Scott Davis and Pon Sagnanert

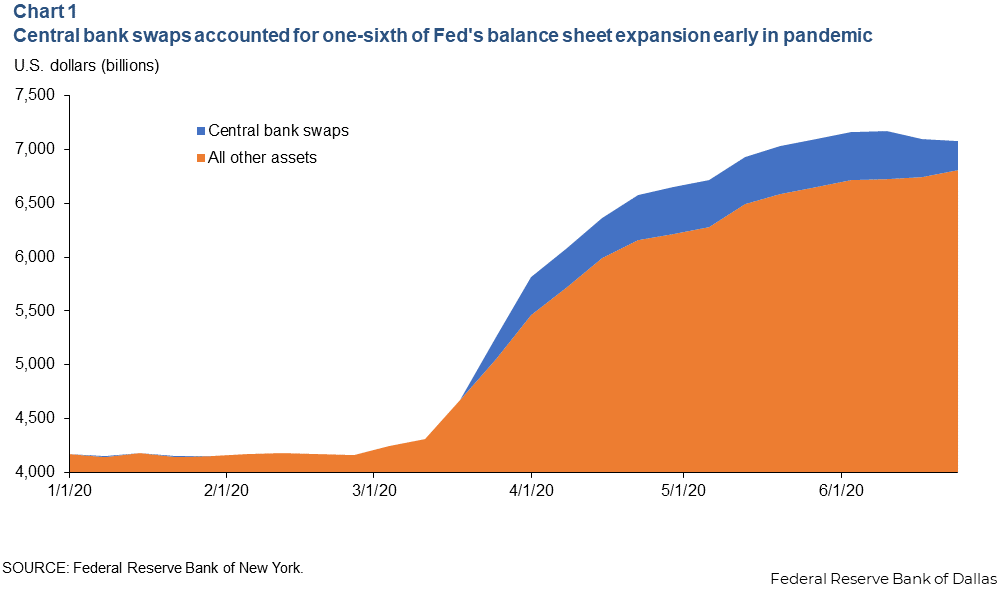

The Federal Reserve’s balance sheet expanded by $3 trillion—to $7 trillion—during the first three months of the COVID-19 crisis, as the Fed dramatically increased the size and scope of its lending programs to aid the economy.

About $450 billion of this expansion—roughly one-sixth of balance sheet growth during the first three months of the crisis—was in the form of dollar liquidity swaps with foreign central banks (Chart 1). Such swaps are short-term instruments used to ensure an emergency supply of dollars to foreign central banks during periods of financial stress.

These dollar liquidity facilities (Fed swap lines) helped stabilize the supply and demand imbalances in overseas dollar funding markets, New York Fed economists Linda Goldberg and Fabiola Ravazzolo argue in a recent article. Additionally, the Fed swaps reduced the cost of offshore dollar borrowing, also known as the foreign exchange swap basis spread.

We argue that these same imbalances in the offshore dollar funding market also led to safe-haven appreciation of the dollar during the COVID-19 crisis and that central bank swap lines reversed this dollar appreciation.

Arbitrage constraints led to dollar shortages during COVID-19 crisis

In a previous article, we discussed how dollar liquidity shortages outside the U.S. can arise during a crisis due to arbitrage limits. These dollar shortages have led to the phenomenon of deviations from covered interest parity (the equilibrium relationship involving interest rates and spot and forward exchange rates between two countries).

Deviations from covered interest parity can be measured with the foreign exchange swap basis spread. A borrower with access to the onshore U.S. market could borrow dollars at a rate close to the U.S. Overnight Index Swap (OIS) rate. The OIS is the market expectation of the average value of the federal funds rate over a given period.

Alternatively, one could borrow dollars through “synthetic” dollar borrowing in the offshore markets. That is, borrowing funds in a foreign currency and then exchanging the sum into U.S. dollars using a swap contract. Mechanically, an investor converts the foreign currency into dollars in the spot market and at the same time enters into a forward contract to convert them back to the foreign currency at a future date at a predetermined exchange rate.

The interest rate on this synthetic dollar borrowing is the foreign OIS rate plus the forward premium—the difference between the forward and spot exchange rates. The forward rate is known when the contract is entered into, so there is no uncertainty. And if counterparty risk is negligible—that is, the credit worthiness of the counterparty on the other side of the swap—borrowing dollars onshore or synthetically should be risk-free transactions.

The foreign exchange swap basis spread is the difference between the cost of this synthetic dollar borrowing and onshore dollar borrowing. A positive spread indicates a higher price of dollar borrowing in the offshore markets and reflects an imbalance between supply and demand.

Increased demand for dollar liquidity in offshore markets would push up the interest rate on synthetic borrowing, leading to a positive swap basis spread. Large global banks and other lenders would recognize the arbitrage opportunity, borrow dollars from the onshore market in the U.S. and lend them in the offshore market. These actions would drive the foreign exchange swap basis spread to zero and relieve any dollar shortage in the offshore market.

