Published as part of the The international role of the euro, June 2023.

Dominant currencies confer important economic, financial and strategic advantages on the issuer, so it is important to understand why some currencies have a more prominent international role than others. This special feature provides insights into various potential determinants of currency choice in cross-border bank lending, such as bilateral distance, measures of financial and trade linkages to issuer countries of major currencies, and invoicing currency patterns. Cross-border bank lending in US dollars, and particularly in euro, is highly concentrated in a small number of countries. The United Kingdom is central in the international network of loans denominated in euro, although there are tentative signs that this role has diminished for lending to non-banks since Brexit, with such loans now possibly booked by newly-established US (or euro area) subsidiaries. Offshore financial centres are pivotal for US dollar loans, reflecting, in particular, lending to non-bank financial intermediaries in the Cayman Islands, possibly as a result of regulatory and tax optimisation strategies of large multinationals and high net worth individuals. An empirical analysis suggests that euro-denominated loans face the “tyranny of distance”, in line with predictions of standard models of trade, as captured by a variety of variables, in contrast to US dollar loans. Complementarities between trade invoicing and bank lending are found for both the euro and the US dollar. Overall, the analysis suggests that the euro tends to be more of a regional currency, while use of the US dollar in cross-border bank lending is global.

1 Introduction

Dominant currencies confer important economic, financial and strategic advantages on the issuer, so it is important to understand why some currencies have a more prominent international role than others. This special feature provides insights into various potential determinants of currency choice in cross-border bank lending, showing that currency choice is affected by geographical distance to the currency issuer and the scale of financial and trade linkages to issuer countries, as well as invoicing currency patterns.

International economics provides a theoretical account of how the use of a currency for trade invoicing is complementary to its role as a safe asset. This special feature contributes to the well-established literature on dominant currencies, particularly Gopinath and Stein (2021).[2] A key point made in Gopinath and Stein’s model is that only dominant currency deposits can be truly considered safe, as they are the only guarantee of purchasing power for imports invoiced in that currency.[3] The greater the share of trade invoiced in the dominant currency, the greater the desire of the economic agents to hold their assets denominated in that currency in banks. At the same time, a bank promising to repay a depositor in the dominant currency in the future should also hold matching assets denominated in the same currency, implying that it will lend in that currency too, even if the revenues of the borrowing firm are not in the dominant currency. This in turn would incentivise the borrowing firm to invoice in the dominant currency, creating a positive feedback mechanism or strategic complementarities that support the emergence of a dominant currency in trade invoicing and global banking.

This article presents empirical analysis that tests whether this economic mechanism is supported by recent and comprehensive data. The granular data provided by the bilateral BIS locational banking statistics make it possible to conduct analysis that provides robust and nuanced supporting evidence of the complementarities described above.

As well as confirming the globally dominant role of the US dollar in cross-border banking, this special feature points to several new stylised facts related to the euro. While the descriptive analysis shows the centrality of the United Kingdom for euro-denominated loans, it also highlights tentative signs of negative Brexit effects (Box 4). Offshore financial centres are pivotal in the network of cross-border loans denominated in US dollars, mainly as a result of lending to non-bank financial intermediaries located in the Cayman Islands, possibly due to regulatory and tax optimisation strategies of large multinationals and high net worth individuals. The outsized role of the United Kingdom and offshore financial centres is one reason why euro- and US dollar-denominated cross-border bank lending appears so geographically concentrated.

The regression analysis suggests that euro-denominated loans are affected by the “tyranny of distance”, in line with predictions of standard models of trade, as captured by a variety of variables, in contrast to US dollar-denominated loans. Complementarities between trade invoicing and bank lending are found for both the euro and the US dollar. Overall, the analysis confirms that the role of the euro in cross-border bank lending is more regional, while use of the US dollar is global.

2 Descriptive analysis

The analysis employs the bilateral BIS locational banking statistics.[4] The data are dyadic, meaning that each observation refers to a country pair, providing information collected from the 48 BIS reporting countries vis-à-vis more than 200 counterparty countries. This extensive data coverage allows for substantially improved descriptive and empirical analysis compared with earlier studies.

