Electricity prices for household consumers

Highest electricity prices in Germany and Ireland

For household consumers in the EU (defined for the purpose of this article as medium-sized consumers with an annual consumption between 2 500 Kilowatt hours (KWh) and 5 000 KWh), electricity prices in the second half of 2023 were highest in Germany (€0.4020 per KWh), Ireland (€0.3794 per KWh), Belgium (€0.3778 per KWh) and Denmark (€0.3554 per KWh) – see Figure 1. The lowest prices were observed in Hungary (€0.1132 per KWh), Bulgaria (€0.1192 per KWh) and Malta (€0.1279 per KWh). For German household consumers, the per KWh cost was 41 % above the EU average price, whereas households in Hungary, Bulgaria and Malta paid less than half the price than the EU average.

The EU average price in the second half of 2023 — a weighted average using the most recent (2022) consumption data for electricity by household consumers — was €0.2847 per KWh.

(€ per KWh)

Source: Eurostat (nrg_pc_204)

Figure 2 depicts the development of electricity prices for household consumers in the EU since the first half of 2008. The price without taxes, i.e., the energy, supply and network, developed very closely to the overall inflation rate (HICP) until the first half of 2021 when it was €0.1341 per KWh, being relatively stable between 2016 and 2020. After a sharp increase during both semesters of 2022, the price excluding taxes had a small decrease in the first half of 2023, and a further decrease in the second half of 2023, figuring at €0.2227 per KWh. In the second half of 2023, the electricity price including taxes for the households was €0.2847 per KWh, was decreased, compared with the first half of the same year, when the price had reached the highest recorded price.

The percentage of taxes in the total price increased by almost 10 percentage points (pp) from 31.2 % in the first half of 2008 to 41.0 % in the second half of 2019. After this point, it substantially decreased until the second half of 2022 (15.5 %), but showed a moderate increase in the first semester 2023 (18.5%) and in the second semester 2023 (21.8%). These figures reflect the impact of the governmental measures to alleviate EU household electricity costs in 2022 and the gradual reduction of those measures in both semesters of 2023.

For the prices adjusted for inflation, the total price for household consumers, i.e., including all taxes, was €0.2265 per KWh in the second half of 2023 compared with €0.1604 per KWh in the first half of 2008. This price is lower than the actual price including taxes (€0.2847 per KWh), showing that the increase in electricity prices is higher than the overall inflation rate.

V.png)

(€ per KWh)

Source: Eurostat (nrg_pc_204)

Weight of taxes and levies differs greatly between EU countries

Figure 3 shows the proportion of taxes and levies in the overall electricity retail price for household consumers. In the EU, the share of taxes in the second half of 2023 was the least in Luxembourg, where the values were in fact negative (-49.2 %). Negative taxes, reflecting the subsidies and allowances, were also observed in Ireland, Austria, the Netherlands, Latvia, Portugal and Lithuania. The relative share of taxes was highest in Denmark, making up 48.1 % of the total price. The average share of total taxes and levies at EU level in the second half of 2023 was 21.8 %, an increase of 6.3 percentage points (pp) when compared with the second half of 2022, and an increase of 2.6 percentage points (pp) when compared with the first half 2023, mostly driven by reduction of subsidies and allowances. The VAT in the EU represented 13.7 % of the total price. It ranged from 4.8 % in Malta to 21.3 % in Hungary.

(%)

Source: Eurostat (nrg_pc_204)

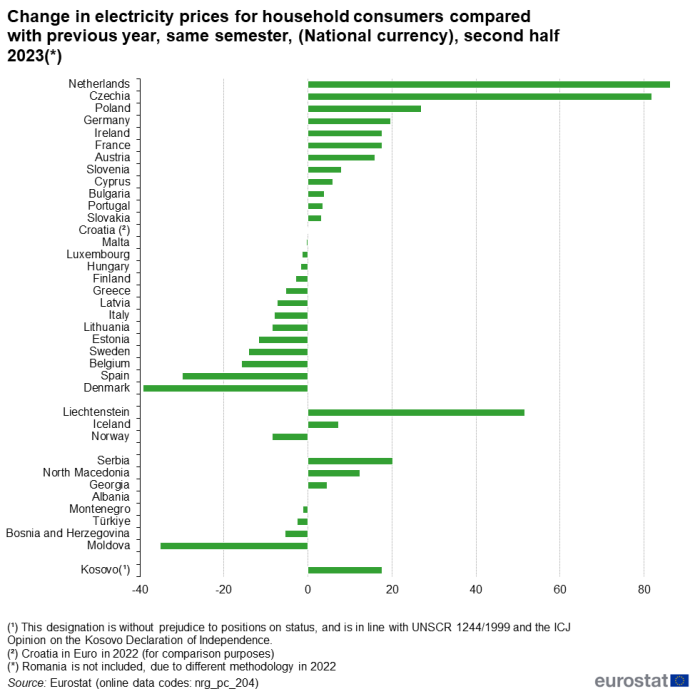

Largest increase in electricity prices in the Netherlands, Czechia and Poland

Figure 4 shows the percentage change in electricity prices for household consumers including all taxes and VAT between the second half of 2023 and the second half of 2022. For comparison purposes the national currencies were used. For energy prices, comparing year on year instead of semester on semester is most meaningful to avoid seasonal effects. However, these seasonal effects are less prominent in the recent semesters. Year on year, the total prices increased in 13 of the EU countries, while they decreased in another 13 EU countries (Romania data were not compared, due to different methodology in 2022). The largest increase was observed in the Netherlands (86.3 %), followed by Czechia (81.9 %) and Poland (26.93 %). Energy and supply costs, as well as the reduction of subsidies and allowances drove the increase. Denmark (-39.3 %), Spain (-29.9 %) and Belgium (-15.8 %) were the three EU countries to record the largest decreases.