This was the case before the 2008 Global Financial Crisis. However, the economics literature points to new regulations introduced since the 2008 crisis that have limited banks’ ability to pursue this arbitrage, resulting in dollar shortages abroad that worsen during a crisis when the demand for dollar liquidity is high. The result is a positive and widening swap basis spread during a crisis.

These limits to arbitrage can lead to the safe-haven appreciation of the dollar in a crisis. When overseas borrowers face a dollar shortage and an increased cost of synthetic dollar borrowing, they may be forced to raise the dollars quickly by selling their domestic currency assets, often in volatile market conditions, and converting the proceeds to dollars in the spot market.

This sudden demand for dollars pushes up their relative price in the foreign exchange market, leading to dollar appreciation.

Sudden overseas dollar shortage emerges in COVID-19 crisis

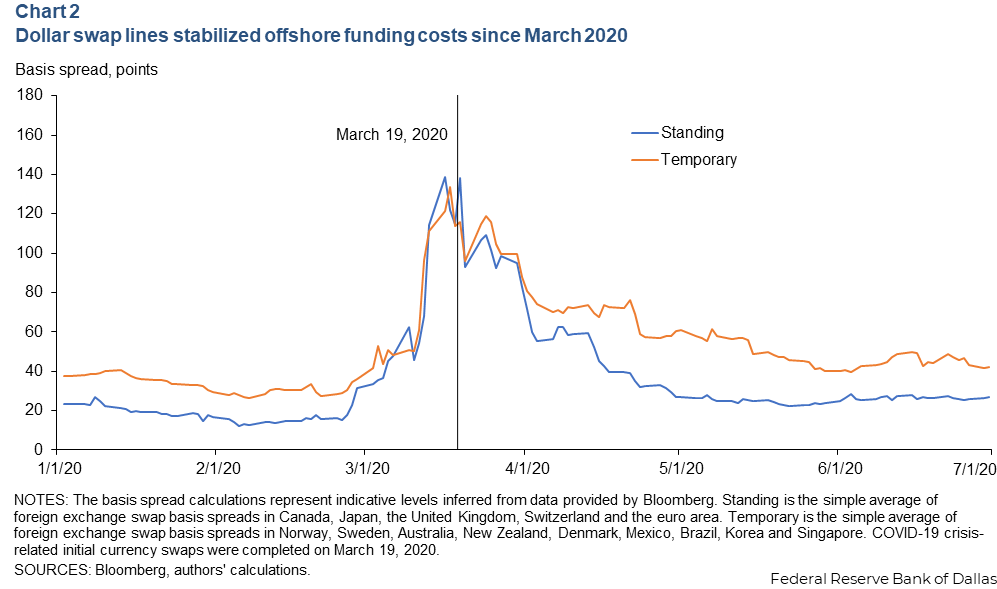

The COVID-19 crisis in March 2020 led to a sudden dollar shortage outside the U.S., as lenders and borrowers each sought to hoard dollars. Chart 2 plots the simple average of the foreign exchange swap spread in two groups of currencies.

“Standing” is the average of the currencies of the five central banks that have standing dollar liquidity swap lines with the Fed (Bank of Canada, Bank of England, European Central Bank, Swiss National Bank and Bank of Japan).

“Temporary” refers to the average of the nine currencies of central banks that gained temporary access to the Fed’s dollar liquidity swaps during the COVID-19 crisis (Norges Bank, Sveriges Riksbank, Reserve Bank of Australia, Reserve Bank of New Zealand, Bank of Denmark, Bank of Mexico, Bank of Brazil, Bank of Korea and Monetary Authority of Singapore).

A “dash for cash” early in the COVID-19 crisis resulted in a spike in the offshore dollar funding cost for the standing and temporary groups. The average foreign exchange swap spread for the standing group rose from around 20 basis points (0.2 percentage points) and for the temporary group from 35 basis points in January to close to 150 basis points for each in mid-March 2020.

