What’s going on here?

The Indian rupee is set to open slightly higher against the dollar, influenced by a dip in US Treasury yields and steady inflation data. Published by Nimesh Vora from Reuters on July 11, traders expect the rupee to trade at 83.48-83.50 to the dollar, up from 83.52 in the previous session.

What does this mean?

Asian currencies, including the Chinese yuan, have rebounded between 0.1% to 0.4%, with the yuan quoted at 7.2870 to the dollar after weakening past 7.31 last week. This recovery coincides with the dollar index dipping below 105, specifically at 104.90. Eased pressure on Asian currencies came from a drop in US Treasury yields driven by soft ISM PMI data and moderating payrolls. A bank currency trader noted that strengthening Asian currencies, particularly the yuan, reduces the chance of the dollar/rupee hitting a new high. Additionally, inflation data expected to show core prices increasing by 0.2% month-on-month in June aligns with existing Federal Reserve plans, potentially leading to interest rate cuts in September.

Why should I care?

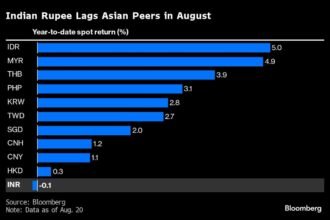

For markets: Turning tides for Asian currencies.

The rupee’s expected rise joins a broader uplift for Asian currencies, thanks to favorable US economic signals. With the dollar index at 104.90 and Brent crude futures up 0.9% to $85.9 per barrel, investors might find reassurances in stabilized commodity prices. Meanwhile, the ten-year US Treasury note yield at 4.29% suggests that bond markets are adapting to the softer economic data.

The bigger picture: Global financial shifts in focus.

Julien Lafargue of Barclays Private Bank remarks that consistent inflation alongside a cooling US economy might prompt the Federal Reserve to cut rates in September. Federal Reserve Chair Jerome Powell confirmed that interest rate decisions will be timely and data-driven, dismissing election-related speculations. As these global financial shifts unfold, investors should watch how these trends play out in broader market strategies.