(%)

Source: Eurostat (nrg_pc_204)

Electricity prices in purchasing power standard

In Map 1, electricity prices for household consumers in the second half of 2023 are shown in purchasing power standard (PPS), grouping the available countries in six categories, with electricity price categories ranging from above 35 PPS per 100 KWh to below 15 PPS per 100 KWh. The final burden for the consumer depends on their own consumption. Electricity prices based on PPS were highest in Czechia (38.7) and Cyprus (37.9). The lowest electricity prices based on the purchasing power standard were observed in Malta (14.3) and Luxembourg (15.4).

(PPS per 100 KWh)

Source: Eurostat (nrg_pc_204)

Share of transmission and distribution costs for household electricity consumers

Figure 5 presents the share of transmission and distribution costs for household electricity consumers. Transmission and distribution costs are only reported once a year, at the end of the second semester. Distribution costs account for the largest share by far, when compared with the transmission costs. This is normal for all types of networks including the electricity system.

Transmission network is used for transmitting bulk amounts of energy over long distances. The distribution network is usually the part of the system where the consumers are connected. The distribution network is denser than the transmission network, therefore, its share in the costs is expected to be higher.

Countries with lower population density require a more extensive transmission network to meet their needs. Its costs are higher when compared with the countries with higher population density. Smaller, densely populated countries use mostly their own distribution network.

In 2023, Luxembourg (100.0 %), Slovakia (95.5 %) and France (91.4 %) had the highest shares of distribution costs. On the other hand, Hungary (40.5 %), Ireland (36 %) and Estonia (33 %) had the highest shares of transmission costs in 2023.

Electricity prices for non-household consumers

Electricity prices highest in Cyprus and Hungary

Non-household consumers are defined for the purpose of this article as medium-sized consumers with an annual consumption between 500 MWh (Mega Watt hours) and 2 000 MWh. As depicted in Figure 6, electricity prices in the second half of 2023 were highest in Cyprus (€0.2759 per KWh) and Hungary (€0.2695 per KWh). The lowest prices were observed in Finland (€0.0885 per KWh) and Sweden (€0.0901 per KWh). The EU average price in the second half of 2023 was €0.2008 per KWh. The aggregates are weighted averages taking into consideration the average consumption in each band.

(€ per KWh)

Source: Eurostat (nrg_pc_205)

Figure 7 shows the development of electricity prices for non-household consumers in the EU since the first half of 2008. The price without taxes, i.e., the energy, supply and network, increased similarly to the overall inflation until 2012, when it peaked at €0.0943 per KWh in the first half. Afterwards it was on the decrease until 2017, followed by consecutive increases, with exception of the second semester of 2019, up to the highest price recorded in the second semester 2022. In the first semester 2023, the price without taxes decreased and it further decreased in the second semester of 2023, reaching €0.1771 per KWh.

The proportion of the taxes increased by 21.0 pp, from 13.8 % in the first half of 2008 to 34.8 % in the first half of 2020, and decreased afterwards. In the second half 2023, the share of taxes was 11.8 %, showing an increase, after the lowest point of 5.6 % observed in the second half of 2022, and 10 % in the first semester 2023, reflecting the reduction of measures taken to alleviate electricity costs.

Looking at the non-household total price, i.e., including the non-recoverable taxes, for the second half of 2023, it more than doubled (107.4 %) compared with the 2008 first half year price, from €0.0968 per KWh to €0.2008 per KWh.

For the prices adjusted for inflation, the total price for non-household consumers, i.e. including taxes, was €0.1367 per KWh in the second half of 2023 compared with €0.0968 per KWh in the first half of 2008.

The total price for non-household consumers, without taxes, was €0.1771 per KWh in the second half of 2023 compared with €0.0834 per KWh in the first half of 2008.

(€ per KWh)

Source: Eurostat (nrg_pc_205)

Proportion of non-recoverable taxes and levies in electricity prices

Figure 8 presents the proportion of non-recoverable taxes and levies on the overall electricity price for non-household consumers. In the second half of 2023, the share of taxes was highest in Poland and Cyprus, where non-recoverable taxes and levies made up 34.9 % and 28.0 % of the total price respectively. The share of taxes for the EU in the second half of 2013 stood at 11.8 %, showing an increase when compared with the second half 2022 (5.6 %), being also in a higher level, compared with the first half of 2023 (10.0 %).

(%)

Source: Eurostat (nrg_pc_205)

Development of electricity prices for non-household consumers

Figure 9 shows the change in electricity prices for non-household consumers including all non-recoverable taxes and levies from the second half of 2022 to the second half of 2023. For comparison purposes the national currencies were used. Increases were reported in nine EU countries. The largest increases were recorded in France (68.4 %) and Luxembourg (54.9 %), followed by Austria (38.4 %). Decreases were reported in 17 countries with the highest decreases in Lithuania (-50.9 %) and Denmark (-48.5 %), (Romania data were not compared, due to different methodology in 2022).

(%)

Source: Eurostat (nrg_pc_205)

Data sources

Defining household consumers

Throughout this article, references to household consumers relate to the medium standard household consumption band with an annual electricity consumption between 2 500 KWh and 5 000 KWh. All figures are consumer retail prices and include taxes, levies and VAT. The full datasets for electricity prices for households consumers are available at:

and

Defining non-household consumers

Throughout this article, references to non-household consumers relate to the medium standard non-household consumption band with an annual consumption of electricity between 500 MWh and 2 000 MWh. In this article, prices correspond to the price of electricity production, its supply, the network costs and includes all non-recoverable taxes and levies. The full datasets for electricity prices for non-households consumers are available at:

and

Methodology

Prices in national currencies are converted into euro using the average exchange rate of the period for which the prices were reported.

Prices are always compared with the prices of the same semesters (i.e. year on year) in order to avoid seasonal effects.