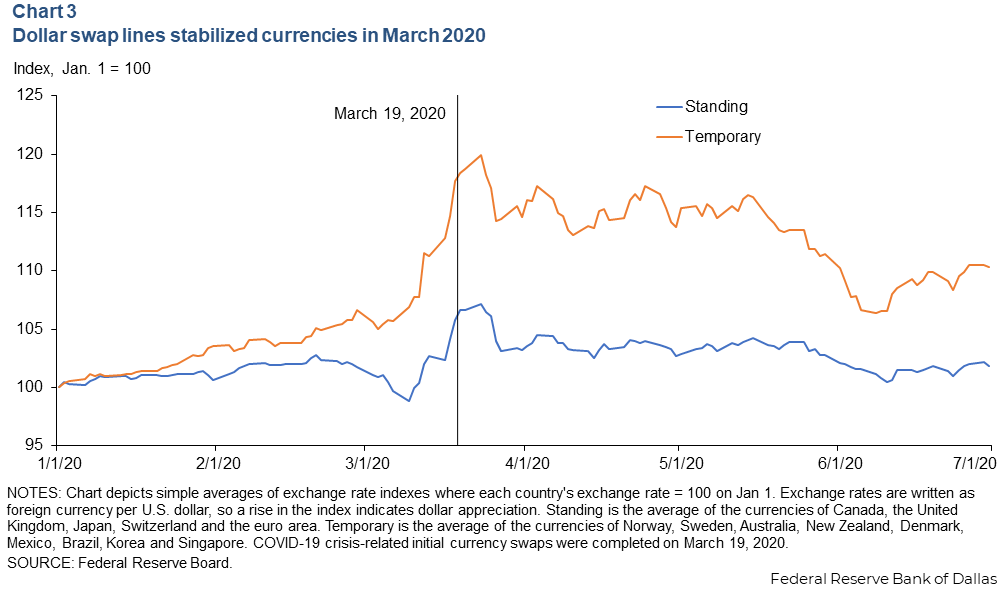

Chart 3 plots the average exchange rate for the same groups. The exchange rate is written as foreign currency per U.S dollar, so an increase in the index indicates dollar appreciation. The dollar appreciated by 7 percent against the currencies in the standing group in the week and a half after the World Health Organization’s declaration of a worldwide pandemic on March 11. Over the same period, the dollar appreciated by 12 percent against the currencies of the countries later granted temporary access to the dollar liquidity facilities.

Central bank swap lines relieved dollar shortages

In 2008, during the Global Financial Crisis, the Fed and foreign central banks established dollar liquidity swap lines in response to overseas dollar shortages. The Fed and the foreign central banks would exchange an amount of their currencies for a short period, and the foreign central bank then lent these dollars to its domestic banks to reduce the dollar shortage in that country.

These dollar swap lines evolved, and at the time of the COVID-19 crisis in March 2020, standing dollar swap lines existed between the Fed and the five standing central banks.

Banks in the five participating countries could borrow dollar liquidity at a rate of the dollar OIS rate plus a specified spread. During the two crises, access to these dollar liquidity swaps was extended to nine other foreign central banks on a temporary basis. Central bankers lowered the spread that determined the borrowing cost, and an 84-day loan term was added to the usual seven-day term.

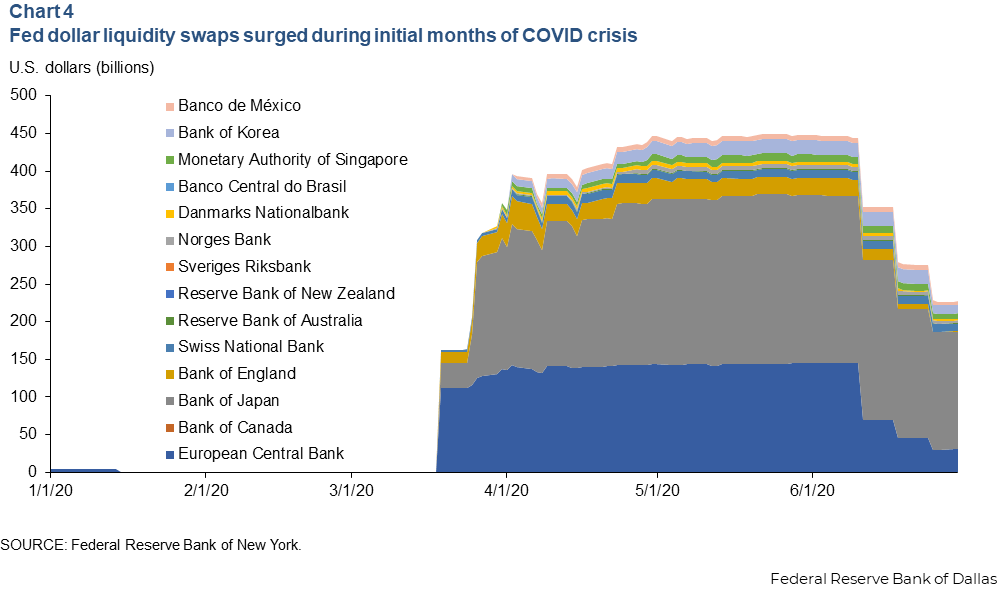

As a result of severe overseas dollar shortages in March 2020, foreign central bank swap-line borrowing surged. From close to zero, the value of liquidity swaps on the Fed’s balance sheet grew by $160 billion on March 19, reaching nearly $450 billion by the end of April (Chart 4).

The first of this COVID-19-era swap-line activity settled on March 19—that is, the dollars were provided to the overseas borrower. Only central banks with standing swap access participated in this initial round. Also on March 19, temporary swap-line access was announced for the nine countries granted temporary standing, with swap settlements completed later in March.

The article by New York Fed economists Goldberg and Ravazzolo showed how the spreads, after widening during the initial days of the COVID-19 turmoil, narrowed once swap-line funding became available in offshore markets.

By early June, when swap-line borrowing peaked, the foreign exchange swap spread returned to prepandemic levels. Sharp currency depreciation among the standing central banks stopped on March 19, and within a week, these currencies had regained nearly half of the value lost in the first few weeks of the crisis. The bottom for the currencies of the temporary swap-line countries occurred a few days later. By early June, these currencies were back at prepandemic exchange levels.

About the authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.