The data record cross-border positions in loans by banks residing in the reporting countries, which can be broken down by currency composition. The data provide information on loans denominated in euro and US dollars, as well as in three other major global currencies (pound sterling, Japanese yen and Swiss franc).[5] The baseline analysis examines cross-border bank loans aggregated vis-à-vis all sectors, while more disaggregated data by counterparty sector are used to examine whether patterns differ across counterparty banks, non-bank financial intermediaries and non-financial sector borrowers. This allows us to shed additional light on the mechanisms underlying currency choice in international bank lending.

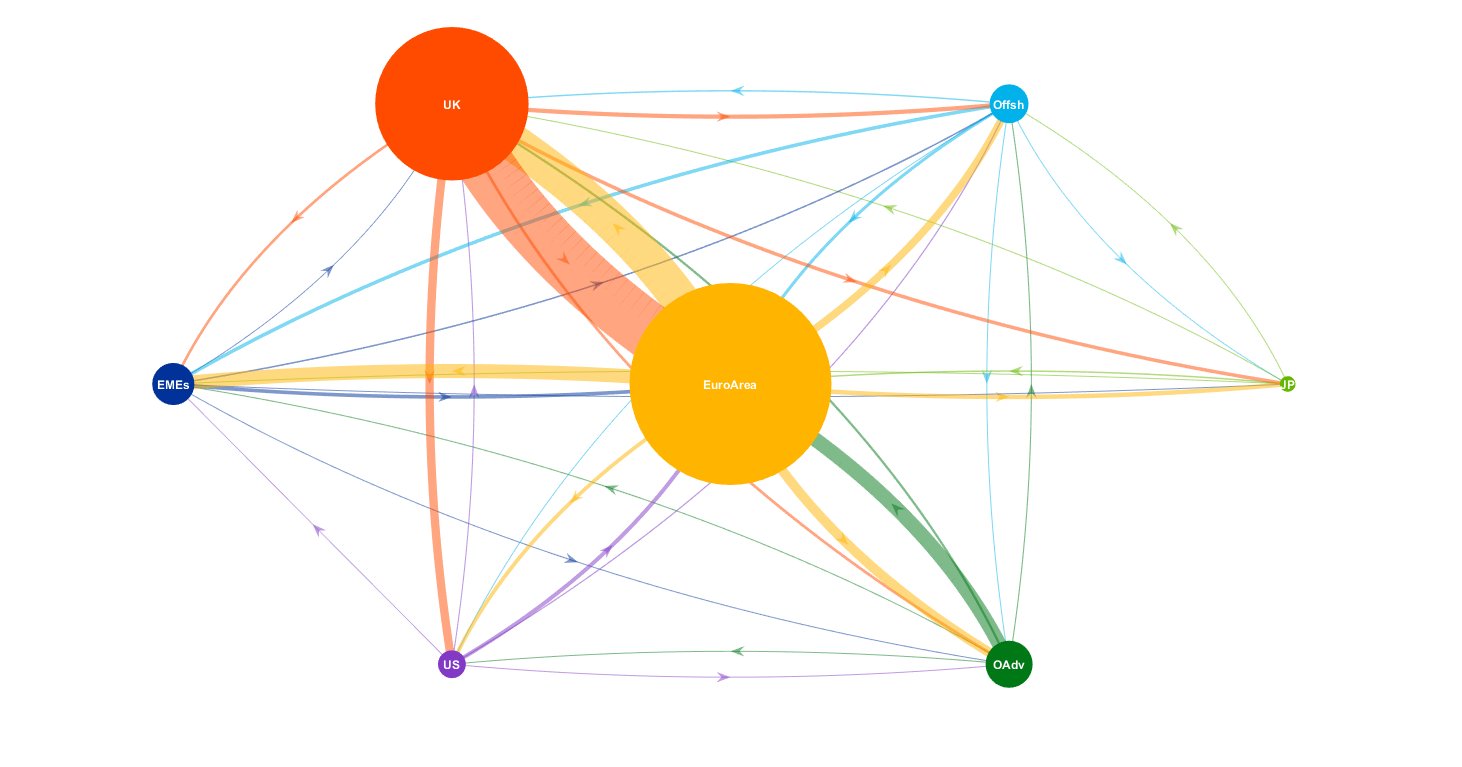

Examining the entire network of euro-denominated loans highlights the important role of the United Kingdom, including for loans vis-à-vis the euro area. Chart C.1, panel a shows the network of cross-border bank loans denominated in euro, with the node sizes and edges proportional to the stock of loans. An arrow originating from a node represents loans by banks located in the country/region to the country/region where the arrow ends. Intra-euro area loans are excluded, but links to and from the euro area are included.[6] The network chart shows that the network of euro-denominated loans is highly centralised in the euro area. It also illustrates that despite Brexit, the United Kingdom continues to play a key role in intermediating euro-denominated loans with the euro area, as well as with the United States and offshore centres. There is a relatively large amount of loan flows from banks located in the United Kingdom to residents in the United States and offshore centres, whereas flows in the opposite direction, i.e. from banks located in the United States and offshore centres to the United Kingdom, are considerably smaller. Euro area-resident banks have substantial euro-denominated loans to emerging market economies.

The network of US dollar-denominated loans is less centralised in the currency issuer than for euro-denominated loans. Chart C.1, panel b shows the network of US dollar-denominated loans. The US dollar is the main vehicle currency in that it exhibits more substantial linkages between countries other than the issuer (i.e. the United States), although the United States remains the most important player. Banks located in offshore centres play a key role in intermediating US dollar-denominated loans to the United States and emerging economies (mainly in Asia).

Chart C.1

a) Network of euro-denominated cross-border bank loans

(scaled in proportion to % of total euro-denominated loans)

b) Network of US dollar-denominated cross-border bank loans

(scaled in proportion to % of total US dollar-denominated loans)

