- UK’s Starmer pushes for economic partnership with the US to bypass 10% export tariffs.

- Trump hints tariffs are leverage for new deals; Bessent says negotiations are underway, lifting risk sentiment.

- Traders await UK GDP data and Fed minutes; sticky US inflation could revive US Dollar strength and weigh on GBP.

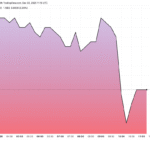

The Pound Sterling (GBP) is recovering some ground against the Greenback on Tuesday, edging up 0.34% amid renewed hopes that tariffs are indeed used as negotiation tools, as United States (US) President Donald Trump said that “many, many, countries are coming to negotiate deals with us.” At the time of writing, the GBP/USD trades at 1.2756 after bouncing off daily lows around 1.2700.

Sterling rises 0.34% as optimism over US-UK trade talks and easing USD support short-term recovery

Hopes fueled by US Treasury Secretary Scott Bessent that trade deals would be made improved the market mood, underpinning global equities, while the US Dollar (USD) retreated somewhat.

UK Prime Minister Keir Starmer said on Monday that they could secure an economic partnership with the US to dodge the 10% tariffs imposed on British exports to the United States.

In the meantime, the UK economic schedule is light with traders eyeing the release of February’s Gross Domestic Product (GDP) figures by the end of the week. Money market traders expect the Bank of England (BoE) to cut interest rates by 25 basis points in May, with market participants estimating 75 bps of easing toward the end of 2025.

Across the pond, tariff news is grabbing the headlines ahead of releasing the latest Federal Reserve (Fed) monetary policy meeting minutes. After that, traders will focus on consumer and producer price inflation figures, which are expected to edge lower. Higher readings would be an unwelcome surprise for investors, pushing the Greenback higher due to inflationary pressures.

GBP/USD Price Forecast: Technical outlook

GBP/USD most likely trades sideways for at least two days, as participants await US inflation and UK GDP data. The range is delineated by the 50-day Simple Moving Average (SMA) at the bottom at 1.2736, while the 200-day SMA sits above the spot price at 1.2811.

In the case of a bearish resumption, the first support would be 1.2700, followed by the 100-day SMA at 1.2628. Conversely, if bulls move in and claim the 200-day SMA, the 1.2900 could be up for grabs.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.45% | 0.97% | 0.96% | -0.33% | 0.40% | 0.00% | 0.19% | |

| EUR | -0.45% | 0.80% | 1.14% | -0.15% | -0.11% | 0.22% | 0.35% | |

| GBP | -0.97% | -0.80% | -0.96% | -0.93% | -0.91% | -0.58% | -0.44% | |

| JPY | -0.96% | -1.14% | 0.96% | -1.27% | 0.39% | 0.31% | -0.44% | |

| CAD | 0.33% | 0.15% | 0.93% | 1.27% | 0.38% | 0.37% | 0.24% | |

| AUD | -0.40% | 0.11% | 0.91% | -0.39% | -0.38% | 0.33% | 0.48% | |

| NZD | -0.01% | -0.22% | 0.58% | -0.31% | -0.37% | -0.33% | 0.14% | |

| CHF | -0.19% | -0.35% | 0.44% | 0.44% | -0.24% | -0.48% | -0.14% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).