In 2016, Regulation (EU) 2016/1952 entered into force. It defines the obligation for the collection and dissemination of electricity prices for household and non-household consumers. Until 2016, the domain of non-household consumers was defined as industrial consumers, but reporting authorities were allowed to include other non-household consumers. Regulation (EU) 2016/1952 changed the definition from industrial to non-household consumers to have a unique methodology for all reporting countries. Until January 2017, the reporting authorities provided their price data for the household sector on a voluntary basis.

Electricity tariffs or price schemes vary from one supplier to another. They may result from negotiated contracts, especially for large non-household consumers. For smaller consumers, they are generally set according to a number of characteristics including the amount of electricity consumed. Most tariffs also include some form of fixed charge. There is, therefore, no single price for electricity. In order to compare prices over time and between EU countries, this article shows information for consumption bands for household consumers and for non-household consumers. Electricity prices for household consumers are divided into five annual consumption bands and, for non-household consumers, into seven different consumption bands.

The prices collected cover average prices over a period of six months (a half-year or semester) from January to June (first semester) and from July to December (second semester) of each year. Prices include the basic price of electricity, transmission and distribution charges, meter rental, and other services. Electricity prices for household consumers presented in this article include taxes, levies, non-tax levies, fees and value added tax (VAT) as this generally reflects the total price paid by household consumers. As non-household consumers are usually able to recover VAT and some other taxes, prices for non-household consumers are shown without VAT and other recoverable taxes/levies/fees. The unit for electricity prices is that of euro per kilowatt-hour (€ per KWh).

Allowances in the reference period 2023 Semester 1

Belgium:

Electricity and gas prices for household customers (2023 S2)

With regard to household consumption of electricity and gas, the Belgium government has decided to keep the lower TVA rate of 6%.

In order to compensate for this, form April 1 2023 there was a huge rise of the excise duties on gas and electricity.

For example:

– Main excise duty on Electricity consumption households:

– Consumption category (0-3 Mwh-Year):

– Before April 1 2023: 13,60 €/Mwh

– April 1 June 30: 42,58 €/Mwh

– Since July 1 2023: 47,48 €/Mwh

– Main excise duty on Gas consumption households:

– Consumption category (0-12 Mwh-Year):

– Before April 1 2023: 0,54 €/Mwh

– April 1 – June 30: 5,06 €/Mwh

– Since July 1 2023: 8,23 €/Mwh

According to convention, excise duties have to be categorized as environmental taxes.

Therefore in the Belgian case in 2023 there was a very significant rise in environmental taxes.

Since 2007, a rather small part of the Belgian households (±10% before and after the ‘energy crisis’; temporarily enhanced to ±15% during the ‘energy crisis’) is eligible to “social energy (electricity and gas) tariffs”.

The policy goal is to protect the most vulnerable households. Eligibility is based on strictly defined social classifications’.

These social tariffs are included in the calculation of in the Belgian semestrial price statistics.

Bulgaria:

In the 2nd semester of 2023, the Bulgarian government continues to apply the program to compensate the final non-household customers only for the months October – November. The program envisages a temporary mechanism to support non-household customers through electricity suppliers in the form of a monthly compensation, calculated for each individual customer. The compensations are deducted from the total final price after VAT has been charged on each monthly invoice.

The certain specifics in the compensation of non-households customers for the months October – November 2023 are the same as the previous semester:

1. The compensation is calculated in the amount of 100 percent of the difference between the real average monthly exchange price of the “day-ahead” segment of “Bulgarian Independent Energy Exchange”EAD, for the relevant month, and the base price of BGN 200/MWh for the period from September 1, 2023 to December 31, 2023.

2. For customers with prices below the base price of BGN 200/MWh, the compensation is not applied.

3. To customers with a price exceeding the base price by an amount smaller than the amount of the compensation calculated according to p.1, compensation is paid in a reduced amount, so that the resulting price for the customer after compensation is not lower than 200.

The way of reporting of these compensations for the semester is fully in accordance with the latest instructions of Eurostat as follows: they are deducted in the 2nd level Electricity prices, excluding VAT and other recoverable taxes and are also recalculated so that the difference between 3rd level prices and 2nd level prices is only 20% VAT.

Czechia:

Electricity:

Price ceilings: since 01.01.2023 – to 31.12.2023

From January 1, households will pay a maximum of 5,000 crowns per megawatt-hour excluding VAT for so-called power electricity. This applies to households, self-employed people and small businesses with a price higher than the price ceiling. They will be capped at 100 percent of their annual consumption. At the low voltage level, prices will be fully capped even for consumption by small, medium and large enterprises.

For high and very high voltage for small and medium-sized businesses, in this case the capped prices will apply to 80 percent of the highest monthly consumption over the past five years. Large businesses will be entitled to a 100% cap on consumption if they are among the public service providers. Others will have a price cap at 80 percent of their consumption.

Fee for supported energy sources (POZE) – was waived for all end-consumers from October 2022 to December 2023.

Natural gas:

Price ceilings: since 01.01.2023 – to 31.12.2023

From January 1, 2023, the price for gas supply will be set at CZK 2,500/MWh without VAT.

The fixed monthly salary for the supply of gas is set at 130 CZK without VAT/point of supply per month for small consumers. If it is not gas supply for small consumers, the price for gas supply applies to 80% of the highest monthly value of gas consumption at the point of consumption, if the customer is a small, medium or large business, with the exception of gas supply for electricity production. The price for energy will be capped at 80% of the highest monthly consumption over the past 5 years. Large businesses will be entitled to a 100% cap on consumption if they are among the public service providers.

All price compensation were ended by 31.12.2023.

Denmark:

The only compensation initiative in first half 2023 is an almost suspended electricity tax. Normally this tax will be about 0.,90 DKK per kWh, but in first Semester 2023 it was only 0,008 DKK per kWh (EU minimum). In second Semester 2022 there already was a reduction, meaning that households only pay about 0,75 DKK per kwh. The reductions mentioned above are basically only for the households – and not active in second Semester 2023.