Sources: BIS locational banking statistics (by residence) and ECB/BIS calculations.

Notes: Offsh denotes offshore financial centres, OAdv are other advanced economies. Arrows originating from a node represent loans by banks located in the country/region to the country/region where arrow ends. Edges (arrows) of a size of less than USD 1 billion have been omitted in the calculations. The node size is proportional to the total and shows relative importance (e.g. banks in the United Kingdom are the largest non-euro area providers of euro-denominated loans, followed by those in offshore centres, the United States, Japan, other advanced economies, Switzerland and emerging market economies). Loans between countries in the same region are excluded. Data reported are the average of quarterly observations for 2021.

Euro-denominated cross-border bank loans excluding direct links to the euro area are more geographically concentrated than those denominated in US dollars. Although the US dollar and – to a lesser extent – the euro are used for cross-border lending by countries all over the world, most of the volume of lending in both currencies is concentrated in a small number of countries. The high degree of concentration in the distribution of cross-border bank links can also be visualised using the Lorenz curve (Chart C.2), following Aldasoro and Ehlers (2019).[7] This curve plots the cumulative share of the number of observations (on the x-axis) versus the cumulative share in associated volumes (on the y-axis). The 45-degree lines in the panels represent the benchmark of perfectly equally distributed volumes, which would occur if all bilateral country-level links were of the same size.[8] Chart C.2 indicates an extremely unequal distribution of both euro and US dollar-denominated lending.[9] Comparing across currencies, euro-denominated cross-border bank loans are slightly more concentrated than US dollar-denominated claims for loans to all sectors (Chart C.2, panel a) and somewhat more for claims on non-bank financial intermediaries (Chart C.2, panel b).

Chart C.2

Sources: BIS locational banking statistics (by residence) and authors’ calculations.

Notes: Loans made by non-resident counterparties of the currency area and non-resident banks. For example, euro-denominated loans related to cross-border claims by banks located outside the euro area on non-residents of the euro area. The curves plot the cumulative share of the number of observations (x-axis) versus the cumulative share in associated volumes (y-axis). The 45° lines in the panels represent the benchmark of perfectly equally distributed volumes, which would occur if all bilateral country-level links were of the same size. Based on quarterly average amounts outstanding in 2021.

