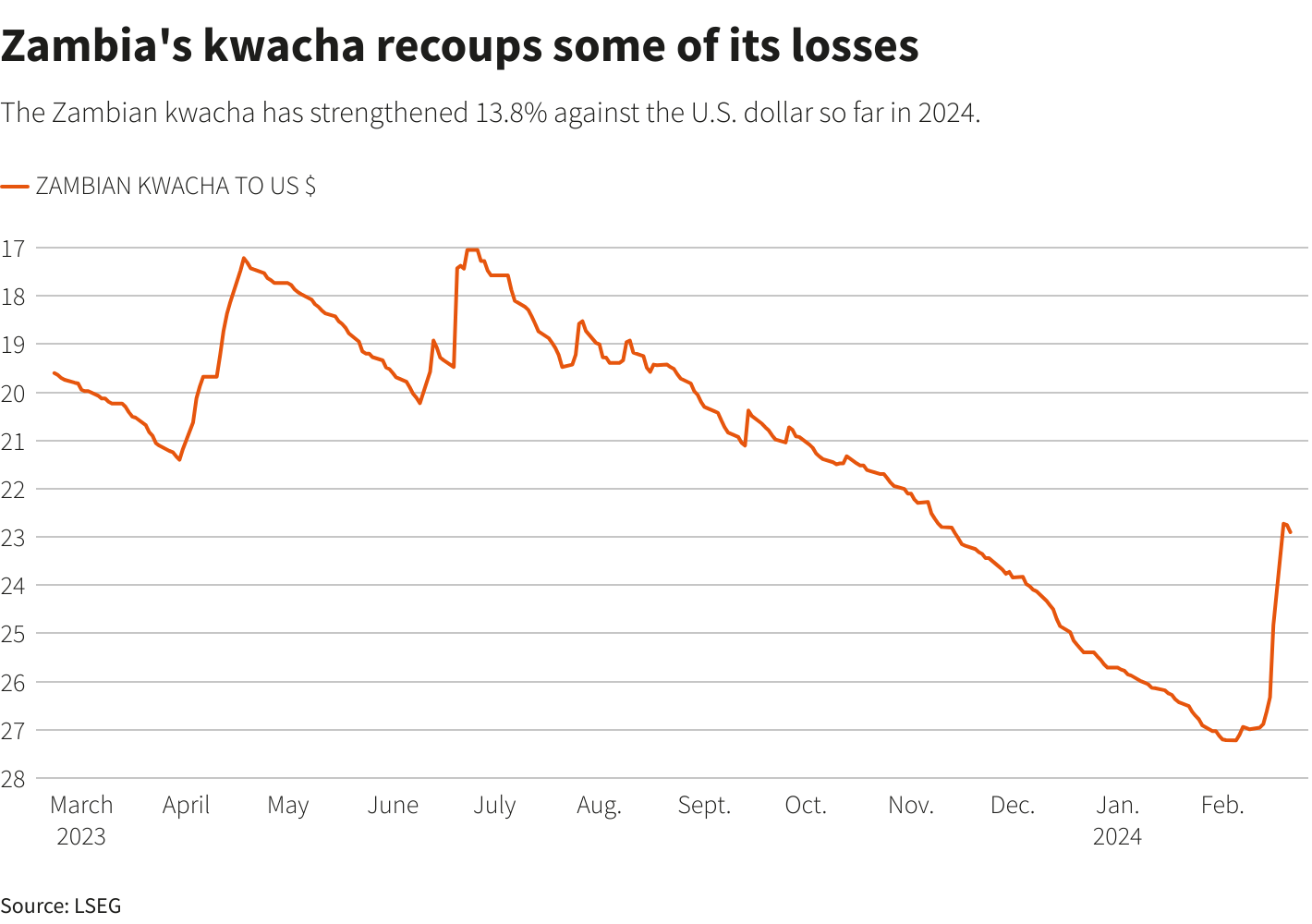

JOHANNESBURG/LUSAKA, Feb 22 (Reuters) – Zambia’s kwacha is Africa’s best performing currency against the U.S. dollar so far this year after the central bank sharply tightened monetary policy, but analysts said it would strengthen sustainably only if the country attracts more foreign investment.

“The kwacha’s performance this year has been remarkable,” said Danny Greef, Co-Head of Africa at research firm ETM Analytics.

Zambian officials have blamed the country’s stalled debt restructuring, now in its fourth year, for stymieing overseas investment and weakening the kwacha. But copper production, the southern African state’s major foreign exchange earner, has also fallen despite government efforts to boost the sector.

“The measures that we have taken… are meant to stem some of the demand, which we thought was excessive as we anticipate supply, which mainly comes from the mining sector,” Bank of Zambia governor Denny Kalyalya told a public forum on Tuesday.

The kwacha has weakened slightly this week from 22.5 to $1, but is still more than 20% stronger than the record low of 27.23 reached on February 6.

“What is expected is an adjustment that will stabilise around the 21-22 per dollar,” economist Munyumba Mutwale said, adding that increased foreign currency flows were required for the kwacha to make further gains.

The government is now concluding arrangements for new investors to take over Mopani and Konkola Copper Mines, while other companies including KoBold Metals are undertaking exploration with commitments to fund new projects.

“To address the structural imbalance between kwacha- and hard-currency liquidity, it is crucial that the government keep to the fiscal consolidation path and balance of payments reform to establish an attractive policy environment,” said Imgard Erasmus, a senior economist at Oxford Economics.

“The conclusion to the external debt restructuring exercise will also be instrumental to providing clarity on the outlook for hard-currency- and fiscal obligations, and unlock pent-up portfolio- and fixed investment flows into the country.”

Sign up here.

Reporting by Rachel Savage and Chris Mfula; Editing by Angus MacSwan

Our Standards: The Thomson Reuters Trust Principles.