For 2022 there was a compensation for mainly private gas users, paid out as lump sum, which reflected in the 2022-submissions. There are no known plans for similar schemes as regards 2023

Germany:

An electricity levy was eliminated in 2022. No further measures were reported for 2023.

Estonia:

The implementation of the measures developed by the state to mitigate the increase in energy prices has ended. No measures were implemented in the second half of 2023.

Ireland:

Electricity: Ireland Household Prices: Due to the increases in energy prices from 2022, Ireland has introduced measures to alleviate the burden on final consumers. Domestic electricity customers, including pay as you go customers, have so far received €950 worth of credits on their electricity cost, spread over their bills as follows:

April/May 2022: €200, November/December 2022: €200, January/February 2023: €200, March/April 2023: €200, December 2023: €150.

Customers will also receive 2 credits of €150 between January and March 2024.

A further measure to tackle rising energy costs has been introduced in the way of a cut in VAT on gas and electricity bills from 13.5 % to 9% from 1 May 2022. This VAT reduction has now been extended to October 2024.

Ireland Non-Household Prices: The Temporary Business Energy Support Scheme (TBESS) was introduced in the second half of 2022 to support non-domestic customers with increases in their electricity or natural gas (energy) costs. The scheme was administered by Ireland Revenue and provided a cash payment to qualifying non-domestic customers. As it was not administered by electricity suppliers, TBESS rebates are not accounted for in the prices. The time limit for making a claim for the Temporary Business Energy Support Scheme (TBESS) expired on 30 September 2023.

Gas: Ireland Household Prices: To tackle rising energy costs, VAT on gas and electricity bills has been cut from 13.5 % to 9% from 1 May 2022. This VAT reduction has now been extended to October 2024.

Ireland Non-Household Prices: The Temporary Business Energy Support Scheme (TBESS)[1] was introduced in the second half of 2022 to support non-domestic customers with increases in their electricity or natural gas (energy) costs. The scheme was administered by Ireland Revenue and provided a cash payment to qualifying non-domestic customers. As it was not administered by electricity suppliers, TBESS rebates are not accounted for in the prices. The time limit for making a claim for the Temporary Business Energy Support Scheme (TBESS) expired on 30 September 2023.

Greece:

In the case of electricity, the consumers, household and non household, received compensations as an amount of €/MWh in their electricity bills, different for each month and according to monthly consumption.

For household consumers: In January the compensation was €330 for consumption 0-500kWh, €280* for 501-1000kWh, €190* for >1001kWh. In February and March €40** for 0-500kWh consumption and in April, May and June €15*** for 0-500 kWh consumption. For July to December the amount ranged from €10-€25 for 0-500kWh consumption and no compensation for large consumptions. For S2 2023, compensation was only for specific business categories, such as bakeries and agriculture €10-€15.

*There was an extra allowance of 50 €/MWh in case the consumption was decreased by 15% compared to the corresponding period of the previous year.

** There was an extra allowance of 40 €/MWh in case the consumption was decreased by 15% compared to the corresponding period of the previous year.

*** There was an extra allowance of 15 €/MWh in case the consumption was decreased by 15% compared to the corresponding period of the previous year.

For non-household consumers the compensation (€/MWh, except <35 kVA) was €134 for January and €20 for February, while there was no compensation for the months March-June.

Moreover, for the first semester of 2022, there was an extra financial allowance for the household customers only which was paid directly to them and did not appear on their electricity bills. Not all household consumers were eligible, as certain conditions had to be met. In any case, this allowance could not exceed €600 per beneficiary. This measure is no longer in force. Furthermore, regarding non-households, the subsidies were provided only for January and February, beyond this period no further measure was applied.

In the case of the consumption of natural gas, there were no support measures during the reference period.

During 2022 the following measures were put in force:

In the first semester of 2022, all consumers (households and non-households) were entitled of a subsidy for the consumption of natural gas. The use of natural gas for electricity production was exempted from the subsidy. The level of the subsidy was different for the two categories of consumers and for each month. During the second semester of 2022 only non-households, with the exemption of electricity production, were entitled of a subsidy for the period July-October 2022. The level of the subsidy differed during this period.

For gas, these measures are no longer in force.

Spain:

The Government of Spain has maintained the measures adopted during 2021 and reinforced them during 2022. The idea is to continue cushioning the impact of electricity prices on final consumers. These measures have focused on the “taxes, fees and charges” component, such as applying reduced rates to both VAT and the Special Electricity Tax, as well applying a new reduction in electricity charges applicable during 2023, comparing them with those of the previous year.

France:

There are slight changes on measures taken the previous year: Since February 2023, the evolution of prices of gas and electricity including taxes is capped at 15% for individual with regulated prices. In 2023, French state mitigates the electricity bill for small and medium-sized companies which do not benefit from regulated tariffs with subsidies up to two millions euros. These subsidies are limited in volume and price.

Croatia:

Gas:

VAT remains at 5%

Decision on subsidizing part of the end price of gas supply for households, and non-households with an annual gas consumption of up to 10 GWh:

-Support for households, the amount of support: 0,0199 EUR/kWh

-Support for non-households, annual gas consumption of up to 10 GWh, the amount of support: 0,0199 EUR/kWh

In March 2023, the Government of the Republic of Croatia has adopted new Regulation on eliminating disturbances on the domestic energy market” which extended the application of special and temporary measures for gas trade, for the period from April 1, 2023 to March 31, 2024. Regulation prescribes the price cap on gas producers price, at which gas producer sells gas to the gas trader for the needs of distribution system operators for the purpose of settling losses for gas distribution, for the purpose of settling gas losses in the transmission system and for operational consumption of technological facilities of the transmission system, for the needs of households who use/or will use the supply under public service obligations and for certain customers from the non-household category.

