It has been a painful few weeks for global investors, with the S&P 500 giving up substantial ground. The reasons are clear enough, what with trade war rhetoric (and measures) ramping up, recession risk rising and the narrative of US exceptionalism hitting the buffers for the time being.

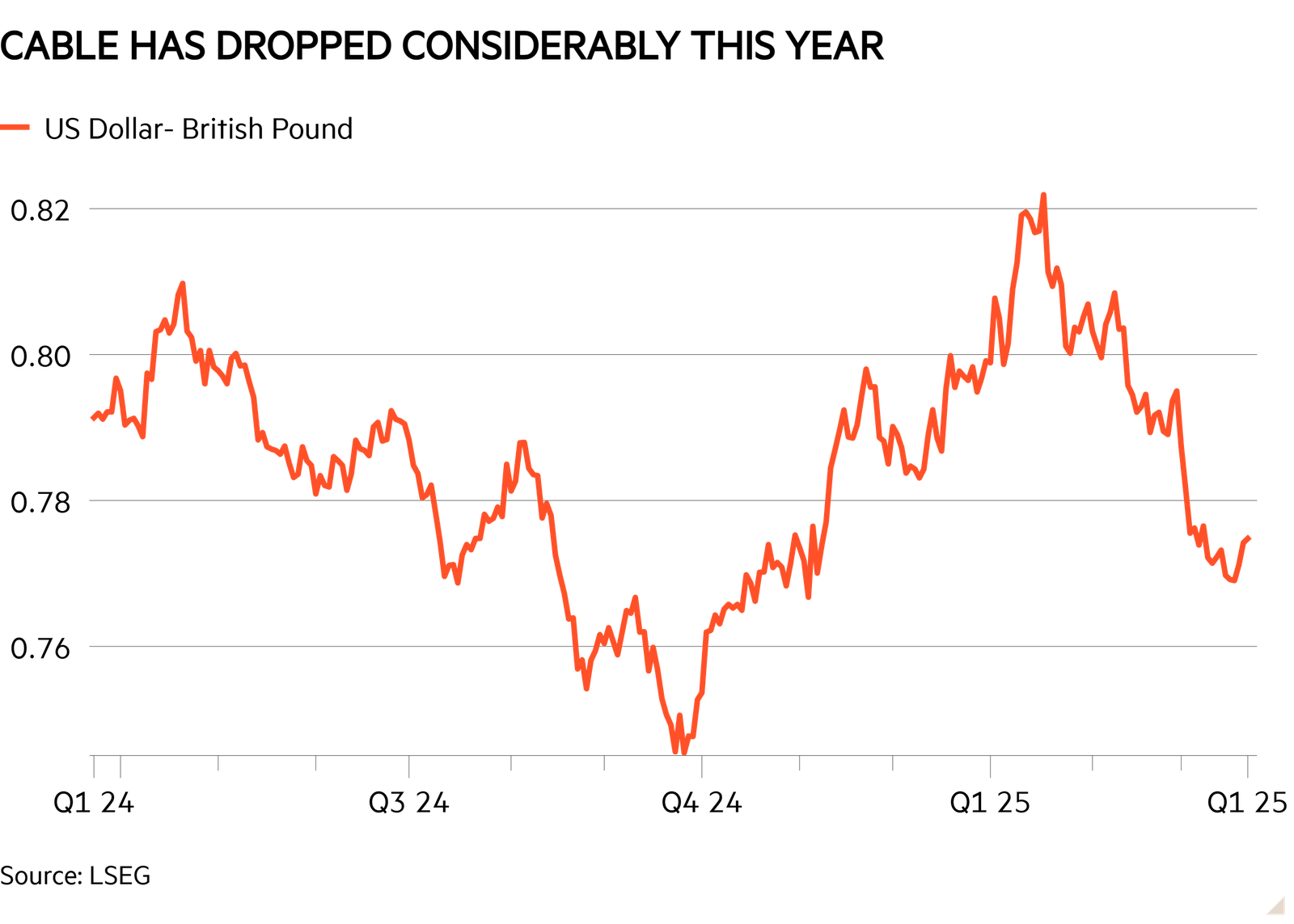

But it’s worth observing that another development has intensified the losses taken by UK investors. The fact that US assets have fallen from favour has led to the US dollar weakening against other major currencies, including the pound.

That means that any returns made in dollars are worth less when translated back into sterling, in effect enhancing underlying US market losses in the process.

A look at the numbers themselves shows the impact has been fairly substantial. The S&P 500 has lost 3.6 per cent for 2025 as of 24 March in dollar terms. For a sterling investor, that loss is amplified to 6.4 per cent. A similar dynamic can be observed for the MSCI World index.

This means that some US and global funds are taking an even bigger hit amid the sell-off.

Turning to the latter, Baillie Gifford Global Discovery (GB0006059330), the open-ended sibling of Edinburgh Worldwide (EWI), is down by 10.3 per cent in sterling terms. FE data suggests more than 2.5 percentage points of that is due to currency shifts alone.

JOHCM Global Select (IE00B3DBRN27), which has a decent US allocation and some big exposure to growth stocks more generally, is down 9 per cent in sterling terms. Screen out currency moves and this would be more like 6 per cent, according to FE.

In a way, this might actually provide some small comfort at a time when certain funds appear to have racked up alarmingly big losses, and it might bolster the case for buying the dip, too: investors could see a pretty chunky recovery if both US shares and the dollar return to favour.

Read more from Investors’ Chronicle

However, such volatility may also strengthen the case for currency hedging, and it’s easy enough to find tracker funds with such attributes. Our Top 50 ETFs list has tended to include a few mainstream trackers that hedge back to sterling, including the iShares Core S&P 500 ETF GBP Hedged (GSPX) for US exposure.

Such funds can be useful as they in effect cancel out any currency effects and would avoid the enhanced losses that have come with a weaker dollar in recent weeks.

But it’s worth remembering that this can cut both ways: a hedged fund would miss out on the gains that come if the dollar regains its poise.

Hedging is also unpredictable, can amount to a form of market timing, and costs you more in fees. GSPX has a 0.1 per cent fee versus 0.07 per cent for the unhedged share class of the same ETF, to give one example.

As such, I tend to view diversification as a much better way to deal with such volatility, even if it is more mundane.

As we’ve recently noted, some European and UK equity funds have been making chunky returns so far this year while US portfolios flounder. Japanese and emerging market shares have also had a decent showing this year.

Holding a bit of everything remains the best way to deal with the ups and downs of markets, even if deciding on the exact mix is no easy task.