GBP/EUR Year-End 2025 Forecast

Consensus from major banks.

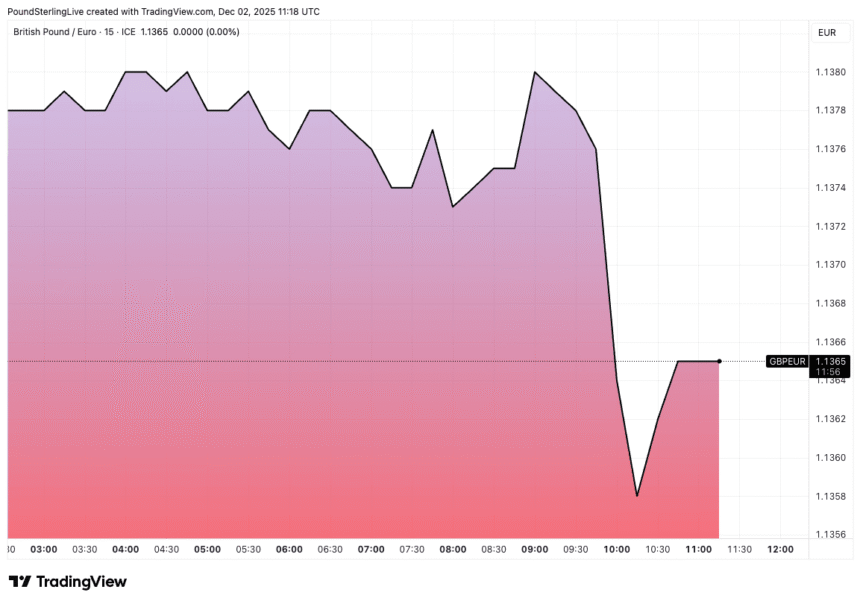

The pound to euro exchange rate extended losses following the release of above-consensus Eurozone inflation data.

The pair fell from 1.1380 to 1.1360 in the minutes following news HICP inflation for November came in slightly higher than expected at 2.2%, up from 2.1% in October.

This is ahead of consensus expectations for an unchanged reading. Core inflation held steady as expected at 2.4%.

The data underscores the European Central Bank’s commitment to keeping interest rates unchanged for the foreseeable future, which offers the euro a fundamental source of support against currencies belonging to central banks where rates will be lowered.

The Bank of England is expected to cut interest rates in December and once again before April, creating an interest rate convergence between the EU and UK that weighs on pound-euro.

“In the UK, we expect rates to be 1% lower by the end of 2026, whereas market pricing looks for a 60bp fall. The UK has more room to cut rates than others and is likely to use it, which won’t help the pound in 2026,” says Kit Juckes, chief FX analyst at Société Générale.

The details of the Eurozone’s inflation report are what probably clinched the FX reaction, as they suggest there’s an element of stickiness in the services sector that risks keeping inflation above the ECB’s 2.0% target.

“The upside surprise was driven by somewhat less of a drag from energy than expected, which came in at -0.5% y/y (our forecast: -0.8%), while services was also slightly higher than expected at 2.5%,” notes Bill Diviney, Senior Eurozone Economist at ABN AMRO.

The euro has started the week on the offensive against the pound and dollar, but analysts at Barclays think the 2025 selloff in GBP/EUR is set to reverse.

They say “last week’s budget generates scope for an, at least partial, unwind of the pound’s fiscal risk premium.”

It adds that “a relatively warm reception” by the Labour party to the budget is important to consider, in that it allays near-term risks of political instability.

“The back-loading of fiscal tightening implies execution and credibility risks, but we think these are already adequately priced,” says Barclays.

Importantly, Barclays also doesn’t see the Bank of England cutting more than two more times in the current cycle, whereas the more bearish views on GBP rest with a belief the Bank will cut further.

“Terminal rate pricing of just under 3.5% for Bank Rate (including a 25bp cut in December) also remains appropriate, in our view, as the macro outlook over the Bank’s policy horizon is largely unchanged,” says Barclays.