Euro-denominated international loans (a more restricted definition than cross-border loans) mainly originate from banks based in the United Kingdom, while offshore centres play a central role in the international network of cross-border loans denominated in US dollars. In Chart C.3 the concept of international loans excludes loans where either the source or the destination of the loan is the currency issuer, in this case countries in the euro area. Examining the geographic breakdown of euro-denominated cross-border loans reveals that the United Kingdom is a major, albeit declining destination (Chart C.3, panel a), but steadily growing source (Chart C.3, panel b), of euro-denominated loans. The share of banks in the United Kingdom as originators has continued to increase steadily from around 45% in the fourth quarter of 2015 to over 50% in the fourth quarter of 2022. By contrast, the share of the United Kingdom as a recipient country has declined, from around 23% in the fourth quarter of 2015 to below 12% in the fourth quarter of 2022. This is driven by a decline in the euro borrowing of non-bank financial institutions since Brexit, which may be partly related to these institutions relocating to other countries. While this decline has been a persistent trend, the share of the United States has exhibited a marked increase since 2015 (Chart C.3, panel a). This could indicate that US banks and non-bank groups have responded to the outcome of the Brexit referendum and the consequent withdrawal of the United Kingdom from the EU by moving euro-denominated borrowing away from their offices located in the United Kingdom, with such loans now possibly booked by newly-established US (or euro area) subsidiaries.

Chart C.3

The United Kingdom remains a major source and destination of cross-border euro-denominated bank loans

Sources: BIS locational banking statistics (by residence) and authors’ calculations.

Notes: Excluding loans to and from the euro area. The discontinuity in the share of emerging markets in 2016 visible in panel b is a consequence of the inclusion of Russia and China as BIS reporting countries.

Offshore financial centres play a sizeable role in intermediating US dollar-denominated loans (Chart C.4). The large share of offshore centres (especially the Cayman Islands) for US dollar-denominated bank loans may be partly related to the regulatory and tax optimisation strategies of large multinational corporations and high net worth individuals (McCauley, McGuire and Wooldridge, 2021; Coppola et al., 2021; Bénétrix, Emter and Schmitz, 2022).[10] The share of offshore centres in US dollar-denominated bank loans to non-bank financial institutions is even larger at around 40%. The share of emerging markets also increased markedly following the global financial crisis and European sovereign debt crisis, but has stabilised in recent years.

Chart C.4

Offshore financial centres such as the Cayman Islands play a sizeable role in intermediating US dollar-denominated loans

Sources: BIS locational banking statistics (by residence) and authors’ calculations.

Notes: Excluding loans to and from the United States. The discontinuity in the share of emerging markets in 2016 visible in panel b is a consequence of the inclusion of Russia and China as BIS reporting countries.

Euro or US dollar-denominated cross-border bank lending is positively correlated with trade invoicing denominated in the same currency. Chart C.5 replicates the key empirical chart of Gopinath and Stein (2021), but for the euro (Chart C.5, panel a) as well as the US dollar (Chart C.5, panel b), and expands considerably on the number of countries by combining the BIS locational banking statistics with the trade invoicing data collected by Boz et al. (2022).[11] The chart confirms the positive correlation between the counterparty country’s share of trade invoicing denominated in a currency and the share of cross-border lending denominated in the same currency for both the euro and the US dollar. This points to complementarities between the role of a currency in trade and finance.

Chart C.5

Euro or US dollar-denominated cross-border bank loans are positively correlated with trade invoicing patterns

Sources: BIS locational banking statistics (by residence) and authors’ calculations.

Notes: The data displayed are for counterparty/destination countries in the BIS data. Euro area countries are included but intra-euro area bank loans are excluded. Reported values are for the 2016-2019 average.

3 Empirical analysis

The empirical analysis investigates how the determinants of cross-border bank lending vary across different currencies. The analysis employs cross-sectional regressions using the following specification:

where are cross-border claims (i.e. log stocks) between source country and destination country denominated in currency of issuer in 2019, where and . are country-source fixed effects, are country-destination fixed effects, and are currency-denomination fixed effects.[12] The regressions include up to 28 of the 45 BIS reporting countries and 170 of the 213 counterparty countries. In line with the convention followed in the rest of the report, the results below exclude intra-euro area positions and exclude observations where either the source or the destination of the loan is the currency issuer. The tables presented below only report results for the euro and the US dollar, but the regressions simultaneously include the three other major global currencies mentioned above.

