth, and renewed currency volatility.

Clients are demanding resilient liquidity, consistent execution under stress, and sophisticated risk-management solutions that work seamlessly across borders, asset classes, and market conditions.

This year’s global winners met those demands by converting market complexity into opportunity and setting the benchmark for how banks support corporates, investors, and financial institutions in an increasingly interconnected currency landscape.

Best Global Foreign Exchange Bank

UBS

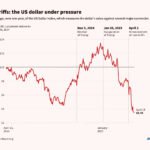

The tectonic plates of the massive $9.6 trillion-per-day FX market were in flux last year, driven by the dollar’s nearly 10% decline and the Bank of Japan continuing 2024’s hawkish shift in January. This volatile environment created the setting for Swiss giant UBS to leverage its unmatched global position, extensive and complex offerings, and deep expertise to achieve a standout year.

Guiding corporate clients through challenging markets on a global scale, the bank achieved record results across all areas of the business.

In global wealth management, FX and related transaction income reached $1.37 billion in the first nine months of 2025, a 5% increase compared to the previous year. Within UBS Investment Bank, FX, rates, and credit revenue grew to $536 million in the third quarter, a 12% rise from the same period last year.

UBS has continued to invest heavily in technology, which the bank credits with helping to reduce latency on major trading routes and expand streaming coverage across emerging-market currencies. The bank also enhanced its single-dealer platform, UBS Neo.

As a result, UBS held a global spot FX market share of over 12%, with dominant positions in key currencies including the Swiss franc, Swedish krona, and Norwegian krone, where its share surpasses 30%. —TM

Best FX Services For Banks (New For 2026)

DBS Bank

In a year marked by sharp shifts in rates and liquidity conditions, DBS’s focus on execution reliability and currency depth was a defining factor for financial institutions looking to offer added liquidity across global markets.

The Singapore-based giant supported institutional flow through matching engines at data centers in London (LD4), Tokyo (TY3), and Singapore (SG1), giving banks and brokers consistent low-latency access to Asian currency liquidity and the broader G10 complex.

As Li Zhen, Head of FX and Digital Assets, notes: “Banks and financial institutions now expect near-continuous, high-quality pricing across a wider range of currency pairs, including Asian crosses. DBS leverages its local market expertise, access to regional liquidity pools, and connectivity with some of the largest Asian currency clearing corridors.”

DBS also refined its AI-enhanced pricing models and expanded the use of its quant engine, Hi-P, to improve spread stability and execution resilience during periods of higher volatility. Moreover, its EdgeFX framework—which links pricing, risk management, and analytics—helped maintain consistent streaming quality during volume surges and fast-moving markets. —TM

Best FX Bank For Currency Heding (New For 2026)

Citi

For its clients seeking to minimize the impact of currency volatility, Citi offers exceptional FX hedging capabilities. The bank leverages an FX franchise with coverage that spans 120 countries and 500 currency pairs, a suite of risk management solutions, and leading FX platforms that can hedge currency exposure in over 80 markets.

The Citi Velocity Trading platform enables clients to manage multiple FX processes, including currency hedging, directly from their treasury management or ERP systems, for an integrated approach. It also includes FX payment solutions, research, and analytical and reporting tools available via desktop, web, and mobile channels.

Citi offers digital FX solutions through its CitiFX platform for currency hedging as well as trading, liquidity, structuring, risk management, and reporting. Citi analysts, quants, and traders offer pre-trade and post-trade analysis and reporting. Complementing these services is CitiFX Pulse, a web-based solution that connects trading to client-treasury functions with end-to-end features covering execution, settlement, research, and analysis. Additionally, the Citi Payments portal provides cross-border services in 135 currencies. —David Sanders

Best FX Derivatives Provider (New For 2026)

Scotiabank

Scotiabank’s extensive FX franchise makes it a leading provider of FX services in North America and globally. Its institutional, corporate, and commercial clients benefit from comprehensive solutions that help manage FX risk and exposure to debt instruments as well as FX payables and receivables through derivatives, including futures contracts, options, and swaps.