Electricity:

In March 2023, the Government of the Republic of Croatia has adopted new Regulation on eliminating disturbances on the domestic energy market” which extended the application of special and temporary measures for electricity trade, for the period from April 1, 2023 to March 31, 2024. Regulation prescribes the price cap on electricity producers price, regulated prices for households and non-households, mitigating the rise in electricity prices, limitation of the increase in fees for electricity. Additionally, social benefits for citizens at risk of energy poverty, support for pensioners with low pensions.

Italy:

The Italian Government has implemented extraordinary and temporary measures to contain the exceptional increases in energy prices with the allocation of resources from the State Budget.

More precisely, the Government has adopted various measures starting from the second half of 2021, which were then continued and, in some cases, strengthened during 2022 and 2023.

It was therefore possible to reduce or to set to zero the price components aimed to cover the general system charges in the electricity sector (ASOS and ARIM tariffs) until March 2023 and in the natural gas sector (RE, GS e UG3 tariffs) for household users and non-household users until December.

Furthermore, starting from the year 2023, the nuclear charges (due to the financing of the decommissioning of nuclear power plants and the financing of territorial compensation measures) hitherto covered with part of the ARIM tariff are no longer collected by electricity suppliers as financed by the state budget. For 2023, the financing has been established at 400 million euros, a value that will be updated annually as needed.

Gas: The Government temporarily reduced the VAT rate applicable to the supply of gas for civil and industrial uses to 5%, in the invoices issued for consumption of the fourth quarter of 2021. This reduction was then further extended to cover consumption until December 2023 (see details in the table 1).

Starting from January 2024, the VAT rate applied to gas consumption has come back under usual conditions:

10% for annual consumption up to 480 m3, and 22% over this threshold for household users;

10% for non-household users.

Starting from the third quarter of 2022 to the second quarter of 2023, the Government has also taken a significant measure in favor of customers with consumption of up to 5,000 m3/year consisting of a large discount (about 30 eurocent per cubic meter), which actually has produced a reduction in the total price. On a formal level, since this discount was applied through a negative component classified among general system charges, it made the total of the charges themselves no longer equal to zero, but negative, for the aforementioned customers (up to 5,000 m3/year).

Finally, the Government adopted some measures which, while not having a direct impact on energy prices, help consumers to alleviate the higher cost of energy products. These measures consist in expanding the number of beneficiaries of energy bonuses and in increasing the value of these bonuses for household consumers in poor economic conditions and in granting a tax credit to non-domestic consumers for the purchase of electricity and natural gas.

Cyprus:

Non-Household Customers

1. Due to Covid-19, prices included a temporary reduction of 10% for the period March – September 2023 – CERA Decision 104/2020.

2. A discount of 65% was imposed on the Regulated Tariffs for the usage of Transmission and Distribution Systems for a total period of 4 months, November-December 2021 and January-February 2022-CERA Decision 294/2021.

3. A percentage subsidy was imposed by the Ministry of Finance on specific categories of consumers based on scaled consumption as from September 2022 to June 2023.

Household Customers:

1. Due to Covid-19, prices included a temporary reduction of 10% for the period March – September 2023 – CERA Decision 104/2020.

2. A discount of 65% was imposed on the Regulated Tariffs for the usage of Transmission and Distribution Systems for a total period of 4 months, November-December 2021 and January-February 2022-CERA Decision 294/2021.

3. According to Council of Ministers’ Decision, VAT was reduced: (a) from January to June 2022 for Domestic Use Customers (tariffs 01, 02 & 56) from 19% to 9% and (b) from January to October 2022 for Domestic Use Special Tariff for Specific Categories of Vulnerable Customers (tariff 08) from 19% to 5%.

4. A percentage subsidy was imposed by the Ministry of Finance on specific categories of consumers based on scaled consumption as from September 2022 to June 2023.

Latvia:

For all consumers, a 100 % discount on distribution tariffs was applied from January 2022 to April 2022. From November 2021, the Electricity Market Law stipulates that protected users (needy or low-income persons, families with many children or families with children with disabilities, as well as persons with group I disabilities) have the right to receive additional support for protected users for electricity payments. The support takes the form of partial compensation of the amount of the monthly electricity bill from the state budget.

Luxembourg:

From 1 May to 31 December 2022, the Government has decided to bear the costs for the distribution network as well as the fixed monthly fee for residential customers.

Cost compensations offer by government are applicable, from 1st January 2023 to 31 December 2024 on electricity, to all final consumers who have a consumption below 25 000 kWh.

Hungary:

Electricity: In Hungary, all of the household consumers are supplied by universal service providers applying regulated tariffs. From the 1st of August 2022 the universal service prices changed, to reflect the higher electricity prices on the market. For consumption above 2 523 kWh/year/consumption point, a higher, but still regulated price needs to be paid for the electricity. This pricing is set quarterly to reflect the changes in the market price.

Natural gas: In Hungary, all of the of household consumers are supplied by universal service providers applying regulated tariffs. From the 1st of August 2022 the universal service prices changed, to reflect the higher natural gas prices on the market. For consumption above 63 645 MJ/year/consumption point, a higher, but still regulated price needs to be paid for the natural gas. This pricing is set quarterly to reflect the changes in the market price.

Malta:

There are no subsidies or allowances directly to the consumer but a financial aid to Enemalta plc (electricity distributor) every month to be able to keep prices stable.

Netherlands:

In 2022 the government provided a refund (allowance) to all electricity consumers. In addition, the VAT percentage went from 21 % to 9 %, only for 2022S2.

Tax relief measures from 2022 are not continued in 2023. The tax refund dropped almost 30%, while the energy taxes on electricity doubled for households. The government has set a price cap on household prices for 2023. These have not yet been implemented in the reported prices. The average prices are therefore higher than the price cap, and a lot higher than the prices would be if implemented.