The key explanatory variables are the distance to the currency-issuer country or a variety of measures of linkages to those countries. is the vector of bilateral controls measured in 2019. As the regression includes reporter and counterparty-country fixed effects, for the most part, the key explanatory variables are bilateral indicators measured vis-à-vis the issuer. For instance, in the baseline specification a variable is included that measures how far away both the source and destination countries are from the issuer.[13] This variable can then be interacted with the currency fixed effects to see if distance to the issuer matters more for some currencies than others. There is a large body of research that finds a crucial role for distance in the international trade of goods and services as well as in international investment and lending, which partly reflects informational frictions.[14] To the extent that such frictions affect cross-border trade and financial interactions, they are likely to also have a bearing on the international use of a currency. Subsequent specifications include variables to control for the share of bilateral foreign direct investment (FDI), portfolio investment and trade linkages of the source and destination country with the currency-issuer country. Euro area countries are not included individually, rather the values of the share of trade and financial linkages of these countries are aggregated to give a single observation for the euro area. The trade invoicing data from Boz et al. (2022) are reported at the country level. However, this variable is interacted with the currency fixed effects to empirically test whether there is any variation across currencies in the correlation between the share of trade that a counterparty country invoices in a particular currency and the volume of lending denominated in that currency this country receives.

Examining the results, the more distant the source and destination countries are from the currency issuer, the less they engage in cross-border lending denominated in the currency of the issuer. In the baseline specification, we find that the more distant the source and the destination countries are from each other, the less they lend cross-border, consistent with the results of the broader literature. Importantly, the results also show that the greater the distance to the currency issuer (e.g. the euro area or the United States), the lower the volume of lending in the currency of the issuer. The coefficient estimates imply that a 1% increase in distance to the issuer is associated with around a 1% decrease in cross-border bank claims in the currency of the issuer (Table C.1, Column 1).

Table C.1

The effect of distance is stronger for euro-denominated claims than for US dollar claims

Baseline regression including log distance to issuer – USD and EUR

Sources: BIS locational banking statistics, CEPII and authors’ calculations.

Notes: Cluster-robust standard errors (reporter, counterpart, currency level) in parentheses. *** p<0.01, ** p<0.05, * p<0.1. “All” refers to bank loans to all sectors, “Banks” refers to bank-to-bank loans, “NBFI” refers to bank loans to the non-bank financial intermediary sector and “Non-finance” refers to banks loans to the non-financial sector. FE indicates the inclusion of fixed-effects.

Euro-denominated loans decline with increased distance from the euro area, in contrast to loans denominated in US dollars. When the distance to issuer is interacted with the currency fixed effect, the effect of distance is estimated to be statistically significant and larger for euro-denominated claims than for other international currencies. By contrast, the estimated interaction effect of distance is the opposite in the case of the US dollar.[15] This implies that if both the source and destination countries are far away from the euro area they are likely to lend less bilaterally in euro, whereas this effect is negligible for bilateral lending in US dollars. Across sectors, the coefficient on the interaction between distance to the issuer and the euro is smallest for claims on banks and largest for the non-financial sector.[16] The stronger effect observed for the euro is consistent with previous research, such as Boz et al. (2022), showing that while the euro may be a regionally dominant currency, the US dollar is a global currency, unaffected by geographic proximity.

Stronger trade and financial links to the currency issuer are associated with greater cross-border bank claims denominated in that currency (Table C.2). The estimated effects of trade linkages are somewhat larger than financial linkages. A 1 percentage point increase in the share of trade links with the currency issuer is associated with a 10% increase in cross-border bank claims in that currency (Table C.2, Column 1). This implies, for example, that more trade with the euro area by the source and counterparty countries is associated with a larger volume of bilateral bank lending denominated in euro. Looking across sectors for the euro, the coefficients on linkages to the currency issuer matter for all sectors, but the effect of trade and financial linkages appear stronger for non-financial sectors (Table C.2, Column 8) than for banks and NBFIs (Table C.2, Columns 4 and 6). Comparing currencies, the coefficient on interaction with the euro is positive and statistically significant, while the negative coefficient on the US dollar suggests that the effects of linkages to the United States are either negligible or smaller compared with other international currencies. Overall, these results suggest that trade linkages to the euro area have a stronger effect for the euro, reflecting the relative importance of trade and global value chain participation for the euro area and euro-denominated lending.

