Conventional wisdom holds that a second Trump administration would struggle to make good on either mission. That view is correct when it comes to the greenback’s global reserve status, but more questionable when it comes to a weaker exchange rate.

A diminished global role for the U.S. dollar is not completely implausible. Indeed, several recent developments have made that momentous shift likelier than in previous decades.

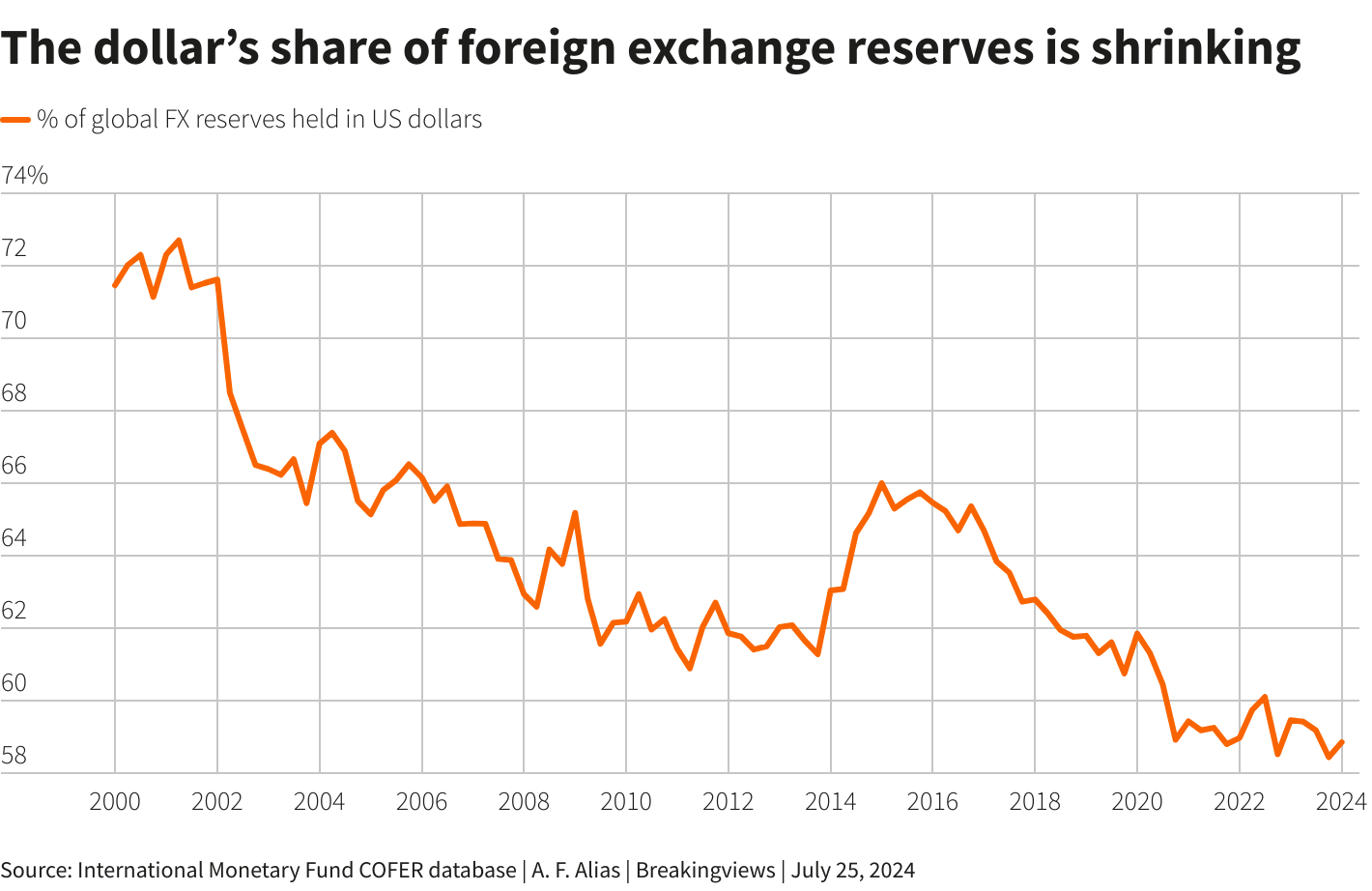

The first is that Uncle Sam has aggressively wielded his currency as a weapon against geopolitical rivals, most prominently freezing Russia’s dollar reserves following the invasion of Ukraine in 2022. That has prompted central banks to diversify their holdings, shrinking the U.S. dollar’s share of global foreign exchange reserves to 59%, from 73% in 2001.

A third reason to take the prospect of global monetary regime change seriously is that the current system is quite new. It was only in 2022 that financial regulators completed the migration of global credit from a model based on unsecured lending and priced off the London Interbank Offered Rate (LIBOR) to one based on secured lending and the new Secured Overnight Financing Rate (SOFR). One consequence is that global finance is now more tightly coupled to the supply of high-quality U.S. dollar collateral. This new regime has yet to be tested in a crisis.

Ultimately, however, King Dollar remains unique in too many important respects. U.S. financial markets are by far the largest and most liquid in the world. An overwhelming proportion of international trade invoices are in dollars. Most importantly, the Federal Reserve is willing and able to backstop global dollar-denominated finance, as it showed most recently when the pandemic roiled markets in 2020. Even Vice President Vance would struggle to shake the dollar’s status as the preferred haven in a financial storm.

