In the realm of global finance, discussions regarding the possible restructuring of the international monetary system are gaining momentum.

A recent tweet by crypto enthusiast Edward Farina, accompanied by a detailed infographic, illustrates a complex but intriguing scenario in which the digital asset XRP could play a pivotal role as both a world reserve currency and a bridge currency.

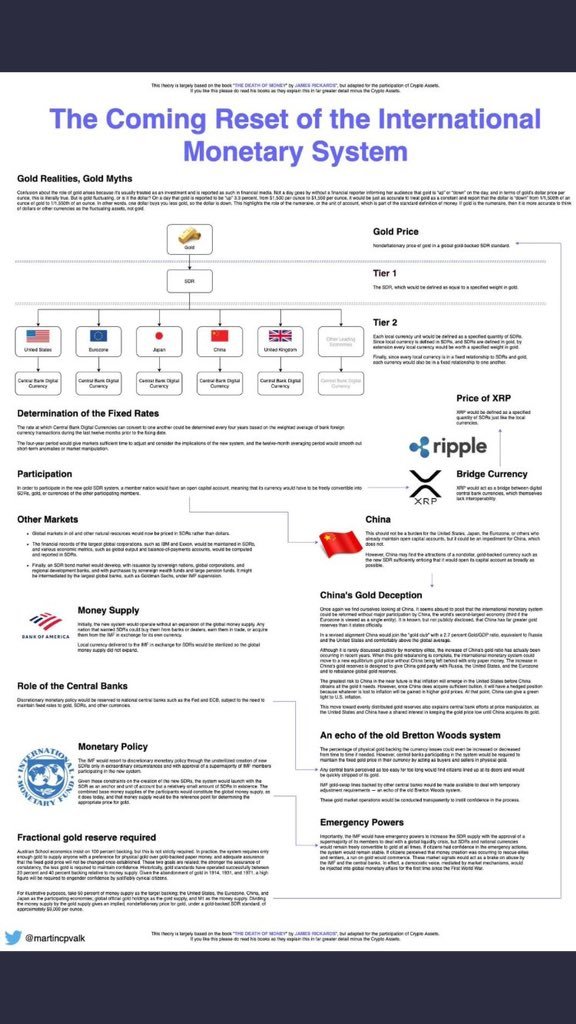

Gold Realities and Myths in a Changing Financial Landscape

The infographic begins by addressing the longstanding debate around gold as a foundation for a stable monetary system. It highlights that while gold has historically been viewed as a stable store of value and a hedge against inflation, its role in modern finance is increasingly seen through the lens of digital transformation.

According to the map, the notion of a global reset involves not just gold but also a move towards digital currencies backed by assets, with gold serving as a crucial anchor.

The Role of Special Drawing Rights (SDRs)

Central to the proposed system is the use of Special Drawing Rights (SDRs), an international reserve asset created by the International Monetary Fund (IMF).

In this framework, gold would be priced in SDRs, creating a benchmark that could underpin global financial stability. The SDR, traditionally a basket of major currencies, would serve as a foundational layer (Tier 1) for this new monetary system.

Tiered Structure of Currencies

The infographic outlines a tiered structure for global currencies. At the top is the SDR, supported by gold. Beneath this are Tier 1 currencies, which would likely include the U.S. Dollar, Euro, Japanese Yen, and other major national currencies. These would be directly backed by gold reserves to ensure stability and confidence in their value.

In Tier 2, digital currencies emerge as significant players. These would be issued by central banks and linked to their respective national currencies. The implication is that these digital assets could interact seamlessly across borders, with a bridge currency like XRP facilitating conversions and transactions between them.

XRP as a Bridge Currency

XRP is posited as a potential bridge currency in this new system. The graphic suggests that XRP could facilitate the conversion of different central bank digital currencies (CBDCs) by providing liquidity and reducing friction in international transactions.

This role as a bridge currency is critical in a world where multiple digital currencies are in use, and interoperability between them is necessary for efficient global commerce.

A noteworthy aspect of the infographic is its focus on China’s strategic positioning in the global monetary landscape. The narrative suggests that China might accumulate gold as part of its strategy to influence the international monetary system.

However, the map labels this as a “gold deception,” implying that China’s intentions may be more complex than simply backing its currency with gold.

China’s approach could involve leveraging its gold reserves in a way that aligns with the broader strategy of using digital currencies, possibly to challenge the dominance of the U.S. Dollar and assert more control over the global financial system.

Implications for Central Banks and Monetary Policy

The proposed reset of the monetary system would necessitate significant changes in the role of central banks. The infographic suggests that central banks would need to adapt to a world where digital currencies and gold-backed assets coexist.

This would likely involve a reevaluation of monetary policy, with an emphasis on maintaining the value of these digital currencies through a combination of asset backing and strategic use of SDRs.

The Echo of the Bretton Woods System

The map draws a parallel between the proposed system and the Bretton Woods system, which established a framework for international monetary policy post-World War II.

However, instead of pegging currencies to the U.S. Dollar and gold, this new system would rely on digital currencies and a broader range of assets to provide stability.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

The inclusion of a bridge currency like XRP reflects a modern approach to an age-old challenge: how to facilitate smooth and reliable international trade and finance.

Finally, the infographic touches on the concept of emergency powers, which governments and international institutions might need to exercise during the transition to this new system. This could involve temporary measures to stabilize markets and ensure that the shift does not lead to significant economic disruptions.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News