The United Kingdom (UK) headline Consumer Price Index (CPI) rose 3.2% over the year in November, compared to a rise of 3.6% in October, the data released by the Office for National Statistics (ONS) showed on Wednesday.

Markets predicted a 3.5% growth in the reported period. The UK inflation reading was well above the Bank of England’s (BoE) 2% inflation target.

The core CPI (excluding volatile food and energy items) rose 3.2% year-over-year (YoY) in the same period, compared to October’s 3.4% print and came in softer than the forecast of 3.4%.

Meanwhile, the monthly UK CPI arrived at -0.2% in November versus a rise of 0.4% reported in October.

GBP/USD reaction to the UK CPI inflation data

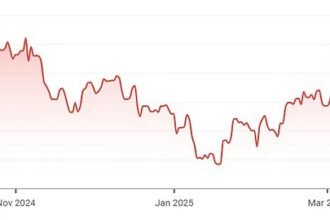

The Pound Sterling (GBP) attracts some sellers in an immediate reaction to the UK CPI inflation data. At the time of writing, the GBP/USD pair is trading 0.59% lower on the day to trade at 1.3345.

Pound Sterling Price This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.28% | 0.27% | -0.30% | 0.08% | 0.52% | 0.53% | 0.28% | |

| EUR | -0.28% | 0.00% | -0.56% | -0.21% | 0.26% | 0.25% | -0.00% | |

| GBP | -0.27% | -0.00% | -0.46% | -0.19% | 0.26% | 0.25% | -0.03% | |

| JPY | 0.30% | 0.56% | 0.46% | 0.36% | 0.81% | 0.80% | 0.75% | |

| CAD | -0.08% | 0.21% | 0.19% | -0.36% | 0.44% | 0.45% | 0.32% | |

| AUD | -0.52% | -0.26% | -0.26% | -0.81% | -0.44% | -0.01% | -0.28% | |

| NZD | -0.53% | -0.25% | -0.25% | -0.80% | -0.45% | 0.00% | -0.28% | |

| CHF | -0.28% | 0.00% | 0.03% | -0.75% | -0.32% | 0.28% | 0.28% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

This section below was published at 05:27 GMT as a preview of the UK Consumer Price Index (CPI) inflation data.

The UK CPI Overview

The United Kingdom (UK) Office for National Statistics (ONS) will publish the highly relevant Consumer Price Index (CPI) data for November on Wednesday at 07:00 GMT.

The UK headline Consumer Price Index is forecast to have eased to a 3.5% year-over-year (YoY) in November from the 3.6% seen in October. Meanwhile, Monthly inflation is expected to be flat at 0% after rising 0.4% in October.

The UK core CPI, considered more relevant for the central bank, as it strips off the seasonal impact of food and energy prices, is expected to remain consistent at a 3.4% YoY rise in November.

How could the UK CPI affect GBP/USD?

GBP/USD is likely to stay subdued if UK CPI meets expectations. However, any upside surprise could cap losses by tempering dovish sentiment ahead of the Bank of England’s (BoE) policy decision on Thursday. The BoE is widely expected to cut rates by 25 basis points to 3.75%, the lowest since 2022, as rising unemployment and economic stagnation ease inflation pressures. Traders will also observe UK Retail Sales and PPI Core Output data.

The GBP/USD pair struggles as the US Dollar (USD) advances after mixed US labor market data for November did little to reinforce expectations of additional Federal Reserve rate cuts. The CME FedWatch tool suggests that Fed funds futures are pricing an implied 74.4% chance of a hold in rates at the US central bank’s next meeting in January, up from nearly 70% a week ago.

Technically, the GBP/USD pair is trading around 1.3390 at the time of writing. Daily chart analysis points to a sustained bullish bias, with the pair holding within an ascending channel and the 14-day RSI remaining above 50. The pair may explore the resistance region around the 13-week high of 1.3536. On the downside, the immediate support lies at the nine-day Exponential Moving Average (EMA) of 1.3662, followed by the psychological level of 1.3300, aligned with the 50-day EMA at 1.3295.