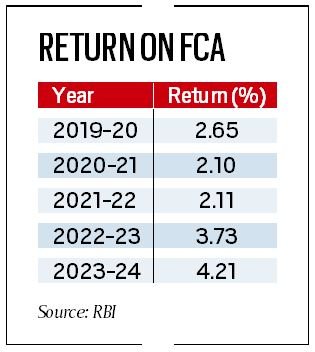

With interest rates rising in the US and other developed countries amid high inflation, the return, or the interest earned, on India’s foreign currency assets doubled to 4.21 per cent during the fiscal ended March 2024 from 2.11 per cent in March 2022, the Reserve Bank of India (RBI) said.

The foreign currency assets comprise of multi-currency assets that are held in multi-asset portfolios. The total value of securities in FCA was $468.98 billion as of March 31, 2024. This means on a 4.21 per cent return, RBI would have earned over $19 billion as interest income. The rate of return on FCA was 3.73 per cent in FY2023 and 2.10 per cent in FY2021 and 2.65 per cent in FY2020, the RBI said in its reply to the RTI application filed by The Indian Express.

The US Federal Reserve hiked the effective federal funds rate (EFFR) to 5.33 per cent in the last two years, which is higher than the long-term average of 4.61 per cent. The EFFR is the interest rate set by the Federal Open Market Committee (FOMC) for banks to borrow money from each other. The US Federal Reserve sets an upper and lower limit for the EFFR and aims to keep it within that range by adjusting the target range for the federal funds rate. The current target range is 5.25 per cent to 5.50 per cent.

CD (certificate of deposit) rates offered by US banks are in the range of 5.20 per cent. On the other hand, the RBI’s main policy rate – Repo rate – is currently 6.50 per cent. State Bank of India (SBI) offers an interest rate of 7 per cent on two-year deposits, at least 200 basis points higher than the US banks.

As of July 11, 2024, the annual inflation rate in the US was 3 per cent for the 12 months ended in June, down from the previous rate increase of 3.3 per cent. This is lower than the long-term average of 3.28 per cent. After adjusting for inflation, the return on FCA is positive for the RBI.

Meanwhile, the RBI reduced the gold kept in safe custody with the Bank of England and the Bank for International Settlements (BlS) by around 50 tonnes to 387.26 metric tonnes during FY24. The RBI apparently reduced the gold held abroad due to the high cost involved. “The information cannot be provided as it falls under the category of information which is exempted under Section 8(1Xa) of the Right to lnformation Act 2005,” the RBI said in its RTI reply when sought the cost of keeping gold in safe custody abroad.

As at end-March 2024, the Reserve Bank held 822.10 metric tonnes of gold, of which 408.31 metric tonnes were held domestically. While 387.26 metric tonnes of gold were kept in safe custody with the Bank of England and the Bank for International Settlements (BlS), 26.53 metric tonnes were held in the form of gold deposits.

Union Road Transport and Highways minister Nitin Gadkari had earlier pitched for formulating a policy for using the RBI’s rising foreign exchange reserves for funding road projects, saying the country needs low-cost finance for such infrastructure projects. However, the RBI has the mandate to invest up to $5 billion in the bonds issued by the India Infrastructure Finance Company (UK) Limited. As at end of March 2024, the amount invested in such bonds stood at $ 932 million.

As at end-March 2024, out of the total FCA of $ 570.95 billion, $ 468.99 billion was invested in securities, $62.17 billion was deposited with other central banks and the BIS and the balance $ 39.79 billion comprised deposits with commercial banks overseas. With the objective of exploring new strategies and products in reserve management while diversifying the portfolio, a small portion of the reserves is being managed by external asset managers. The investments made by the external asset managers are governed by the permissible activities as per the RBI Act, 1934.

© The Indian Express Pvt Ltd

First uploaded on: 16-07-2024 at 03:58 IST