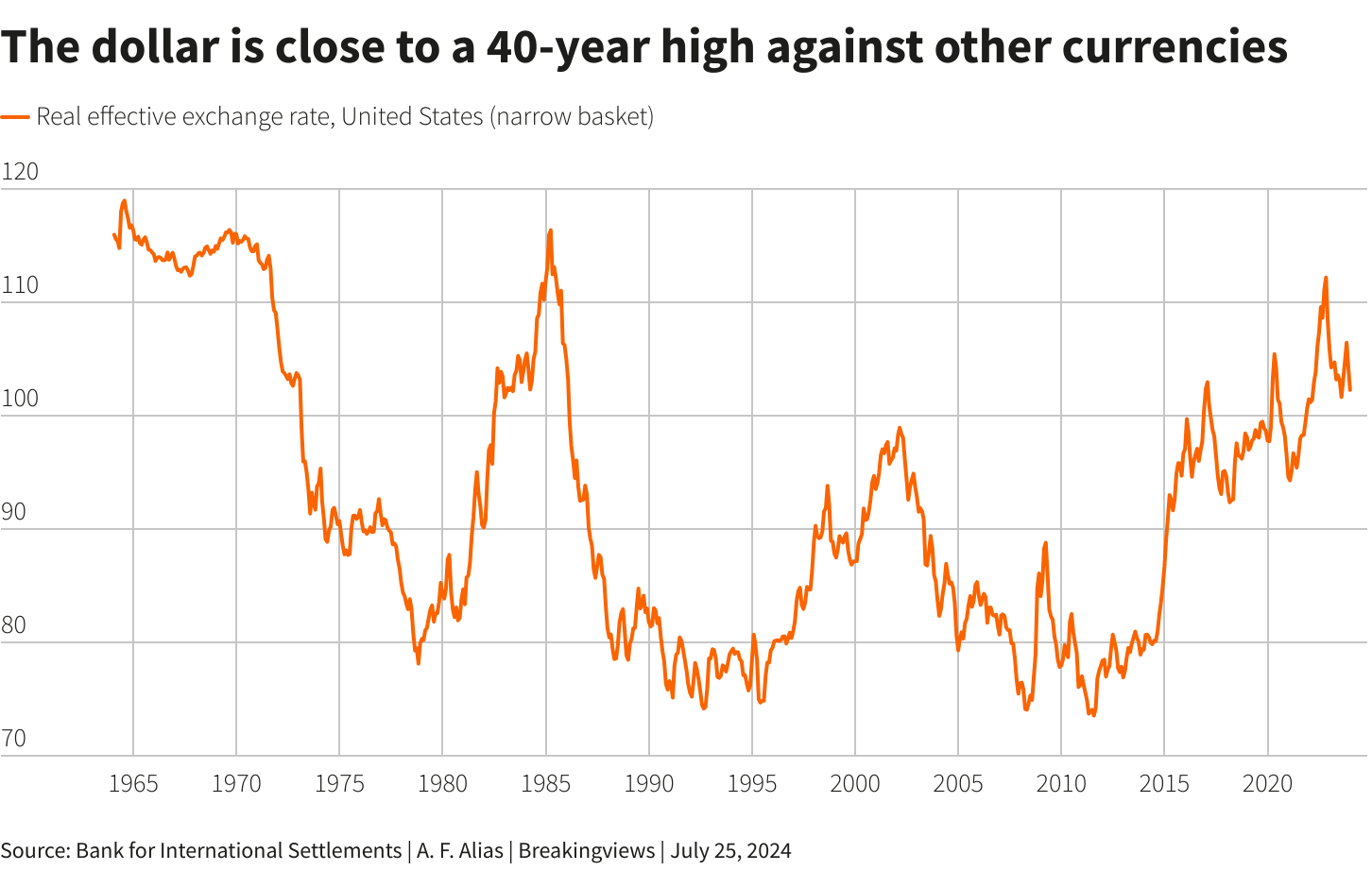

The buck’s value relative to other currencies, however, is a different matter. There is no doubt that the U.S. dollar is indeed historically strong. In real, trade-weighted terms, it has appreciated more than 30% in the last decade and is close to its richest in 40 years, the BIS calculates.

On the face of it, Trump’s mooted policies would do little to reverse this trend. Start with trade. The former reality TV host has talked of imposing a 10% tariff on all imports, rising to 50% or 60% for products from China. If implemented, that would probably strengthen the dollar as higher import prices staunch demand for overseas goods and services and hence for the currency needed to purchase them. It is also likely to stoke inflation, prompting the Fed to keep interest rates high and thus attracting more capital inflows.

Trump’s future fiscal plans could make things even worse. The former president has pledged to renew the tax cuts introduced during his first term and to reduce corporation tax. Such largesse would goose demand, leading to tighter monetary policy still – and thus an even stronger dollar.

Such heterodox measures are risky. Conventional wisdom holds that the benefits of a weaker dollar are historically not broad enough to win sufficient support. While parts of the domestic economy would stand to gain from a cheaper greenback, the financial sector likes sound money. It is also unclear why Asian creditor nations would agree to help their biggest debtor devalue.

