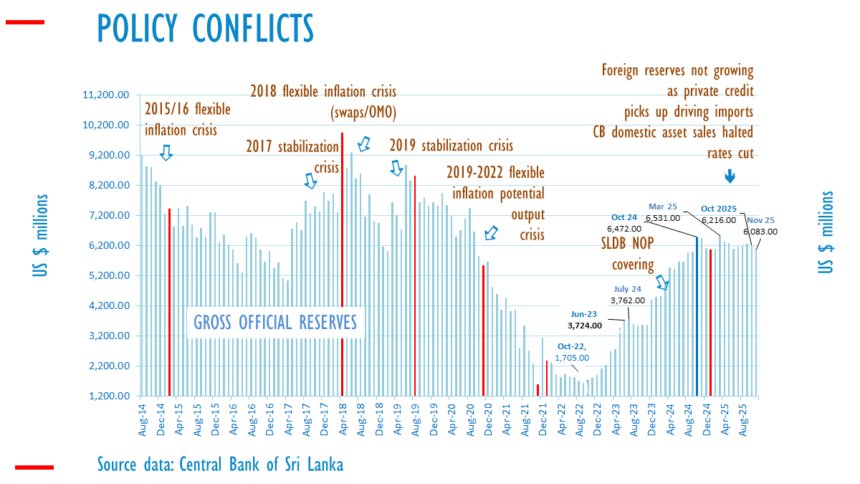

ECONOMYNEXT – Sri Lanka’s foreign reserves dropped to 6,083 million US dollars by end November 2025, dropping 256 million over a year official data shows, amid rate cuts and attempts to related the nation.

Reserves dropped 133 million dollars over the month.

Sri Lanka has not been able build reserves on a gross basis since October 2024, a few weeks after inflationary open market operations were aggressively deployed against monetary stability, printing around 100 billion rupees in what critics say was creditable imitation of a floor system (a true single policy rate).

RELATED : Sri Lanka prints Rs100bn through open market operations

In the first quarter, inflationary open market operations were reversed in strong deflationary policy and in March 400 million dollars were bought in the market driving reserves to 6,531 million dollars.

Gross official reserves also include Treasury receipts of loan proceeds and IMF tranches.

In December, Sri Lanka is expected to get 400 million dollars from the Asian Development Bank (370 budget support) and another 100 million was approved last week.

RELATED : Sri Lanka central bank warned local fx swaps are a ‘hot money operation’ by COPF members

In May 2025 rates were cut which critics said was mis-signalling the banking system, even though a scarce reserve regime has been re-established, at a time when private credit was expanding steeply and deposit rates were bottoming out.

The central bank also engaged in buy-sell swaps injecting money and driving up rupee credit, further reducing its ability to buy dollars outright, though some of it has been unwound since then extinguishing rupees, helping retain reserves.

Analysts had warned that Sri Lanka cannot cut rates claiming that statistical inflation was low in the past 12 -months (flexible inflation targeting) and the actual interest rate is the rate determined by domestic credit and the reserve target.

For the central bank to collect and retain reserves (unlike any other agency including the Treasury) it has to run deflationary policy.

The reserve target is the residual after any debt repayment.

The practice of cutting rates as private credit recovered had led to reserve targets not being met or actual reserve losses within IMF programs (2012 and 2018), and eventual sovereign default when rates cuts were enforced with inflationary open market operations.

Sri Lanka’s central bank is operating some deflationary policy through the coupons on its bond stock which allows it to retain some of the dollars it bought.

The IMF program now in place allowed the agency not to run active deflationary policy (sell down its bond stock) and deflationary was limited to coupon payments in its bonds.

Ignoring, any other loans the central bank had to run deflationary policy amounting 1.1 billion US dollars to repay its own reserve related debt service to the IMF (216 million dollars) and Reserve Bank of India (about 900 million dollar plus interest).

However, over-purchasing dollars above its deflationary policy had led to the rupee being steeply depreciated over 2025, despite record current account surpluses from debt repayments.

The central bank itself had repaid its own debt (reserve related liabilities) to the IMF, and Reserve Bank of India taken after inflationary rate cuts and sell-buy fx swap unwinding to cut rates 2014/15 claiming historical 12-month inflation was low and aggressive macro-economic policy in 2020 for potential output targeting.

By over-purchasing dollars without sufficient deflationary policy the central bank had depreciated the rupee from 292.58 to the US dollar in end December 2025, 308.02 by end November 2025.

RELATED : Sri Lanka’s exchange rate depreciation by ‘Political Ravishment’

The depreciation was engineered amid a record current account surplus, confouding macro-economists who usually blame current account deficits for external trouble.

President Anura Dissanayake called for the exchange in the budget for 2026.

He has several time held up the stable exchange rate as proof of the good economic policies of the government, as had previous President Ranil Wickremesinghe.

Unfortunately however, the sanction for a five percent rise in cost of living per year (a floor rate inflation target of 5 percent) was given during his tenure.

The IMF program review expected to be delayed to February 2026 with additional funds to come in a new program. (Colombo/Nov06/2025)