Table C.2

Trade and financial linkages to the issuer

Sources: BIS locational banking statistics, CEPII, IMF Coordinated Portfolio Investment Survey, Coordinated Direct Investment Survey, Direction of Trade Statistics and authors’ calculations.

Notes: Cluster-robust standard errors (reporter, counterpart, currency level) in parentheses. *** p<0.01, ** p<0.05, * p<0.1. “All” refers to bank loans to all sectors, “Banks” refers to bank-to-bank loans, “NBFI” refers to bank loans to the non-bank financial intermediary sector and “Non-finance” refers to banks loans to the non-financial sector.

Consistent with Gopinath and Stein (2021), the currency denomination of cross-border bank lending and trade currency invoicing are complementary, but more so for the euro than the US dollar (Table C.3). This is consistent with the descriptive analysis presented above. However, the estimated coefficients for the euro are generally somewhat larger than for the US dollar (e.g. Table C.3, Columns 1 and 2), as a 1 percentage point increase in the share of the euro in a country’s trade invoicing is associated with 3% higher cross-border bank loans denominated in euro, compared with around 2% for the US dollar.[17] This could point to the importance of path dependency and network effects in sustaining the dominant role of the US dollar.[18]

Table C.3

The choice of trade invoicing currency is a complement to both euro and US dollar-denominated loans.

Invoicing currency and currency denomination of loans – USD and EUR

Sources: BIS locational banking statistics, CEPII, IMF Coordinated Portfolio Investment Survey, Coordinated Direct Investment Survey, Direction of Trade Statistics and authors’ calculations.

Notes: Cluster-robust standard errors (reporter, counterpart, currency level) in parentheses. *** p<0.01, ** p<0.05, * p<0.1. “All” refers to bank loans to all sectors, “Banks” refers to bank-to-bank loans, “NBFI” refers to bank loans to the non-bank financial intermediary sector and “Non-finance” refers to bank loans to the non-financial sector.

Moreover, these results vary considerably across bank lending to different sectors, as the coefficients are smaller and less significant for the NBFI sector (Table C.3, Columns 5 and 6). This could indicate that the mechanism outlined in Gopinath and Stein (2021) (i.e. the need to match the currency of imports with the currency of deposits) may not be the key factor at play in explaining the choice of currency denomination in bank to NBFI sector lending. In turn, this suggests that additional mechanisms could be at play for lending to the NBFI sector, such as regulatory arbitrage or tax optimisation.[19]

4 Concluding remarks

Overall, the analysis in this special feature confirms certain aspects of the role of the euro in global finance and uncovers new facts. It confirms that the euro tends to be more of a regional currency, while use of the US dollar in cross-border bank lending is global. Moreover, the results suggest that the effect of distance is much stronger for the euro than the US dollar, reflected in the fact that euro-denominated lending is more geographically concentrated. Indeed, the effect of distance and linkages is often found to be negligible for the US dollar, such that its use transcends distance. Consistent with economic theory, the choice of currency for cross-border bank loans and trade invoicing appears to be complementary. However, additional factors are at play, such as the centrality of offshore financial centres in the international network of cross-border loans in US dollars, which largely reflects lending to NBFIs. Moreover, the United Kingdom remains a hub for euro-denominated bank lending, though there are some signs that Brexit has affected lending to NBFIs. The United Kingdom continues to play an outsized role in euro-denominated bank lending, above and beyond what can be explained by its proximity and continued strong trade and financial linkages to the euro area. This probably also reflects the key role of the City of London in the global financial system, as also suggested by the prominence of the United Kingdom in the global network of US dollar-denominated loans.

These results have implications for policy. To the extent that stronger trade and financial links to the euro area foster international use of the euro, preserving the openness of international trade and the financial markets could be supportive of the global appeal of the euro.