Yet much of this history is out of date. Under the new regime of secured finance, for example, the global credit system depends on the U.S. running fiscal deficits to provide an adequate supply of collateral to borrowers. That makes easy money a requirement for robust credit growth and means the interests of Main Street and Wall Street are more aligned. America’s allies in the emerging world, meanwhile, are generally U.S. dollar debtors who would benefit from a weaker greenback. In the shorter term, slowing growth will enable the Fed to lower rates anyway, easing the upward pressure on the U.S. currency.

These new realities mean that efforts to weaken the dollar may soon be pushing at an open door. While the greenback’s role as the global currency is here to stay, the days of dollar strength are numbered – regardless of who wins the presidential election in November.

(The author is a Reuters Breakingviews columnist. The opinions expressed are his own.)

For more insights like these, click here to try Breakingviews for free.

Editing by Peter Thal Larsen and Streisand Neto

Breakingviews

Reuters Breakingviews is the world’s leading source of agenda-setting financial insight. As the Reuters brand for financial commentary, we dissect the big business and economic stories as they break around the world every day. A global team of about 30 correspondents in New York, London, Hong Kong and other major cities provides expert analysis in real time.

Sign up for a free trial of our full service at https://www.breakingviews.com/trial and follow us on Twitter @Breakingviews and at www.breakingviews.com. All opinions expressed are those of the authors.