For 2023 Semester 1 the following (changes in) support measures are taken into account:

(a) VAT rate is back to 21%, from 9% in 2022S2, (b) Energy tax rates are back to levels from 2021, where 2022 saw a big drop in these rates for electricity – for gas the incline in rates is steady in all these years, (c) the annual allowance (refund) is still in place, as it has been for years. The amount however is lower than in 2022 and more in range of the 2021 amount, (d) The lump sum of €1.300 paid to low incomes (<120% of social minimum income) is also implemented in 2023, (e) the additional allowance of €190 is ceased. This was only for 2 months in 2022.

Austria:

Natural Gas: The natural gas levy has been reduced from 1 May 2022 to 31 December 2023 from 0,066 €/ m3 to 0,01196 €/ m3.

Electricity: 1. The electricity levy has been reduced from 1 May 2022 to 31 December 2023 from 0,015 €/kWh to 0,001 €/kWh.

2. For certain load profiles (H, G or L) the energy price up to 2,900 kWh per year has been limited with 10 Cent/kWh. That applies from 1 December 2022 to 30 June 2024. Households with four or more people get additional money which has been paid out in three tranches.

a. Tranche 1: 1 December 2022 to 30 June 2023 – €61.25 per additional person

b. Tranche 2: 1 July 2023 to 31 December 2023 – €52.50 per additional person

c. Tranche 3: 1 January 2024 to 30 June 2024 – €52.50 per additional person

3. Households get a voucher of 150 € for energy cost compensation. This voucher has been paid out with the yearly bill. The vouchers have been taken into account from the first half-year of 2022 to the end of 2023.

4. The network tariffs have been reduced for households with low income from 1 January 2023 to 30 June 2024. The network tariffs for those households are reduced up to 75%.

5. Several provinces have additional financial support for their inhabitants.

a) Lower Austria (October 2022 – September 2023): Fixed amount depending on the household size: One person household € 169,58, Two-person household € 272,36, Three-person household € 374,44, Four-person household € 415,80, Five-person household € 457,07, For each additional person € 41,27

b) Vorarlberg: In 2022 each household got 33,33 € and households with low income got 120 €. From 1 April 2023 to 30 June 2024 the energy price has been reduced by 3 Cent/kWh

c) Salzburg: price cap for hot water boiler (load profiles ULA and ULB) up to 1,000 kWh per year with 10 Cent/kWh.

Poland:

Measures for Gas: For certain groups of eligible customers, the maximum price for gaseous fuel shall apply. This applies mainly households and the majority of public utilities (education, health care, social assistance and many others).

The net fuel price (level 1 without energy`s supply) for such customers is a maximum of 55,602(7) PLN/GJ. The maximum price of gas fuel for the indicated groups is to be valid until June 31, 2024.

Portugal:

1. Fornecimento supletivo (Regulation No. 951/2021, of november 2)

Application of supplementary supply, in the gas and electricity sectors, similarly to what happened in the previous semester, whose immediate effect is felt in reported prices as customers are now billed by the CUR (last resort seller).

2. Reduction in electricity network access tariffs for 2023: significantly alleviates impact of high wholesale price rises in end-user electricity bills (household and non-households) via considerable reductions in the network access tariffs applied to all voltage levels.

3. The reduction of the VAT rate for electricity customers in BTN, with contracted power less than or equal to 3.45 kVA.

4. Application of the intermediate rate of VAT (13%) to electricity consumption (does not include fixed component, fees and taxes) of all contracts with a power not exceeding 6.9 kVA, for monthly periods of 30 days, with the following limits: does not exceed 100 kWh per 30-day period or, when purchased for consumption by large families, 150 kWh per 30-day period.

5. Social tariffs, applied to economically vulnerable electricity customers.

6. Iberian mechanism for limiting electricity prices, applied since June 15, 2022, an ended in December 2023. The Iberian Mechanism makes it possible to set a reference price for natural gas consumed for the production of electricity, based on which a significantly lower value in the Iberian Electricity Market (MIBEL).

7. Possibility of returning to the regulated tariff in the gas Market (Since September 7, 2022). Applies to consumers in the domestic sector and small businesses with annual consumption of less than 10 000 m3.

8. A discount on the price of natural gas for customers with annual consumption exceeding 10 000 m3, only applies to the energy component (Decree-Law no. 84-D/2022, of December 9). The discount covers 80% of each consumer’s reference period consumption under this support. Furthermore, regardless of whether that 80% level is reached or not, the discount ends as soon as the amount of 1 000 000 000 euros is exhausted.

Romania:

The average prices presented in the EUROSTAT format are those from the supply contracts, as they were reported by the suppliers active on the electricity and natural gas retail market in the first semester of 2023.

Compared to the contractual values presented, in the reporting period, according to the provisions of the Government Emergency Ordinance no. 27/2022 regarding the measures applicable to final clients in the electricity and natural gas market during 1 April 2022-31 March 2023, as well as for the modification and completion of some normative acts in the field of energy (GEO 27/2022), with subsequent amendments and additions, the prices billed to electricity and natural gas household and non-household final clients have been capped, resulting in values that for certain categories are significantly lower than contractual values. The following table shows the capped values of the prices billed to electricity household clients, according to GEO no. 27/2022. Since the cap is applied on monthly consumption bands, the conversion to annual consumption bands is indicative. The final capped billed prices include network tariffs, taxes and VAT (EGO no. 27/2022). For annual consumption between 0 – 1200 kWh the capped billed price (lei/kWh) is 0.68, for 1200 – 3060 kWh 0.8, for 3060 – 3600 0.8-1.3 and >3600 1.3.

For electricity non-household clients, EGO no. 27/2022 provides for two capped values of the final price, 1 leu/kWh and 1.3 lei/kWh, which do not depend on the monthly or annual consumption but on the type of activity.

