LONDON, June 5 (Reuters) – A sharp drop in Mexico’s currency after a landslide election result has shaken foreign exchange markets as far as Hungary and Turkey this week, leaving investors asking whether the unwinding of hugely popular “carry trades” will continue.

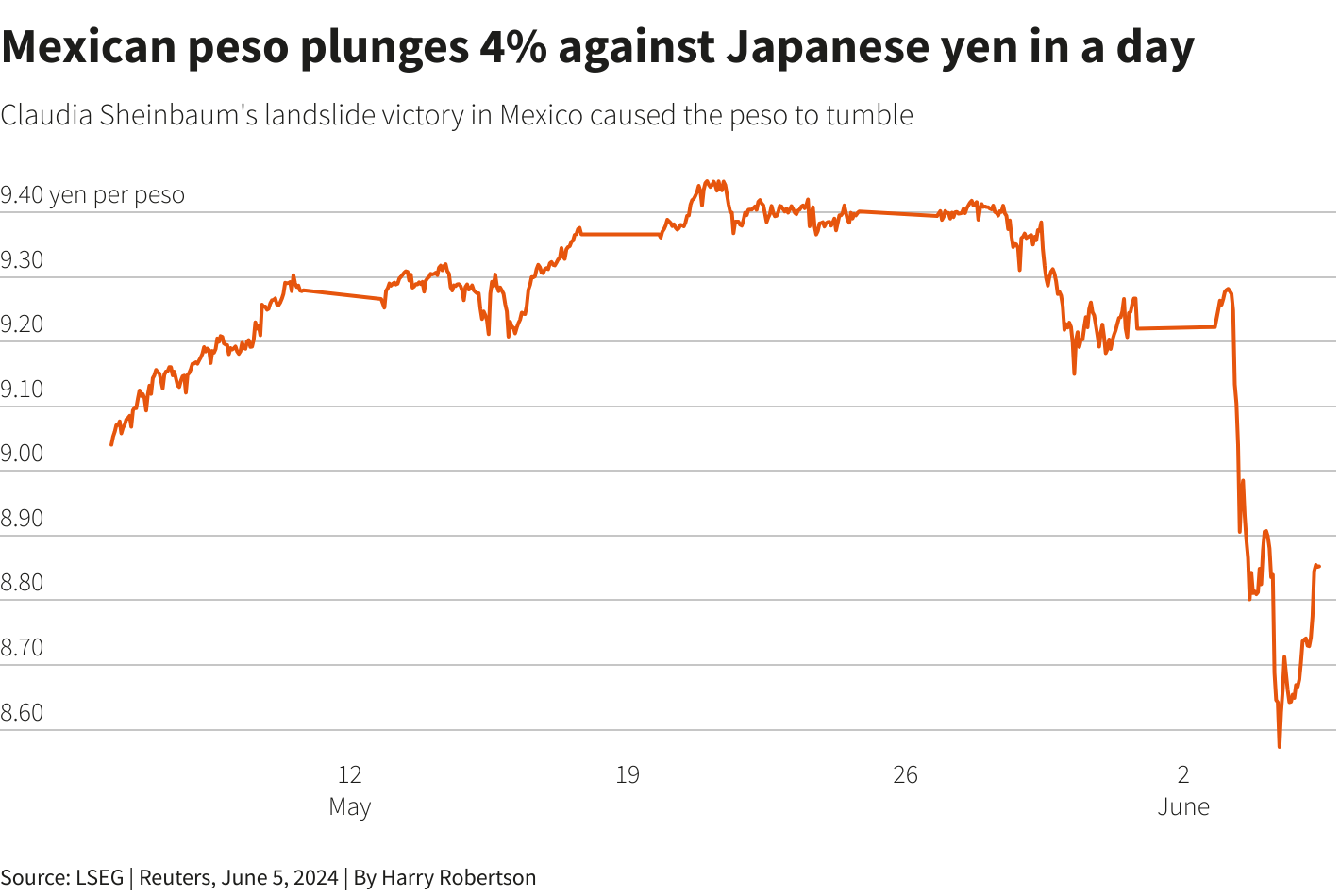

Yet the peso’s dramatic fall against the yen this week – it dropped 4.4% on Monday in its biggest daily decline since the COVID-19 crisis – is a sign that investors have been rapidly backing out of some of their favourite, and most lucrative, trades.

“The generalised rise in emerging market FX volatility … has prompted de-leveraging in carry around the world,” said Chris Turner, head of global markets at lender ING. “Where do we go from here?”

ELECTION SHOCKS

The twin drops caused wild swings across emerging markets, knocking other favoured currencies such as Hungary’s forint and the Turkish lira . Low-yielding “funding currencies” like the yen and peso rallied, while the euro and dollar bounced around in the ripples.

“My sense is participants have in large part liquidated these trades and moved to flat,” said Neil Jones, a senior FX sales executive at TJM Europe. “The market is likely still holding core long term carry trades, but certainly far reduced from 48 hours prior.”

Yet some spy an opportunity. “With the peso-yen cross having fallen 6.3% in two days, we ask if the shakeout has largely played out and if this is a time to re-engage,” said Chris Weston, head of research at Pepperstone. “That trade feels aggressive, but let’s see how Japanese traders play the yen moves today.”

MOVING PARTS

Investors will have to gauge a whole host of factors when deciding whether to return to carry trade strategies. ING’s Turner said markets will be keeping a close eye on Sheinbaum’s policies and the path of the U.S. dollar, the main driver of global currencies.

“In Mexico, it seems local authorities are already trying to calm investors over possible fiscal concerns,” he said. “And internationally, we think the scope for slightly lower U.S. rates and a softer dollar can support the risk environment, lower volatility and limit a further sell-off in the carry trade.”

Sign up here.

Reporting by Harry Robertson; Editing by Amanda Cooper and Christina Fincher

Our Standards: The Thomson Reuters Trust Principles.