Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

FX markets saw subdued activity on Monday

FX markets saw subdued activity on Monday (except SEK for G10), as the USD index consolidated.

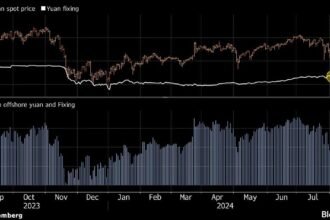

The USD/JPY pair consolidated around 160.80, still above key psychological support level of 160.

In the US, equity and fixed income markets showed little movement on a quiet Monday, setting the stage for key events later in the week.

In Europe, the French election outcome caused some volatility, with French bonds, credit, and equities outperforming slightly.

The EUR/USD pair rejected 1.0840 before softening to 1.0832, while MXN broke through 18.00 resistance on political headlines.

We expect a cautious Asian session as markets await the upcoming US catalysts.

Key events for today (SGT):

22:00 – Fed Chair Powell testifies to Senate Banking

Expect NFIB small business optimism index to stay within range

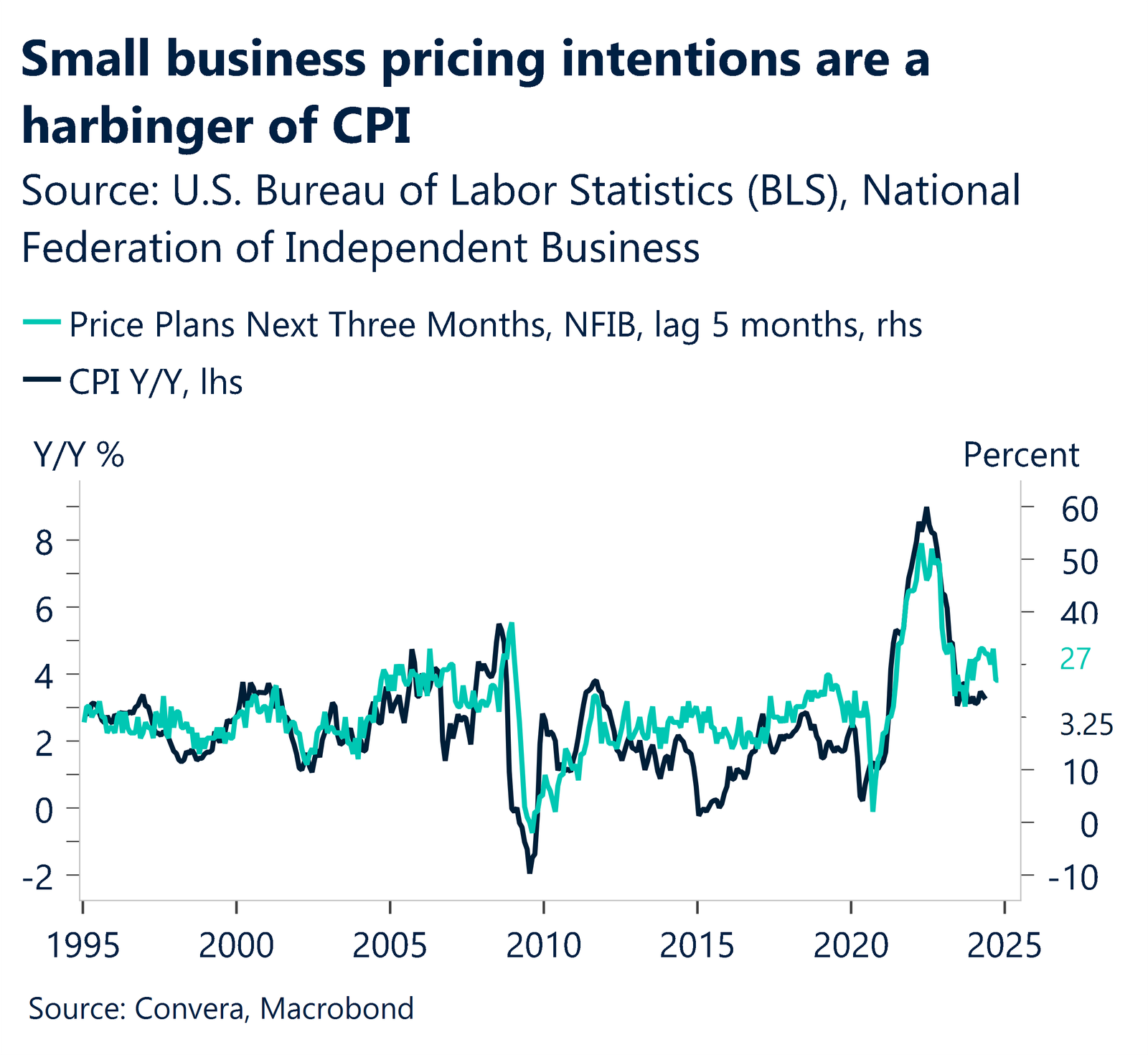

In June, we anticipate that the NFIB small business optimism index most likely stayed within its current range. The lately rising net proportion of enterprises expecting an improvement in the economy is unlikely to change. Although the percentage of businesses increasing employee pay and average selling prices has just stopped declining, we believe that as long as disinflation persists, the slide will eventually resume.

Because of the ongoing uncertainty caused by high loan rates, the number of businesses intending to expand their workforces and undertake capital expenditures is probably going to stay close to where it was three years ago.

Considering the theme of US relative exceptionalism, we remain positive on DXY.

Pound may be supported by carry and growth

June retail sales are subject to both positive and negative impacts. On the negative side, reduced BRC shop price inflation may be impeding the nominal pace of sales growth. The CBI revealed a significantly poorer sales balance in its monthly distributive trades survey.

Furthermore, the trend in yearly sales growth appears to have slowed from the second half of last year when unpredictable Easter sales are taken out. Positive factors for retail sales include reduced inflation, growing earnings, increased confidence, and perhaps the Euro 2024 competition. In June, we anticipate nominal sales growth rates akin to those observed in May.

Strong GBP carry and improved UK growth could boost GBP further.

Aussie retreated slightly from 2024 highs

Table: seven-day rolling currency trends and trading ranges

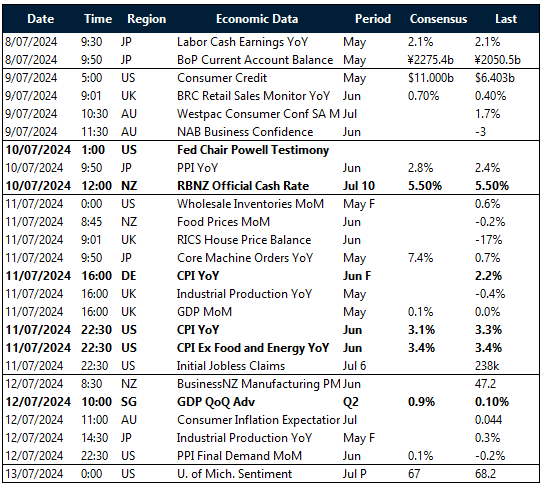

Key global risk events

Calendar: 8 – 13 July

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]