These services are delivered through the bank’s FX platform, which provides 24-hour global coverage with a full range of capabilities in sales, trading, strategy, structuring, and market execution in 30 major currencies through seven global trading desks. FX specialists provide sector-specific research, insights, and statistical analysis on G10 and Latin American currencies.

Scotiabank’s investment in technology drives rapid product innovation. This, combined with strong client service, has contributed to solid growth in its FX business line. Ongoing enhancements to its ScotiaRED proprietary platform augment its FX offerings, including e-trading for more-streamlined execution and a specialized suite of FX products for markets in South and Central America and the Caribbean. Working with its technology partners and structuring team, the bank now offers expanded services in the options market with the rollout of more than 60 new option-based trading products.

The bank strives to provide an enhanced client experience across its FX franchise, says Scotiabank’s Larivière. “We choose to approach our business from the standpoint of our clients, and we look forward to continue supporting our clients and their ambitions in 2026 and beyond.” —DS

Best FX Bank For Corporates

BBVA

Amid global FX volatility and shifting interest rates that produced a year full of opportunities and risks for corporates worldwide, BBVA excelled by connecting developed and emerging markets through a single, coherent execution framework. Clients have access to a full range of FX instruments—spot, forwards, swaps, options, nondeliverable forwards (NDFs), nondeliverable swaps, and structured solutions—across several key emerging-market currencies, all delivered through onshore and offshore pricing across Europe, Latin America, and Asia.

This range of services helped BBVA notch record-breaking corporate volumes, including $35 billion in FX derivatives, handled through its enterprise channels, and a high transaction count that reflects its role as a daily liquidity provider for large regional and multinational clients. Alongside product depth, BBVA has focused on giving corporate treasuries consistent reach, clearer post-trade processing, and more-efficient workflows.

On the tech side, the Spanish giant enhanced its global connectivity by enabling ForexClear access for institutional hedgers and strengthening its pricing infrastructure to deliver steady liquidity on cross-border exposures. The bank also continues to integrate AI and big data models into its already leading suite of integrated corporate FX cash-management channels, supporting corporate needs across both emerging and developed markets with a single, streamlined FX architecture. —TM

Best FX Bank For Frontier & Emerging Markets Currencies

BTG Pactual

Trading more than 28 currencies across frontier, emerging, and developed markets and with a footprint spanning six Latin American countries and six global hubs, Brazil-based BTG Pactual continues to make its mark across some of the most challenging currency pairs.

During one of the most volatile years for FX in decades, the bank helped clients avoid the distortions that come with proxy hedges by enabling corporates to hedge exposures directly in their local currencies with G7 currency precision and sophistication. BTG handled some of the region’s most challenging flows, including long-dated, illiquid, and cross-border instruments where liquidity is shallow and pricing can move quickly.

Ongoing platform modernization strengthened these capabilities. In 2025, BTG introduced automated aides that now approve 30% of FX transactions instantly: a meaningful improvement for emerging-market trades where timing and credit checks often slow execution. The bank reduced real settlement times in Brazil for inbound US dollar flows by more than 600 minutes through its real-time settlement infrastructure, sharply improving predictability and reducing settlement-window risk for cross-border flows.

Geographically, BTG expanded its regional network last year with the acquisition of HSBC Uruguay, adding roughly 50,000 clients representing a 7% market share in that country. —TM

Best Liquidity Provider

Citi

Liquidity is essential to maintaining stable and efficient FX markets, ensuring consistent trade execution and competitive rates. Important to day-to-day operations, liquidity becomes critical when economic shocks and geopolitical upheaval turn markets volatile.

With its deep balance sheet and a banking network that extends to 120 countries across all global time zones and 500 currency pairs, Citi offers access to diverse liquidity pools and seamless trade execution. Its CitiFX platform includes a suite of FX services and a full range of features for trading, structuring, and reporting.

