By Rajiv Shah

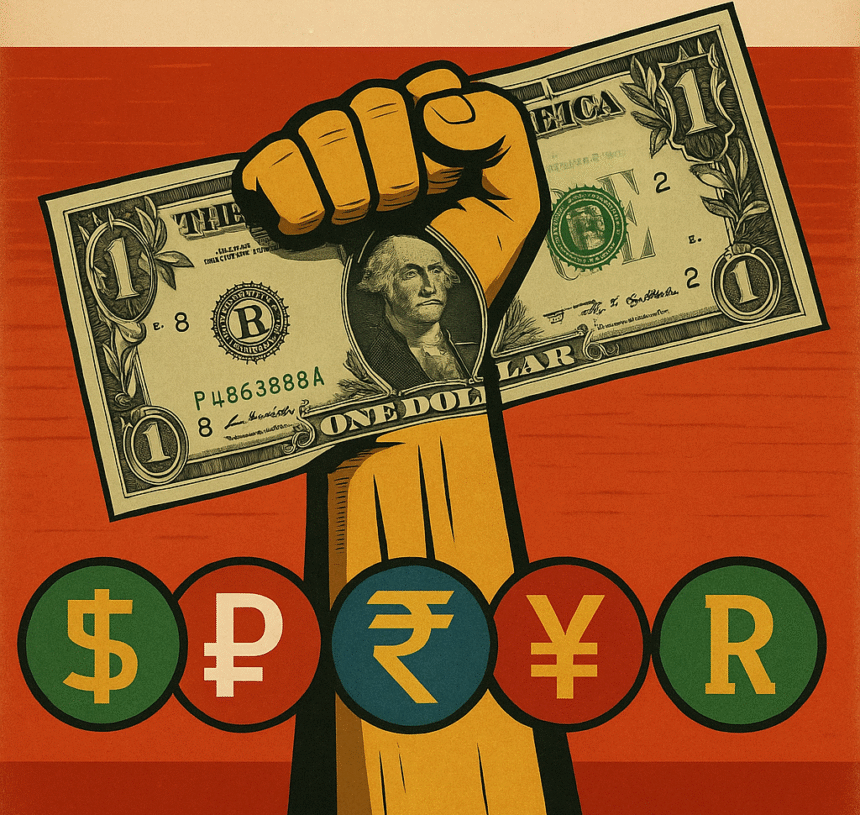

The Dollar’s Grip on the Global Financial Pulse For over seven decades, the United States dollar has reigned not just as a currency, but as a global instrument of financial power and control.

Backed by political influence and military might rather than gold or goods, the USD has embedded itself into nearly every corner of global trade, commodity pricing, and debt settlement.

Through mechanisms like SWIFT, IMF conditionalities, and the dominance of the petrodollar system, the U.S. has created a monetary empire that allows it to finance its deficits by simply printing and issuing more currency—at the expense of developing and emerging economies.

While nations trade in goods and services, the U.S. trades in paper—profiting from seigniorage and exorbitant privilege.

This system, critics argue, siphons real value from the global South, inflates debt burdens through dollar-pegged loans, and leaves countries vulnerable to U.S. sanctions and monetary policy changes they have no control over.

It is a subtle form of modern financial colonization—one that is now being challenged.

Chronology of the U.S. Dollar’s Rise and Manipulation 1944 – Bretton Woods Agreement:

The USD became the world’s reserve currency, pegged to gold, while other currencies were pegged to the dollar.

1971 – Nixon Shock: The U.S. unilaterally ended the dollar’s convertibility to gold, effectively making it a fiat currency and setting the stage for unchecked issuance.

Post-1970s: The U.S. leveraged its dollar supremacy through oil trade (petrodollar), IMF loans, and military dominance to maintain its hold on global markets.

2008 Financial Crisis & After: Quantitative Easing (QE) allowed the Federal Reserve to expand the money supply digitally, causing concerns over real value dilution.

2020–2025: Critics argue that the U.S. increasingly “solves” economic shocks by printing more money, maintaining its internal stability while externalizing inflation and financial risk.

Is the U.S. Printing Its Way Out of Trouble? It is widely alleged that whenever the U.S. economy faces turbulence, the Treasury and Federal Reserve resort to issuing more currency—both physically and digitally.

While this may temporarily resolve domestic concerns, it often exports inflation and causes capital flight from emerging markets, who rely on dollar-denominated reserves and loans.

This artificial liquidity often leads to undervaluing local currencies globally while further strengthening the dollar’s dominance in forex markets.

This pattern, many argue, enables the U.S. to earn billions annually from foreign exchange manipulation, SWIFT transaction tolls, and interest on dollar-denominated sovereign debt—without producing commensurate value.

BRICS and the Global Pushback Against Dollar Dictatorship Emerging economies, especially the BRICS nations (Brazil, Russia, India, China, and South Africa), have started pushing back against this asymmetric system through initiatives like trade in local currencies, the BRICS Pay system, dedollarization of reserves, and models such as the African PAPSS.

Latest Developments (June 2025 Snapshot) – Global Reserve Trends:

The U.S. dollar still holds ~58% of global forex reserves but has declined from over 70% two decades ago.

BRICS Currency Debate:

At the 2025 Rio Summit, members reaffirmed local currency trade but rejected immediate moves toward a single BRICS currency, citing infrastructure gaps.

Shift in Central Bank Strategy:

More than 30 central banks, including those in ASEAN, Gulf, and Latin American countries, are building gold and yuan reserves to reduce dollar reliance.

U.S. Reaction:

In response to growing dedollarization, Washington has warned of trade penalties and sanctions.

Financial Market Impact:

The dollar has weakened by ~8% since Q4 2024, as confidence in a multi-polar monetary order slowly builds.

The Road Ahead Despite the dollar’s deeply embedded position in global finance, cracks have begun to show.

As geopolitical tensions rise and countries explore multi-currency systems, the idea of a “dollar monopoly” is being actively questioned.

BRICS nations have taken the lead, but success will require sustained cooperation, infrastructural realignment, and trust-building.

The next decade may not immediately dethrone the dollar—but it is likely to diversify the power centers of global finance, offering emerging economies a longawaited chance at fiscal sovereignty.

(Author is a scion of legal acumen from India. Views are personal.)