For natural gas clients the capped prices are a maximum of 0.31 lei/kWh, for household clients, respectively a maximum of 0.37 lei/kWh for non-household clients and thermal energy producers (in cogeneration plants and in thermal plants for the consumption intended for the consumers as direct clients of natural gas producers – PET), the only constraint to qualify for capping is for the category of non-household final clients whose annual consumption of natural gas in the previous year at the place of consumption is of no more than 50,000 MWh.

Slovenia:

In order to mitigate the consequences of rising energy prices for final consumers in Slovenia certain measures in the field of electricity and natural gas were taken. The measures that were in place during the year 2023 are listed below. 1. Temporarily omitting or reducing certain contributions: One of the first measures that is in place from February 2022 is the amended Regulation on determining the amount of excise duty for electricity reduced the excise duty for final consumers of electricity for 50 %: – with an annual consumption of 0 to 10,000 MWh from EUR 3.05 per MWh to EUR 1.525 per MWh, – with an annual consumption above 10,000 MWh from EUR 1.800 per MWh to EUR 0.900 per MWh. At the same time amended Regulation on determining the amount of excise duty on energy products reduced the excise duty for final consumers of natural gas used for heating for 50 % (from 0.0184 EUR per Sm3 to 0.0092 EUR per Sm3 ). All excise duties are reported under “environmental taxes” in Eurostat’s tables (annual data). From September 2022 the VAT on electricity and natural gas prices (including all contributions, with an exception of administrative costs for issuing the invoice) was reduced from 22% to 9.5%. The measure was in force until 31 May 2023. From June 2023 VAT on electricity and natural gas prices is again put at 22%. CO2 contribution (environmental contribution for burdening the environment with carbon dioxide emissions) for natural gas was omitted from 1 September 2022 onwards (contribution equalled 0). The measure was in force until 8 May 2023. Regulation on the method of determining and calculating contributions for providing support for the production of electricity in cogeneration with high efficiency and from renewable energy sources was amended, which resulted in reduced contribution of RES+CHP for electricity consumers (by 50%) for household and small business from September 2022 onwards. RES+CHP contribution is reported under “environmental taxes” in Eurostat’s tables for electricity prices.

2. Specific aid to the industry and commercial sector: In December 2022 the Act on Aid to the Economical Sector to Mitigate the Consequences of the Energy Crisis was adopted. With this Act, the governmentsubsidizesthe payment of high energy prices to beneficiaries in the period between January 1 and December 31, 2023. Commercial companies, independent entrepreneurs, economic interest associations and cooperatives, private institutes and associations, as well as chambers and trade unions are eligible for assistance – for all of them, it is a condition that they perform economic activity. Beneficiaries do not include small business customers, as they already have a regulated price for electricity and gas, as well as subjects from finance and insurance. Beneficiaries are able to apply for assistance in the amount of between 40 and 80 percent of the eligible costs, namely above 1.5 times the increase in the prices of electricity, natural gas and steam in 2023 – and the price comparison will be calculated based on the average price in 2021, except in the case of taking into account the principle of proportionality, when the year 2019 will be taken into account. The law sets the maximum allowed average prices for 2021 for electricity and natural gas for simple assistance. If the beneficiary has a lower average price, he can claim the latter. When calculating simple aid, the actual amount of energy used in 2023 will be taken into account, while special aid will take into account 70% of the amount of energy used in 2021. In total, the maximum allowable aid for the same costs and period is from EUR 2 million and all up to EUR 150 million per beneficiary. With the aim of helping the most affected companies with the measure, the maximum possible upper price per unit of energy product in 2023, which the beneficiary can claim is limited. This is EUR 510 per MWh for electricity and EUR 160 per MWh for natural gas. At the same time, the lowest price per unit of energy was determined in 2023, namely EUR 150 per MWh for electricity and EUR 79 per MWh for natural gas. The beneficiary will be able to claim only one type of aid among the five types of aid: – In the case of simple aid, the beneficiaries will receive 50% of the eligible costs reimbursed, or up to EUR 2 million in total aid. Aid in agriculture will be lower, namely up to EUR 250,000 and in fisheries up to EUR 300,000; – basic special aid may comprise 50% of eligible costs and up to a maximum of EUR 4 million of total aid; – special aid for reduced economic performance of 40% of eligible costs and up to EUR 100 million; – special aid for energy-intensive companies 65% of eligible costs and up to EUR 50 million; – special aid in special sectors 80% of eligible costs and up to EUR 150 million. The law sets additional conditions for each category of aid, and at the request of the European Commission, the aid received under the temporary framework of all subordinate and parent companies is totaled for all aid for the economy. In addition to that: with a government regulation, from 1 September 2022 the highest permitted tariff items of the price of electricity for small business customers with a connection power equal to or less than 43 kW, who are not household customers, excluding VAT, was set to: Higher tariff: 0.13800 EUR/kWh Lower tariff: 0.09900 EUR/kWh Uniform tariff: 0.12400EUR /kWh.

Small business customers can have several measuring points. In order to be entitled to regulated prices according to the regulation, the total power of all metering points must not exceed 86 kW. The regulation also applied to natural gas prices. The highest permitted tariff rate for natural gas in the amount of EUR 0.079/kWh (excluding VAT) applied to: – basic social services, kindergartens, primary schools, medical centres and small business clients, – replacement and basic electricity distribution for basic social services, kindergartens, primary schools, medical centres and small business clients. – heat distributors for district heating, supplying heat to kindergartens, primary schools and basic social services.

3. Specific aid to households: With a government regulation, from 1 September 2022 the maximum permitted tariff items for the price of electricity for household customers and for the supply of electricity in common areas of multi apartment buildings and mixed multi-apartment-commercial buildings, without VAT, amounts to: Higher tariff (VT): 0.11800 EUR/kWh Lower tariff (NT): 0.08200 EUR/kWh Uniform tariff (ET): 0.09800 EUR/kWh In the same way, from September 2022 onwards the highest permitted tariff rate for natural gas in the amount of EUR 0.073/kWh (excluding VAT) applies to household customers and joint household customers, replacement and basic natural gas distribution for household customers and joint household customers, and distributors for district heating that supply heat to household customers.