Algorithmic trading strategies help clients optimize trades across internal and external liquidity pools with customizable solutions that improve execution and cost efficiency. The Citi Velocity trading platform is compatible with multiple FX processes and provides a reliable source of liquidity in uncertain market conditions. Citi Velocity is optimized for performance and resiliency to ensure that clients have access to deep liquidity pools, supported by the strength of Citi’s FX market-making business. —DS

Best FX Market Maker

UBS

UBS converted volatility into results for both itself and its clients last year by strengthening the core mechanics of its liquidity engine, continuously delivering some of the tightest, most reliable spreads across major currencies.

The bank refined its pricing-and-order ingestion logic to lower rejects and improve fill quality, reducing latency across major trading routes; and it expanded continuous streaming into a wider set of emerging-market and Middle Eastern currencies, including the dirham and riyal. UBS Neo and its mobile FX app leveraged these capabilities to provide clients access to more than 550 currency pairs, covering spot, forwards, NDFs, and options, supported by integrated pre- and post-trade analytics.

Together, these capabilities allow UBS to deliver consistent, scalable liquidity to over 2,500 institutional clients worldwide.

Revenues in UBS Investment Bank’s Global Markets division from FX, rates, and credit revenues surged 41% year on year (YoY) in the second quarter to roughly $666 million, driven primarily by stronger FX flow and higher client activity. Elevated volatility also lifted FX within the bank’s derivatives-and-solutions business, where demand for options and structured products rose as clients hedged and repositioned through rapid rate and currency swings. —TM

Best ESG-Linked Derivatives

Deutsche Bank

Deutsche Bank remained at the forefront of the ESG-linked derivatives market in 2025 by integrating sustainability-performance mechanisms into FX forwards, swaps, and cross-currency structures used by corporate and institutional clients.

The bank’s leadership in this area is based on its long-standing, holistic commitment to sustainable finance. Deutsche Bank facilitated €440 billion (about $517 billion) in sustainable finance, ESG-linked investments, and transition-finance activities by the third quarter of 2025, including a record €28 billion in the second quarter alone. This momentum supports Deutsche Bank’s new long-term goal of delivering €900 billion in sustainable and transition finance by 2030.

In FX, ESG-linked derivatives are executed through Deutsche Bank’s global electronic platform, Autobahn, which provides pricing and execution in more than 170 currencies and allows clients to embed sustainability metrics directly into their cross-border risk-management programs. All sustainability-linked derivatives follow the International Swaps and Derivatives Association’s Sustainability-Linked Derivatives Guidelines, ensuring that selection, validation, and reporting of key performance indicators (KPIs) are transparent, externally benchmarked, and consistently applied.

Deutsche Bank also applies a structured governance framework to these transactions, including independent verification of ESG KPIs and full-lifecycle reporting that links sustainable outcomes to derivative-pricing adjustments. This combination of market infrastructure, governance rigor, and growing sustainable-finance capacity positioned Deutsche Bank as a leader in ESG-linked FX solutions in 2025. —TM

Best FX Commodity Trading Bank

UBS

As volatility on both the macroeconomic and geopolitical fronts combined to make 2025 one of the biggest years for precious metals in decades, UBS clients found the bank’s unmatched offering and execution in this area a significant competitive advantage.

UBS provided deep support for spot, forwards, swaps, NDFs, and options across major gold and silver pairs. Clients relied on this consistency for price discovery, hedging, and flexibility across US dollar, euro, Swiss franc, British pound, Japanese yen, and offshore renminbi exposures. At the same time, UBS expanded its offering meaningfully, broadening access to commodity hedging across more tenors and structures, and giving corporates and asset managers more-precise tools to manage volatility and funding pressures.

The bank expanded its streaming coverage of metals-linked currency crosses, particularly amid accelerating demand for gold and silver against emerging-market currencies. In parallel, UBS enhanced its collateral and financing solutions, enabling clients to use gold and other commodities more efficiently for certain transactions. Increased demand for precious metals enabled UBS to boost liquidity, with holdings of physical metals and commodities rising to $10.9 billion, up roughly 49% from the banks year-end 2024 holdings. —TM