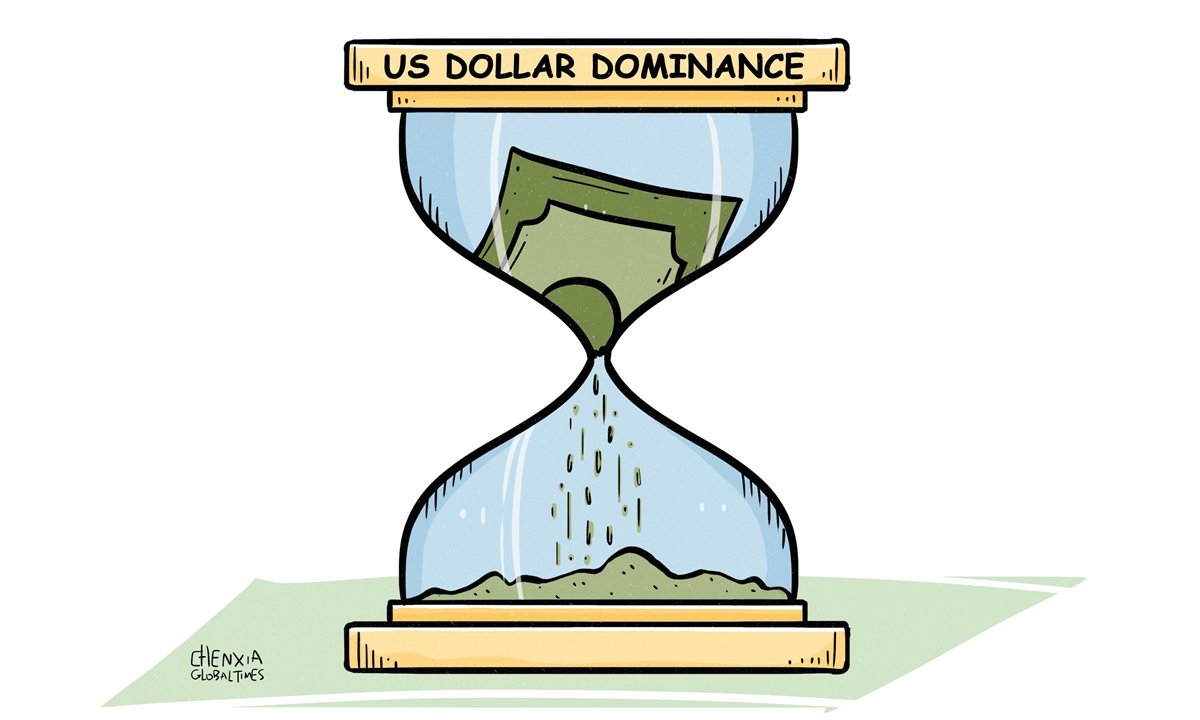

Illustration: Chen Xia/Global Times

The US, by persisting in its reckless tariff policies, is chipping away at the very foundation of the US dollar’s status as the world’s most dominant reserve currency. This erosion is not a sudden collapse but a gradual accumulation of policy missteps that undermine global confidence in the dollar’s reliability, prompting questions about the dollar’s once-impregnable safe-haven status in the global financial system.

On Wednesday, former US Treasury Secretary Lawrence Summers said that the broad approach the US government is taking to the rest of the world “represents the biggest threat to the US dollar’s role as the central currency in the world economy we have had in the last five decades,” according to a Bloomberg report. Summers’ warning came as the US administration rolled out a series of new tariffs this week. Meanwhile, the US Dollar Index has witnessed consecutive declines, falling by more than 3 percent so far this week, catching many investors off guard.

Conventionally, the dollar has been the risk-free bedrock of global finance, leading many investors to bet on a strengthening of the currency after the imposition of new US tariffs. However, its unexpected sluggishness has challenged this conventional wisdom and become a cause for concern within the US. This may in part reflect “the potential loss of the dollar’s safe-haven status,” according to Deutsche Bank AG. George Saravelos, the bank’s global head of FX strategy, said in a note to clients that a declining historical correlation between the dollar and risk assets, and the growing US current account deficit, has typically marked the limits of dollar “overvaluation,” according to the Financial Times. This viewpoint reflects a broader skepticism about the safety of holding assets in a country that frequently wields tariff threats and flouts trade rules, to achieve unilateral gains.

Notably, Deutsche Bank is not the only investment bank suggesting that the dollar could lose its safe-haven currency status. According to Sarah Ying, head of FX strategy at CIBC Capital Markets, the market is thinking about the negative impacts of tariff uncertainty on the US economy, and the traditional safe-haven bid on the dollar is being questioned.

The US, in its pursuit of unilateral economic interests at the expense of its traditional role as a global economic coordinator, may achieve some short-term protection for certain domestic industries. However, in the medium to long term, this approach will surely undermine the outside world’s confidence in the dollar. The dollar’s status as a global currency hinges on the international community’s confidence in its stability and reliability. By weaponizing tariff policies, the US is not only jeopardizing its own economic relationships but also squandering the hard-earned confidence that has underpinned the dollar’s dominance in international trade and finance.

Historical precedents show that the collapse of a currency’s dominance often starts with a wavering of confidence. The potential decline of the US dollar’s hegemony is unlikely to occur abruptly; rather, it will unfold over time as confidence in the dollar diminishes.

For instance, the decline of the British pound as the world’s reserve currency began with market confidence erosion due to the UK’s economic policy missteps. In such a trajectory, developments that erode confidence at certain crucial initial junctures often become important drivers for change. Now the abuse of tariffs by Washington represents one such critical juncture, potentially opening the door to a decline in global confidence in the US dollar.

The US dollar’s dominance remains unchallenged in the short term, but its long-term prospects are now clouded by doubts. This is a critical moment for countries around the world to re-examine and adjust their monetary and financial strategies. While these changes have not yet escalated into a full-scale upheaval, they undeniably signal the emergence of the first cracks in the dollar’s grip on the global financial system. With the continuous evolution and volatility of the global economy, an increasing number of countries are seeking diversified monetary and financial strategies to reduce their over-reliance on the dollar. This is not an isolated phenomenon but part of a broader global trend.