June 26, 2025 – Written by James Fuller

STORY LINK Pound Sterling to Euro Forecast: Consolidation Around One Week Best

The Pound to Euro (GBP/EUR) exchange rate has consolidated just above 1.1730 after hitting 1-week highs close to 1.1750.

Both currencies have benefited from the decline in energy prices this week, with markets also looking at underlying fundamentals.

Yield spreads are underpinning the Pound, but UK equities moved lower.

According to UBS, GBP/EUR will hit strong selling on any move to 1.19 with an eventual retreat to 1.1630.

As far as the Bank of England is concerned, Governor Bailey reiterated his core message: “The path of rates is still downwards, but it is going to be very gradual and very careful because we’ve got this [inflation] bump and we’ve got to see that come out.”

BoE Bailey also pointed to trade risks; “It is very unpredictable where this is all going to end up. Clearly we are coming towards the end of the 90-day period that President Trump set out for reaching agreements.”

He added; “We have one agreement so far, which is with the UK. That obviously isn’t implemented yet. So quite where this is going to go to, I’m afraid we don’t know at this stage.”

On domestic grounds, Bailey did note; “We are starting to see softening of the labour market and while pay increases are still well above a level consistent with the target they are coming off”.

He refused to be drawn on policy direction; “there would be no explicit guidance on the direction of monetary policy ahead of the next rate-setting meeting. In these circumstances we are particularly careful about what we say on that front because the world is just so uncertain.”

Deputy Governor Ramsden maintained a more dovish stance and added; “Because even at 4% I assess that monetary policy would remain clearly in restrictive territory. So if evidence emerged that pointed to higher inflation in the medium term then Bank Rate could be held higher for longer than would otherwise be the case.”

Bank of America commented; “We see scope for inflation to be lower than the BoE’s estimates and expect cuts in August, September and November with a dovish pivot in H2. Having said that, we acknowledge that elevated inflation, gradual guidance and rising energy/food prices put our call for a September cut at risk. But we think the bar to cut less than quarterly is high.”

Markets were starting to focus on the government’s difficulties over welfare reform.

According to Monex, “The implication is that substantial tax rises or additional borrowing would be needed come the autumn, if the government cannot pass reforms to limit spending on entitlements.”

It added; “And that is not a sterling-positive dynamic if similar recent episodes are anything to go by.”

According to UBS; “the UK may face difficulties should inflation remain sticky while growth weakens materially. With a sky-high deficit severely limiting fiscal headroom, the BoE may be put in a tricky position, but this is not our base case, for now.”

Euro-Zone policies will also be an important element. On fiscal policy, there will be further pressure to boost defence spending.

According to Bank of America, there is still scope for ECB rate cuts; “The progress on core inflation in May keeps us confident that core inflation will undershoot expectations. We still expect the ECB to cut policy rates in September and December, taking the terminal rate to 1.5%.”

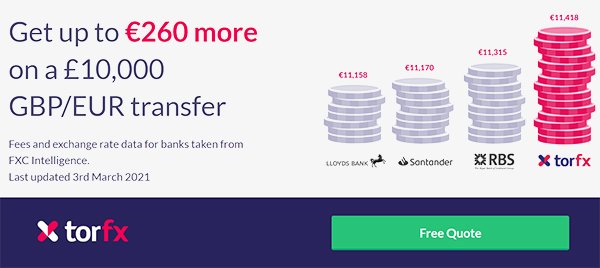

International Money Transfer? Ask our resident FX expert a money transfer question or try John’s new, free, no-obligation personal service! ,where he helps every step of the way,

ensuring you get the best exchange rates on your currency requirements.

TAGS: Pound Euro Forecasts