Slovakia:

Maximum households prices were fixed for the whole year.

Non-households consumers are divided into vulnerable customers with regulated prices and unregulated customers with market prices. The category of vulnerable customers with a regulated price consists of entities that meet conditions set by legislation.

From February to November 2023, economic entities could apply for a subsidy to cover additional costs due to the increase in energy prices – electricity and gas. The authorized recipient of the subsidy had to fulfil the conditions specified in the call. The months from January to September 2023 are the authorized period for which the mentioned entities could send an application.

Finland:

The Finnish government has taken several measures about energy cost compensations. The time period affected is from 1.11.2022-30.4.2023. No more measures are planned beyond this period. Thus, the effect on electricity prices limit on periods S2/2022 and S1/2023. S2/2022 is final. S1/2023 includes the VAT reduction and retroactive electricity bill compensation (1 and 2), but not the compensation reducing taxation (3) or compensation paid as electricity cost support (4). These data is only available after taxation for 2023 is final.

(1) Value added tax of the electricity was reduced from 24 % to 10 % from 1.12.2022 until 30.4.2023.

(2) Retroactive electricity bill compensation if the VAT-inclusive electricity price in household’s electricity contract exceeded 10 cents per kilowatt-hour or if the electricity contract was based on spot prices (so-called market price) in November and December 2022 and/or January 2023. The compensation for electricity costs was 50% of the VAT-inclusive price of the electricity bill. The compensation was not granted to the distribution rate or electricity tax. The compensation couldn’t exceed €700 per month. The amount of the compensation was calculated based on the part of your electricity bill that exceeded the threshold of €90/month. The compensation was paid in two instalments. The amount of the instalments was calculated in two different ways: The amount of the first instalment was calculated based on your electricity bills for November and December. The amount of the second instalment was calculated based on your electricity bill for January 2023 and is multiplied by two.

Additional measures took effect from 1.1.2023 until 30.4.2023.

(3) The compensation of the big electricity bills are part of the existing system of tax credit for household expenses. Electricity bill exceeding €2 000 until €6 000 during 1.1.-30.4.2022 will be compensated by 60% and reduces the amount of tax the customer has to pay.

(4) If no taxable income the compensation is made in the form of the electricity cost support. The 60 % compensation will be paid by the Social Insurance Institution of Finland if the electricity bill will exceed 400 €/month but not 1 500 €/month during 1.1.-30.4.2022.

Natural gas prices are not compensated by any means.

Sweden:

Following the compensation provided during 2021 and 2022, there have not been support measures in 2023 for gas or electricity regarding households. For the non-household consumers it is still work in progress.

Iceland:

Iceland is an independent producer of heat and electricity for housing. Heating is generally of geothermal origin. All electricity in the country is produced in hydro-powerplants in the country and thus does not rely on gas/nuclear/coal/fuels etc. Iceland’s electricity net is not connected to Europe. The associated prices are thus not surging in Iceland as in many other countries. The government has not issued any measures to compensate prices for heating or for electricity nor is there any pressure to do so.

Norway:

The government of Norway introduced a temporary support scheme from December 2021 onwards where all households receive an amount of support per KWh electricity used. This amount varies from month to month depending on the average electricity spot price. This support is paid to household consumers by lowering their electricity bill, in all months where the wholesale electricity price is above a certain threshold. This support is paid to household consumers by lowering their electricity bill. The temporary electricity support scheme for households is expected to last at least until the end of 2024.

Context

The price and reliability of energy supplies, electricity in particular, are key elements in a country’s energy supply strategy. Electricity prices are of particular importance for international competitiveness, as electricity usually represents a significant proportion of total energy costs for industrial and service-providing businesses. Contrary to the price of fossil fuels, which are usually traded on global markets with relatively uniform prices, electricity prices vary widely among EU Member States. The price of primary fuels and, more recently, the cost of carbon dioxide (CO2) emission certificates influence, to some degree, the price of electricity.

Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, Energy Emergency – preparing, purchasing and protecting the EU together, COM2022(553) final, coordinates solidarity efforts, secures the energy supply, stabilises price levels and support households and companies facing high energy prices.

Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, REPowerEU: Joint European Action for more affordable, secure and sustainable energy, COM2022(108) final, Commission to propose measures to coordinate solidarity efforts, secure the energy supply, stabilise price levels and support households and companies facing high energy prices.

In 2019, the European Commission presented the Clean energy for all Europeans package. The Commission completed a comprehensive update of its energy policy framework to facilitate the transition away from fossil fuels towards cleaner energy and to deliver on the EU’s Paris Agreement commitments for reducing greenhouse gas emissions.

The Fit for 55 legislative proposals cover a wide range of policy areas including climate, energy, transport and taxation, setting out the ways in which the Commission will reach its updated 2030 target in real terms.

Regulation (EU) No 2016/1952 tackles data weaknesses led to the recommendation to improve the detail, transparency and consistency of energy price data collection. An energy prices and costs report would be prepared every 2 years. The European Commission thus published such a report also in 2016 and 2018.

The Seventh report on the state of the energy union was published on 18 October 2022. The 2022 report is the third report since the adoption of the European Green Deal and the first after the adoption of the REPowerEU plan. It highlights the challenges that the energy sector has faced in the past 12 months and the progress made in addressing both shorter-term issues and Europe’s long-term climate goals. In particular, the report takes stock of the EU’s energy policy response to the current energy crisis, exacerbated by Russia’s war in Ukraine.

Increased transparency for gas and electricity prices should help promote fair competition, by encouraging consumers to choose between different energy sources (oil, coal, natural gas and renewable energy sources) and different suppliers. Energy price transparency is more effective when publishing and broadcasting as widely as possible prices and pricing systems.