- The Pound Sterling faced rejection again near 1.3450 versus the US Dollar.

- The Fed and BoE policy announcements are set to rock the GBP/USD pair in the week ahead.

- Technically, the pair could see dip-buying as the daily RSI still holds above the midline.

The Pound Sterling (GBP) witnessed a downside correction against the US Dollar (USD) after the GBP/USD pair faced rejection again near the 1.3450 barrier.

Pound Sterling hit three-year highs, then reversed

King Dollar regained its throne, booking the third weekly gain, due to receding tariff war fears and optimism emerging from potential trade deals between the United States (US) and its major Asian trading partners.

US President Donald Trump and some of his colleagues stuck to their rhetoric that trade negotiations continued with China even though Beijing dismissed such talks. Trump said during the week that he has “potential” trade deals with India, South Korea and Japan and that there is a very good chance of reaching an agreement with China.

China eventually confirmed in the latter part of the week, with the Chinese Commerce Ministry stating that “the US has recently sent messages to China through relevant parties, hoping to start talks with China. China is currently evaluating this.”

Optimism on the trade front allayed fears of a likely slowdown in the US economic growth, keeping the USD recovery intact. The first look of the US annualized Gross Domestic Product (GDP) showed on Wednesday that the US economy contracted by 0.3% in the first quarter of 2025 as US firms frontloaded to get ahead of the US levies, resulting in an import surge.

However, Thursday’s ISM Manufacturing PMI eased US growth concerns. The index fell to 48.7 in April from 49.0 in March, against expectations for a bigger fall to 48.

Therefore, the sustained USD demand remained the primary driver behind the GBP/USD pair’s moves as the Pound Sterling finally gave in to the Greenback’s resurgence. The pair hit a fresh three-year high at 1.3445 at the start of the week before setting off a correction to near 1.3250 heading into the release of the US employment report on Friday.

The US Bureau of Labor Statistics (BLS) reported that Nonfarm payrolls (NFP) rose by 177,000 in April, surpassing the market expectation of 130,000. In this period, the Unemployment Rate held steady at 4.2% and annual wage inflation, as measured by the change in the Average Hourly Earnings, remained unchanged at 3.8%. GBP/USD struggled to gain traction after the US labor market data and remained in the lower half of its weekly range heading into the weekend.

Focus on trade headlines and central banks’ bonanza

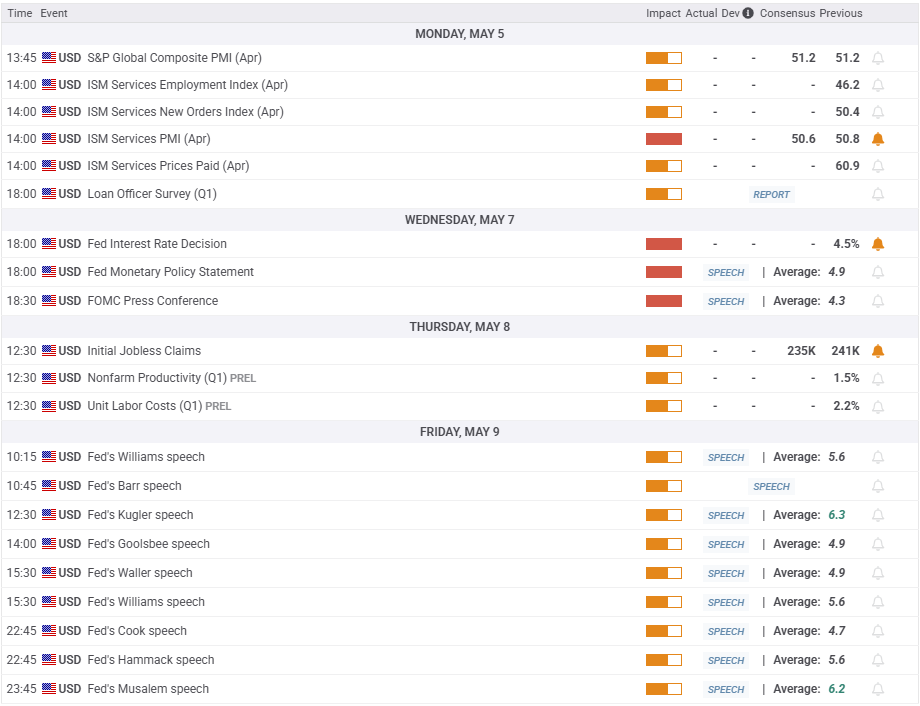

Following a US economic data-dominated week, the upcoming week is relatively light, notwithstanding the Fed and BoE monetary policy decisions.

On Monday, the US ISM Services PMI will be of note for the major as the UK markets will remain closed in observance of May Day. Tuesday lacks any top-tier UK or US macro news, so all eyes turn toward Wednesday’s Fed interest rate decision.

The Fed is widely expected to hold rates following the May policy meeting. Still, Chairman Jerome Powell’s words on the potential impact of US tariffs on the economic and inflation outlook will hold the key and impact the USD performance across the board.

The BoE will steal the spotlight on ‘Super Thursday’as the Bank’s Monetary Policy Report (MPR) and Governor Andrew Bailey’s press conference will throw fresh hints on the timing of the next interest rate cut.

Later that day, the US will publish its weekly Jobless Claims data.

BoE Governor Bailey will make his second public appearance of the week on Friday, speaking at the Reykjavík Economic Conference in Iceland. Fed policymakers will also return to the rostrum after the ‘blackout period’.

That said, potential trade deals between the US and its major trading partners and developments on the tariff front will continue playing a pivotal role in the week ahead.

GBP/USD: Technical Outlook

Amid a Golden Cross and a bullish 14-day Relative Strength Index (RSI) on the daily chart, risks remain skewed to the upside for the GBP/USD pair in the short term.

The 50-day Simple Moving Average (SMA) crossed above the 200-day SMA on a daily closing basis on April 17, providing conviction to the bullish streak.

Meanwhile, the 14-day Relative Strength Index (RSI) has turned north while above the midline, currently near 59.

The pair must close the week above the critical 1.3350 psychological barrier to negate the corrective bias. The next powerful resistance aligns at the three-year high of 1.3445.

Acceptance above that level will likely kick off a fresh uptrend toward the February 2022 high of 1.3644.

Alternatively, if the correction gathers steam, the 1.3200 round level will be tested initially, below which the immediate support of the 21-day SMA at 1.3184 will be tested.

A sustained break below the 21-day SMA will target the 50-day SMA at 1.3007, followed by the 200-day SMA at 1.2845.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data.

Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money.

When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.